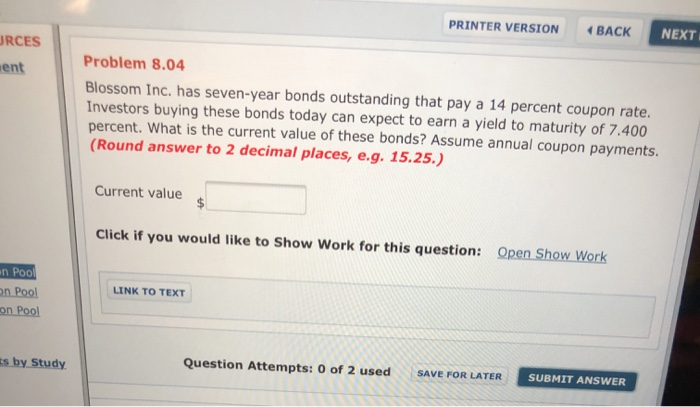

Question: ( BACK PRINTER VERSION NEXT URCES Problem 8.04 ent Blossom Inc. has seven-year bonds outstanding that pay a 14 percent coupon rate. Investors buying these

( BACK PRINTER VERSION NEXT URCES Problem 8.04 ent Blossom Inc. has seven-year bonds outstanding that pay a 14 percent coupon rate. Investors buying these bonds today can expect to earn a yield to maturity of 7.400 percent. What is the current value of these bonds? Assume annual coupon payments. (Round answer to 2 decimal places, e.g. 15.25.) Current value Click if you would like to Show Work for this question: Open Show Work n Pool LINK TO TEXT on Pool on Pool Question Attempts: 0 of 2 used s by Study SUBMIT ANSWER SAVE FOR LATER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts