Question: B30 vix fx B D E F G H 1 J 1 Madison Makeup reported the following on its most recent financial statements (in $

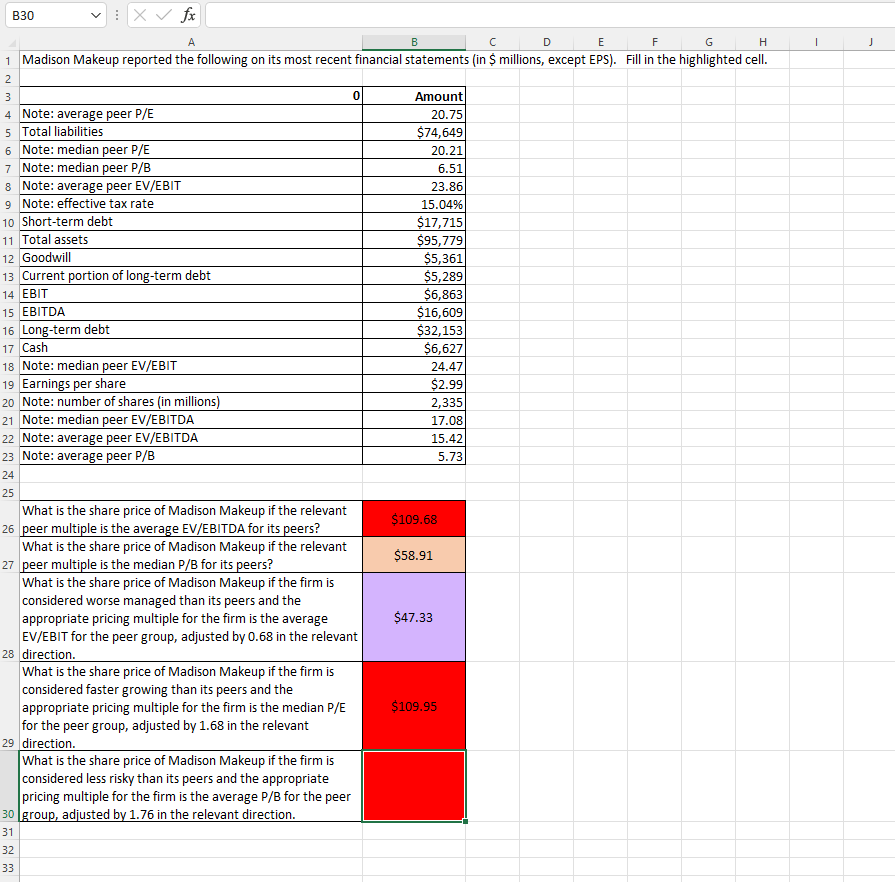

B30 vix fx B D E F G H 1 J 1 Madison Makeup reported the following on its most recent financial statements (in $ millions, except EPS). Fill in the highlighted cell. 2 0 3 4 Note: average peer P/E 5 Total liabilities 6 Note: median peer P/E 7 Note: median peer P/B 8 Note: average peer EV/EBIT 9 Note: effective tax rate 10 Short-term debt 11 Total assets 12 Goodwill 13 Current portion of long-term debt 14 EBIT 15 EBITDA 16 Long-term debt 17 Cash 18 Note: median peer EV/EBIT 19 Earnings per share 20 Note: number of shares (in millions) 21 Note: median peer EV/EBITDA 22 Note: average peer EV/EBITDA 23 Note: average peer P/B 24 Amount 20.75 $74,649 20.21 6.51 23.86 15.04% $17,715 $95,779 $5,361 $5,289 $6,863 $16,609 $32,153 $6,627 24.47 $2.99 2,335 17.08 15.42 5.73 25 $109.68 $58.91 $47.33 What is the share price of Madison Makeup if the relevant 26 peer multiple is the average EV/EBITDA for its peers? What is the share price of Madison Makeup if the relevant 27 peer multiple is the median P/B for its peers? What is the share price of Madison Makeup if the firm is considered worse managed than its peers and the appropriate pricing multiple for the firm is the average EV/EBIT for the peer group, adjusted by 0.68 in the relevant 28 direction. What is the share price of Madison Makeup if the firm is considered faster growing than its peers and the appropriate pricing multiple for the firm is the median P/E for the peer group, adjusted by 1.68 in the relevant 29 direction. What is the share price of Madison Makeup if the firm is considered less risky than its peers and the appropriate pricing multiple for the firm is the average P/B for the peer 30 group, adjusted by 1.76 in the relevant direction. $109.95 31 32 33 B30 vix fx B D E F G H 1 J 1 Madison Makeup reported the following on its most recent financial statements (in $ millions, except EPS). Fill in the highlighted cell. 2 0 3 4 Note: average peer P/E 5 Total liabilities 6 Note: median peer P/E 7 Note: median peer P/B 8 Note: average peer EV/EBIT 9 Note: effective tax rate 10 Short-term debt 11 Total assets 12 Goodwill 13 Current portion of long-term debt 14 EBIT 15 EBITDA 16 Long-term debt 17 Cash 18 Note: median peer EV/EBIT 19 Earnings per share 20 Note: number of shares (in millions) 21 Note: median peer EV/EBITDA 22 Note: average peer EV/EBITDA 23 Note: average peer P/B 24 Amount 20.75 $74,649 20.21 6.51 23.86 15.04% $17,715 $95,779 $5,361 $5,289 $6,863 $16,609 $32,153 $6,627 24.47 $2.99 2,335 17.08 15.42 5.73 25 $109.68 $58.91 $47.33 What is the share price of Madison Makeup if the relevant 26 peer multiple is the average EV/EBITDA for its peers? What is the share price of Madison Makeup if the relevant 27 peer multiple is the median P/B for its peers? What is the share price of Madison Makeup if the firm is considered worse managed than its peers and the appropriate pricing multiple for the firm is the average EV/EBIT for the peer group, adjusted by 0.68 in the relevant 28 direction. What is the share price of Madison Makeup if the firm is considered faster growing than its peers and the appropriate pricing multiple for the firm is the median P/E for the peer group, adjusted by 1.68 in the relevant 29 direction. What is the share price of Madison Makeup if the firm is considered less risky than its peers and the appropriate pricing multiple for the firm is the average P/B for the peer 30 group, adjusted by 1.76 in the relevant direction. $109.95 31 32 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts