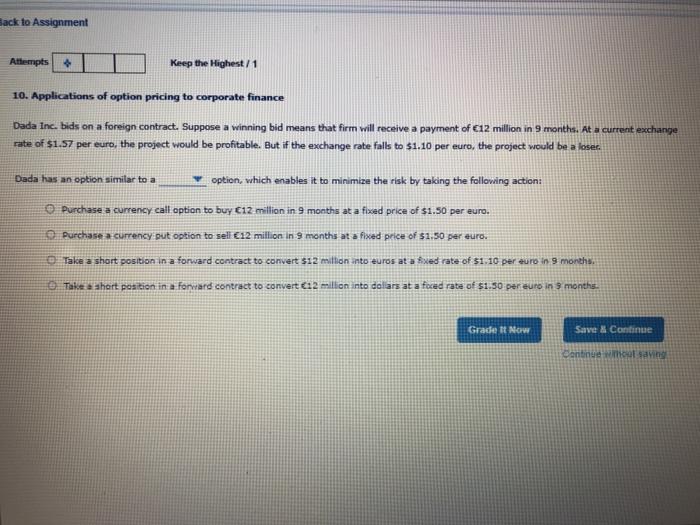

Question: Back to Assignment Attempts + Keep the Highest/1 10. Applications of option pricing to corporate finance Dada Inc. bids on a foreign contract. Suppose a

Back to Assignment Attempts + Keep the Highest/1 10. Applications of option pricing to corporate finance Dada Inc. bids on a foreign contract. Suppose a winning bid means that firm will receive a payment of C12 million in 9 months. At a current exchange rate of $1.57 per euro, the project would be profitable. But if the exchange rate falls to $1.10 per euro, the project would be a loser. Dada has an option similar to a option, which enables it to minimize the risk by taking the following action: Purchase a currency call option to buy C12 million in 9 months at a fixed price of $1.50 per euro. Purchase a currency out option to sell 12 million in 9 months at a fixed price of $1.50 per euro. Take a short position in a forward contract to convert $12 million anto euros ata xed rate of 31.10 per euro in 9 months. Take their position in a forward contract to convert 12 million into dollars at a faced rate of $1.50 per euro in 9 months. Grade It Now Save Continue Continue we saying Ch 05: Assignment - Financial Options Back to Assignment Attempts Keep the Highest / 1 10. Applications of option pricing to corporate finance Dada Inc, bids on a foreign contract. Suppose a winning bid means that firm will rece rate of $1.57 per euro, the project would be profitable. But if the exchange rate falls Dada has an option similar to a option, which enables it to minimize the O Purchase a currency call In to buy 12 million in 9 months at a fixed pa O Purchase a currency put in to sell 12 million in 9 months at a fixed pr O Take a short position in a forward contract to convert $12 million into euro O Take a short position in a forward contract to convert 12 million into dolla

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts