Question: Back to Assignment Attempts Keep the Highest / 10 1. Problem 19-04 (Lease versus Buy) ED eBook Problem Walk-Through Lease versus Buy Big Sky Mining

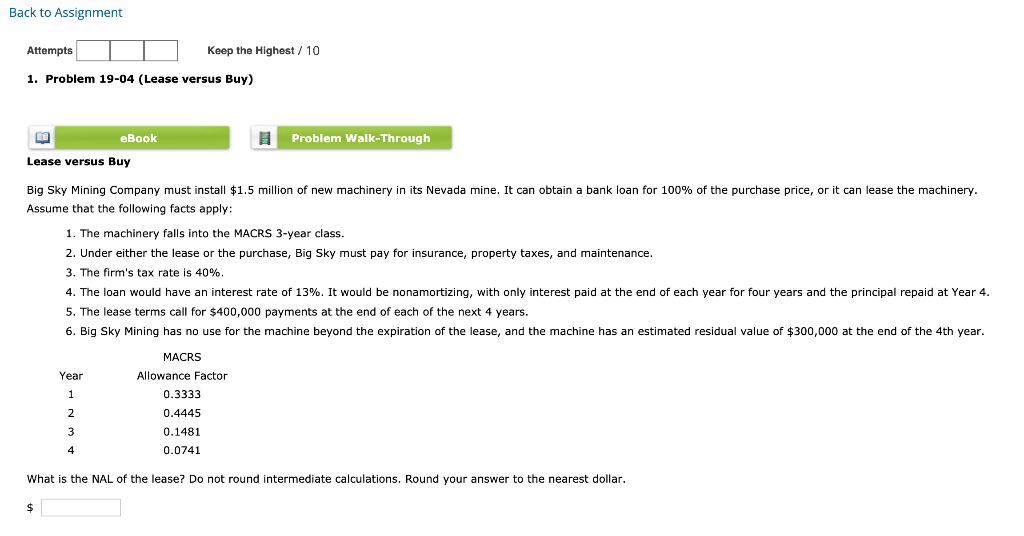

Back to Assignment Attempts Keep the Highest / 10 1. Problem 19-04 (Lease versus Buy) ED eBook Problem Walk-Through Lease versus Buy Big Sky Mining Company must install $1.5 million of new machinery in its Nevada mine. It can obtain a bank loan for 100% of the purchase price, or it can lease the machinery. Assume that the following facts apply: 1. The machinery falls into the MACRS 3-year class. 2. Under either the lease or the purchase, Big Sky must pay for insurance, property taxes, and maintenance. 3. The firm's tax rate is 40%. 4. The loan would have an interest rate of 13%. It would be nonamortizing, with only interest paid at the end of each year for four years and the principal repaid at Year 4. 5. The lease terms call for $400,000 payments at the end of each of the next 4 years. 6. Big Sky Mining has no use for the machine beyond the expiration of the lease, and the machine has an estimated residual value of $300,000 at the end of the 4th year. Year 1 MACRS Allowance Factor 0.3333 0.4445 0.1481 0.0741 2 3 4 What is the NAL of the lease? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Back to Assignment Attempts Keep the Highest / 10 1. Problem 19-04 (Lease versus Buy) ED eBook Problem Walk-Through Lease versus Buy Big Sky Mining Company must install $1.5 million of new machinery in its Nevada mine. It can obtain a bank loan for 100% of the purchase price, or it can lease the machinery. Assume that the following facts apply: 1. The machinery falls into the MACRS 3-year class. 2. Under either the lease or the purchase, Big Sky must pay for insurance, property taxes, and maintenance. 3. The firm's tax rate is 40%. 4. The loan would have an interest rate of 13%. It would be nonamortizing, with only interest paid at the end of each year for four years and the principal repaid at Year 4. 5. The lease terms call for $400,000 payments at the end of each of the next 4 years. 6. Big Sky Mining has no use for the machine beyond the expiration of the lease, and the machine has an estimated residual value of $300,000 at the end of the 4th year. Year 1 MACRS Allowance Factor 0.3333 0.4445 0.1481 0.0741 2 3 4 What is the NAL of the lease? Do not round intermediate calculations. Round your answer to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts