Question: b) The project has a normal pattern of cash flows (i.e. an initial outflow followed by several years of inflows). What would be the effects

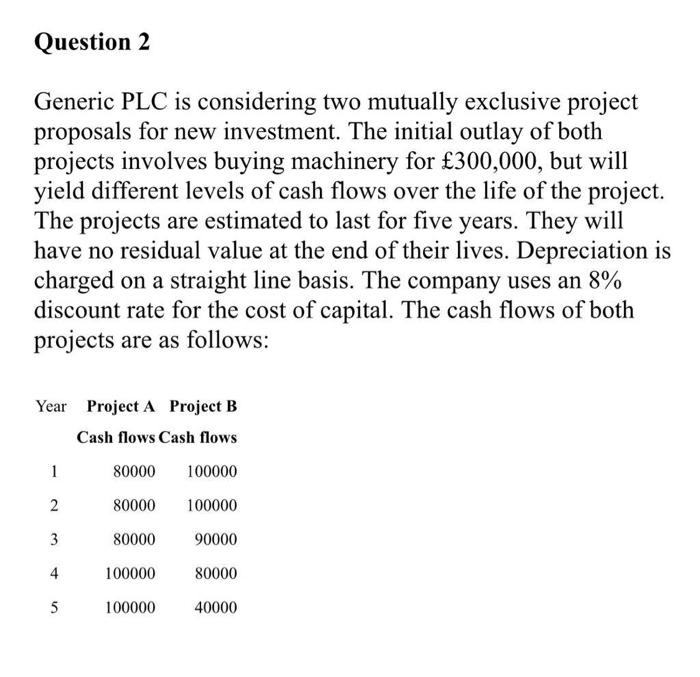

Question 2 Generic PLC is considering two mutually exclusive project proposals for new investment. The initial outlay of both projects involves buying machinery for 300,000, but will yield different levels of cash flows over the life of the project. The projects are estimated to last for five years. They will have no residual value at the end of their lives. Depreciation is charged on a straight line basis. The company uses an 8% discount rate for the cost of capital. The cash flows of both projects are as follows: Year Project A Project B Cash flows Cash flows 1 80000 100000 2 80000 100000 3 80000 90000 4 100000 80000 5 100000 40000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts