Question: Back to Assignment Attempts 0 Keep the Highest 0/2 3. Cho3 Financial Planning Exercise 7 eBook Chapter 3 Financial Planning Exercise 7 Effect of tax

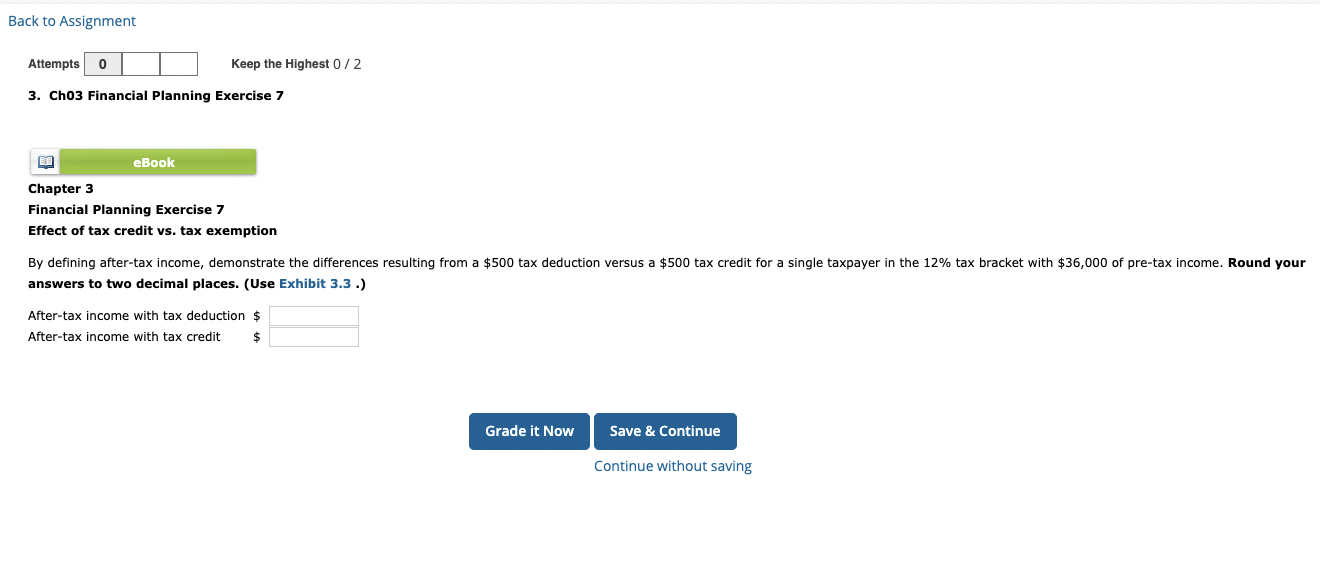

Back to Assignment Attempts 0 Keep the Highest 0/2 3. Cho3 Financial Planning Exercise 7 eBook Chapter 3 Financial Planning Exercise 7 Effect of tax credit vs. tax exemption By defining after-tax income, demonstrate the differences resulting from a $500 tax deduction versus a $500 tax credit for a single taxpayer in the 12% tax bracket with $36,000 of pre-tax income. Round your answers to two decimal places. (Use Exhibit 3.3.) After-tax income with tax deduction $ After-tax income with tax credit Grade it Now Save & Continue Continue without saving Back to Assignment Attempts 0 Keep the Highest 0/2 3. Cho3 Financial Planning Exercise 7 eBook Chapter 3 Financial Planning Exercise 7 Effect of tax credit vs. tax exemption By defining after-tax income, demonstrate the differences resulting from a $500 tax deduction versus a $500 tax credit for a single taxpayer in the 12% tax bracket with $36,000 of pre-tax income. Round your answers to two decimal places. (Use Exhibit 3.3.) After-tax income with tax deduction $ After-tax income with tax credit Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts