Question: Having some trouble with these and I need some help please! Please show me how to make the solution in excel, I will rate asap!

Having some trouble with these and I need some help please!

Please show me how to make the solution in excel, I will rate asap! Thanks!

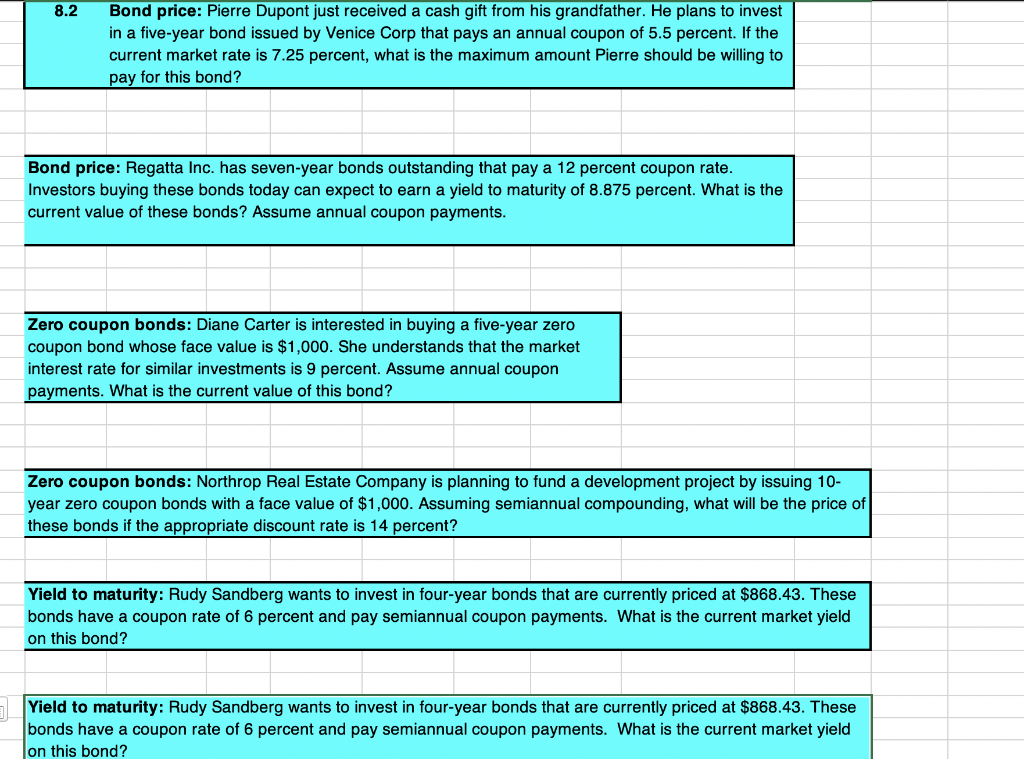

8.2 Bond price: Pierre Dupont just received a cash gift from his grandfather. He plans to invest in a five-year bond issued by Venice Corp that pays an annual coupon of 5.5 percent. If the current market rate is 7.25 percent, what is the maximum amount Pierre should be willing to pay for this bond? Bond price: Regatta Inc. has seven-year bonds outstanding that pay a 12 percent coupon rate. Investors buying these bonds today can expect to earn a yield to maturity of 8.875 percent. What is the current value of these bonds? Assume annual coupon payments. Zero coupon bonds: Diane Carter is interested in buying a five-year zero coupon bond whose face value is $1,000. She understands that the market interest rate for similar investments is 9 percent. Assume annual coupon payments. What is the current value of this bond? Zero coupon bonds: Northrop Real Estate Company is planning to fund a development project by issuing 10- year zero coupon bonds with a face value of $1,000. Assuming semiannual compounding, what will be the price of these bonds if the appropriate discount rate is 14 percent? Yield to maturity: Rudy Sandberg wants to invest in four-year bonds that are currently priced at $868.43. These bonds have a coupon rate of 6 percent and pay semiannual coupon payments. What is the current market yield on this bond? Yield to maturity: Rudy Sandberg wants to invest in four-year bonds that are currently priced at $868.43. These bonds have a coupon rate of 6 percent and pay semiannual coupon payments. What is the current market yield on this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts