Question: B . Use the basic stock valuation formula, the Dividend Growth Model, or the CAPM formula to calculate the value for the stock in each

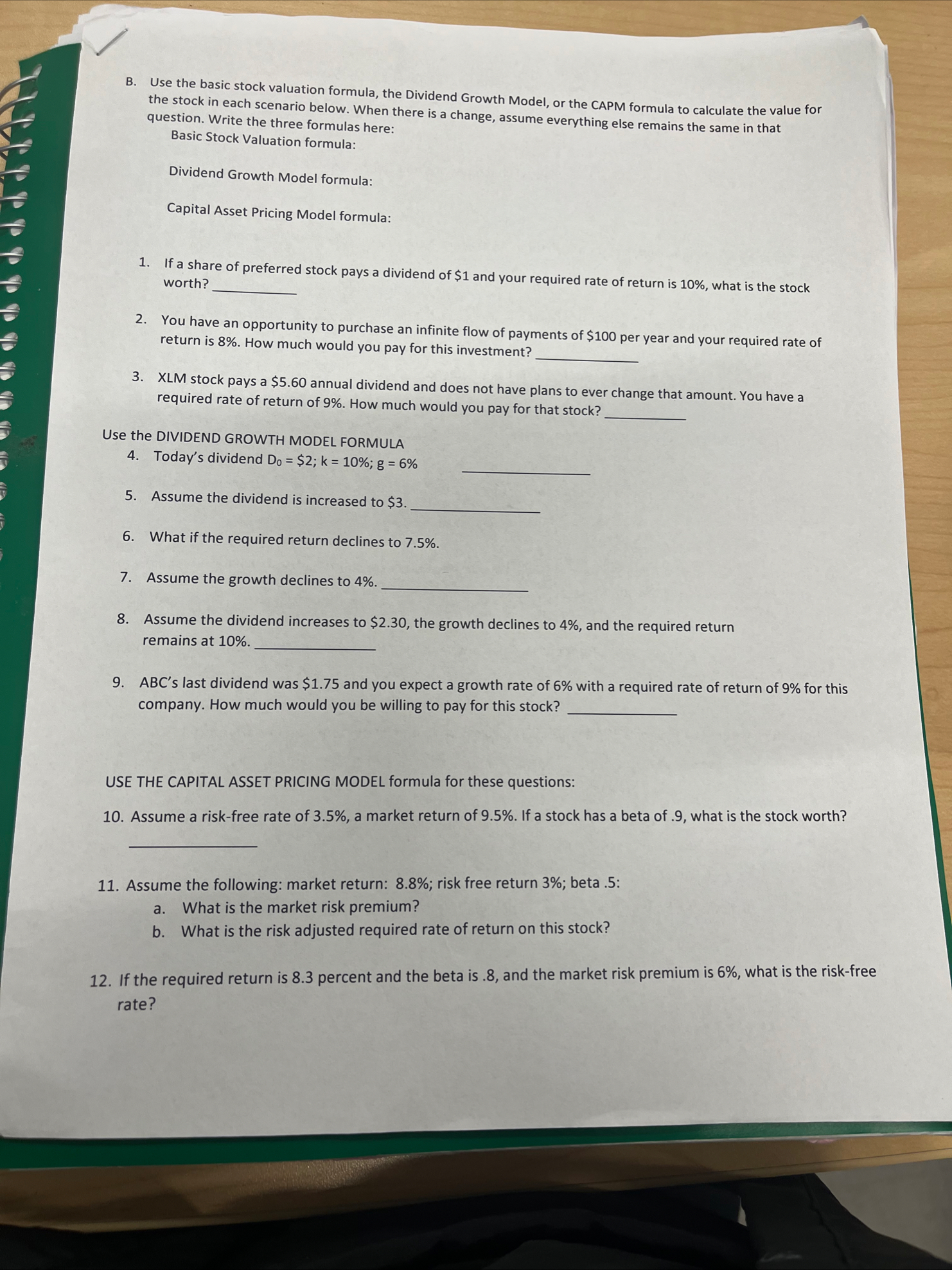

B Use the basic stock valuation formula, the Dividend Growth Model, or the CAPM formula to calculate the value for the stock in each scenario below. When there is a change, assume everything else remains the same in that question. Write the three formulas here:

Basic Stock Valuation formula:

Dividend Growth Model formula:

Capital Asset Pricing Model formula:

If a share of preferred stock pays a dividend of $ and your required rate of return is what is the stock worth?

You have an opportunity to purchase an infinite flow of payments of $ per year and your required rate of return is How much would you pay for this investment?

XLM stock pays a $ annual dividend and does not have plans to ever change that amount. You have a required rate of return of How much would you pay for that stock?

Use the DIVIDEND GROWTH MODEL FORMULA

Today's dividend $;;

Assume the dividend is increased to $

What if the required return declines to

Assume the growth declines to

Assume the dividend increases to $ the growth declines to and the required return remains at

ABC s last dividend was $ and you expect a growth rate of with a required rate of return of for this company. How much would you be willing to pay for this stock?

USE THE CAPITAL ASSET PRICING MODEL formula for these questions:

Assume a riskfree rate of a market return of If a stock has a beta of what is the stock worth?

Assume the following: market return: ; risk free return ; beta :

a What is the market risk premium?

b What is the risk adjusted required rate of return on this stock?

If the required return is percent and the beta is and the market risk premium is what is the riskfree rate?C Bond Valuation Practice Set. Assume annual coupon payments in answering the following questions.

What is a bond? Please be specific and provide an example of a current bond being floated.

Explain the difference between current yield, yield to maturity, and coupon rate.

Assume a bond has a coupon of and matures in years. If the market rate on similar bonds is what is the price of this bond?

What would the price of the above bond be if it matures in years?

Why did the price rise when the number of years was reduced?

What is the current yield on each of these bonds?

Assume a bond has a percent coupon and matures in years. If the market rate is percent, what is the bond's price?

Assume you have had the bond in # for six years and interest rates are still percent. What price could you get if you wanted to sell the bond?

Assume a bond with years to maturity has a percent coupon. If the bond sells for par value, what is the yield to maturity?

How much would you pay for a year zero coupon bond if your required rate of return is

What is the price of a bond with a percent coupon that matures in years if the market rate on similar bonds Is

What is the price on the bond in the above question # if the market rate is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock