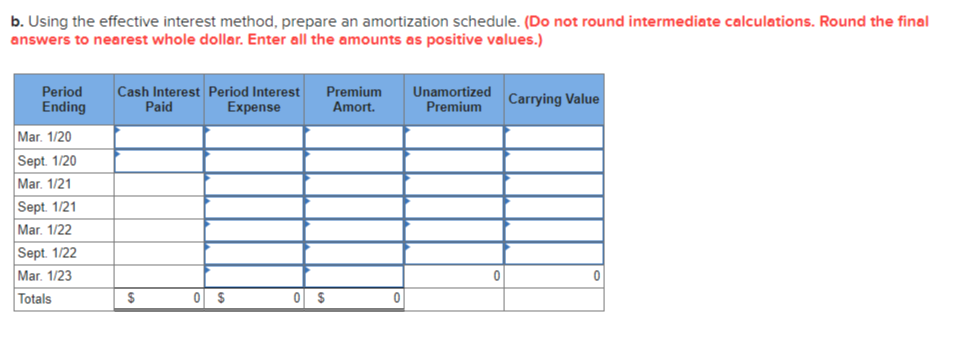

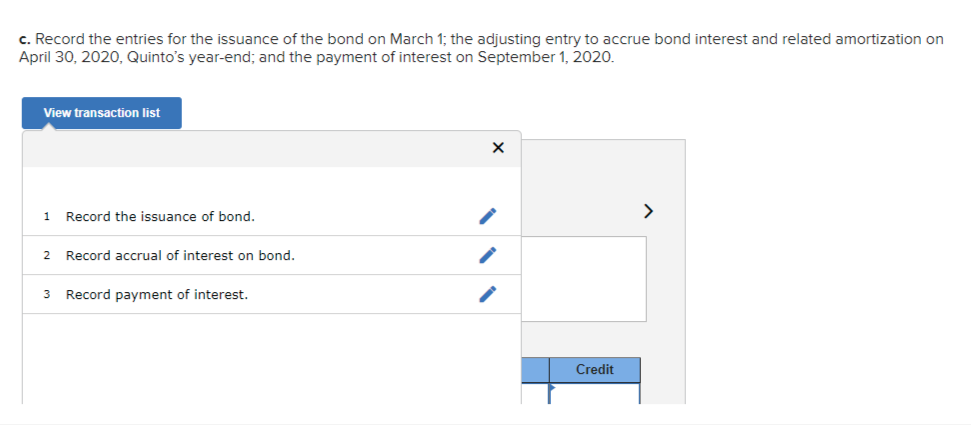

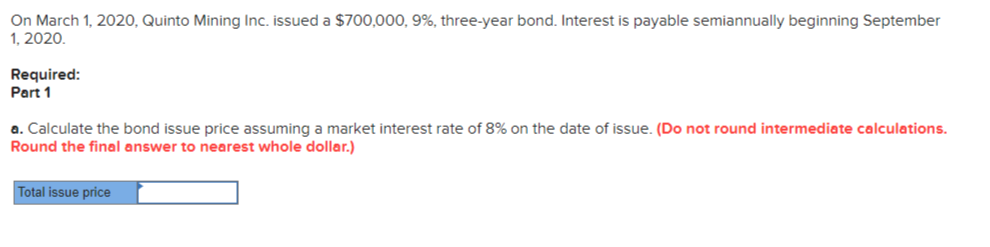

Question: b. Using the effective interest method, prepare an amortization schedule. (Do not round intermediate calculations. Round the final answers to nearest whole dollar. Enter all

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock