Question: b) Your firm has just issued five-year floating-rate notes indexed to six-month U.S. dollar LIBOR plus 1/4%. What is the amount of the first coupon

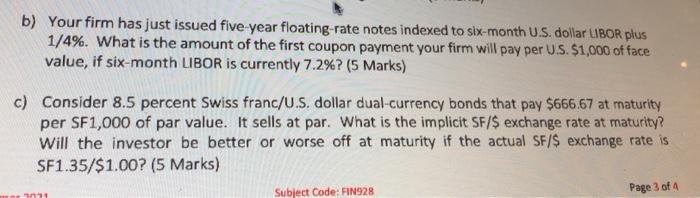

b) Your firm has just issued five-year floating-rate notes indexed to six-month U.S. dollar LIBOR plus 1/4%. What is the amount of the first coupon payment your firm will pay per U.S. $1,000 of face value, if six-month LIBOR is currently 7.2%? (5 Marks) c) Consider 8.5 percent Swiss franc/U.S. dollar dual-currency bonds that pay $666.67 at maturity per SF1,000 of par value. It sells at par. What is the implicit SF/$ exchange rate at maturity? Will the investor be better or worse off at maturity if the actual SF/S exchange rate is SF1.35/$1.00? (5 Marks) Subject Code: FIN928 Page 3 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts