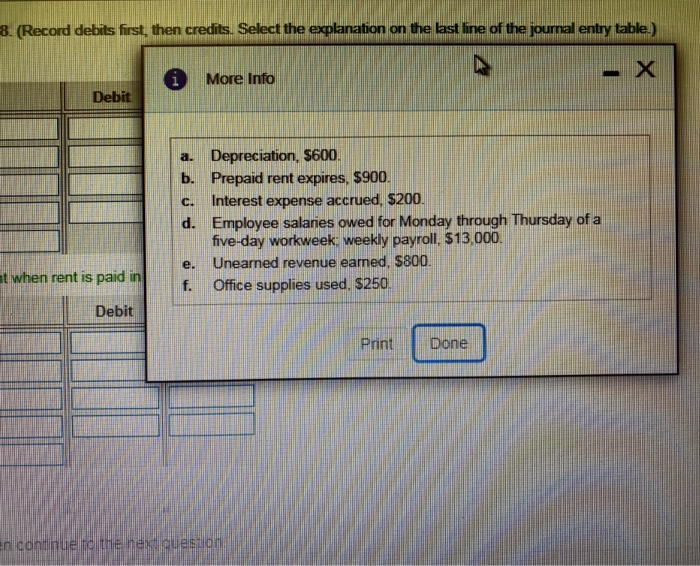

Question: B. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) * More Info Debit a. Depreciation, $600.

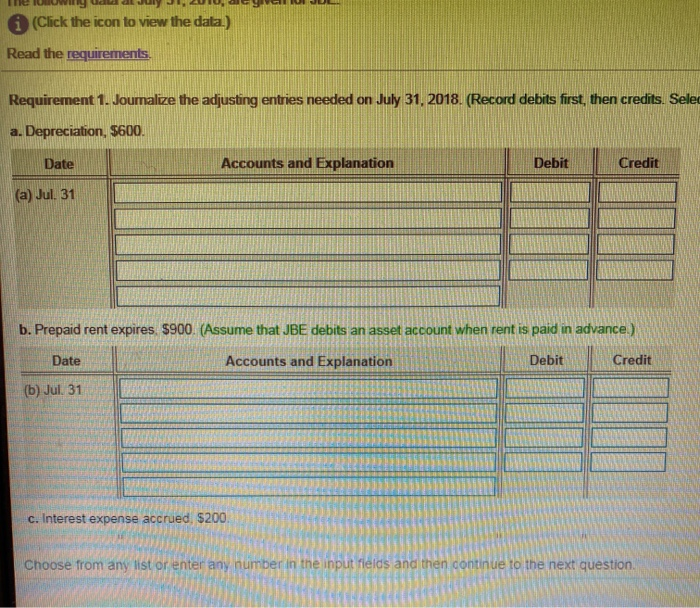

B. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) * More Info Debit a. Depreciation, $600. b. Prepaid rent expires. $900. c. Interest expense accrued, $200. Employee salaries owed for Monday through Thursday of a five-day workweek, weekly payroll, $13,000. e. Unearned revenue earned, $800. Office supplies used. $250. t when rent is paid in Debit Print Done n continue to the next a U I JUL Te luwilig udla July 1, 2010, C (Click the icon to view the data) Read the requirements. Requirement 1. Joumalize the adjusting entries needed on July 31, 2018. (Record debits first, then credits. Selec a. Depreciation, $600. Date Accounts and Explanation (a) Jul. 31 Debit Credit b. Prepaid rent expires $900. (Assume that JBE debits an asset account when rent is paid in advance) Date Accounts and Explanation Debit Credit (b) Jul. 31 L TO c. Interest expense accrued $200. Choose from any list or enter any number in the input fields and then continue to the next question TENDE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts