Question: Back Problem 10 Answer a) How many dollars do you need to deposit today into your retirement account in order to receive $100,000,000 in 40

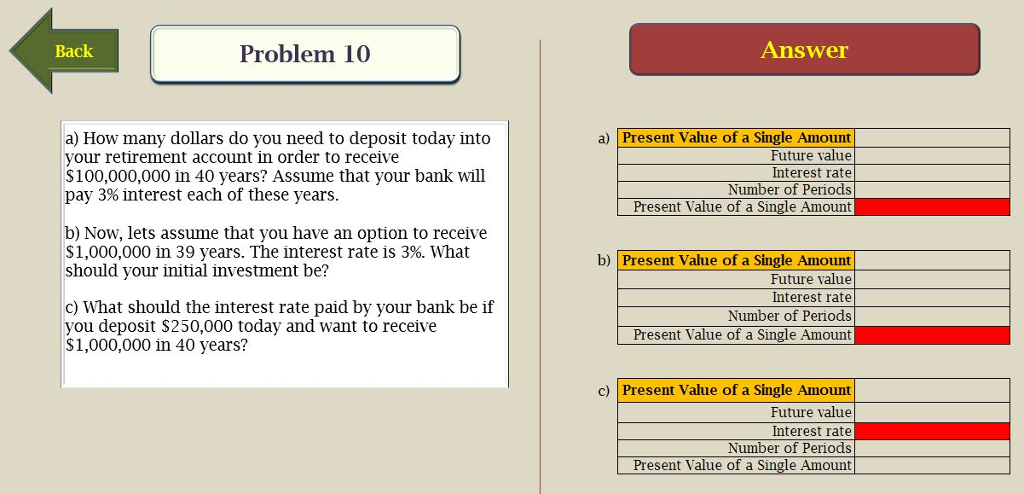

Back Problem 10 Answer a) How many dollars do you need to deposit today into your retirement account in order to receive $100,000,000 in 40 years? Assume that your bank will pay 3% interest each of these years a) Present Value of a Single Amount Future value Interest rate Number of Periods Present Value of a Single Amount b) Now, lets assume that you have an option to receive $1,000,000 in 39 years. The interest rate is 3%. What should your initial investment be? b) Present Value of a Single Amount Future value Interest rate Number of Periods Present Value of a Single Amount c) What should the interest rate paid by your bank be if you deposit $250,000 today and want to receive $1,000,000 in 40 years? c) Present Value of a Single Amount Future value Interest rate Number of Periods Present Value of a Single Amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts