Question: B1. a) Explain any three major differences between hedge funds and mutual funds. (12 marks) b) Discuss the following two concepts: market must be in

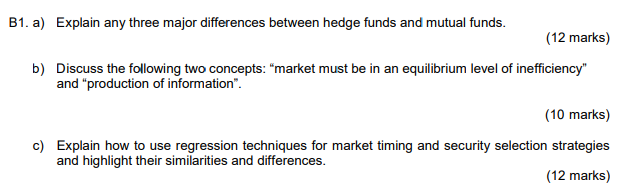

B1. a) Explain any three major differences between hedge funds and mutual funds. (12 marks) b) Discuss the following two concepts: "market must be in an equilibrium level of inefficiency and "production of information" (10 marks) Explain how to use regression techniques for market timing and security selection strategies (12 marks) c) and highlight their similarities and differences. B1. a) Explain any three major differences between hedge funds and mutual funds. (12 marks) b) Discuss the following two concepts: "market must be in an equilibrium level of inefficiency and "production of information" (10 marks) Explain how to use regression techniques for market timing and security selection strategies (12 marks) c) and highlight their similarities and differences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts