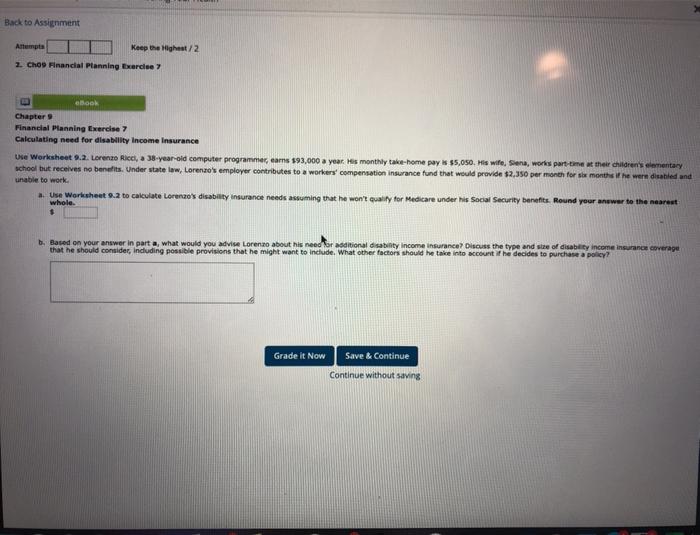

Question: Back to Assignment Attempts Keep the Highest/2 2. Choo Financial Planning Exercise ebook Chapter Financial Planning Exercise 7 Calculating need for disability Income Insurance Use

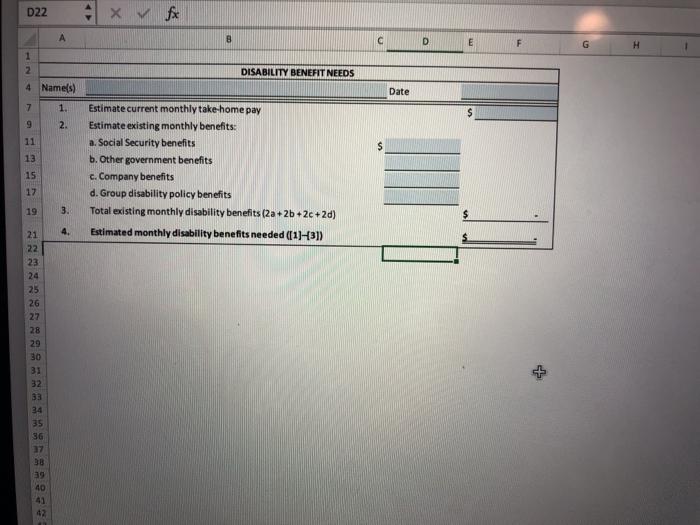

Back to Assignment Attempts Keep the Highest/2 2. Choo Financial Planning Exercise ebook Chapter Financial Planning Exercise 7 Calculating need for disability Income Insurance Use Worksheet 9.2. Lorenzo Ricci, a 38-year-old computer programme cams 193,000 a year les monthly take home pay $5,050. His wife, Siena, work part time at their children's elementary school but receives no benefits. Under state law, Lorenzo's employer contributes to a workers' compensation insurance fund that would provide $2.350 per month for month he were disabled and unable to work. Worksheet 2.2 to cakulate Lorenzo's disabilty insurance needs assuming that he won't quality for Medicare under his Social Security benefits. Round your answer to the nearest whole. b. Based on your answer in part a, what would you advise Lorenzo about his need for additional disabity income insurance Discuss the type and size of disability income insurance coverage that he should consider, including possible provisions that he might want to include. What other factors should be take into account the decides to purchase a policy? Grade it Now Save & Continue Continue without saving D22 x fx 8 C D E F H 1 2 4 Name(s) DISABILITY BENEFIT NEEDS Date 7 9 1. 2. 11 13 15 Estimate current monthly take home pay Estimate existing monthly benefits: a. Social Security benefits b. Other government benefits c. Company benefits d. Group disability policy benefits Total existing monthly disability benefits (2a+2b +20+2d) Estimated monthly disability benefits needed (11-31) 17 19 3. 4. 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 27 38 39 40 42 Back to Assignment Attempts Keep the Highest/2 2. Choo Financial Planning Exercise ebook Chapter Financial Planning Exercise 7 Calculating need for disability Income Insurance Use Worksheet 9.2. Lorenzo Ricci, a 38-year-old computer programme cams 193,000 a year les monthly take home pay $5,050. His wife, Siena, work part time at their children's elementary school but receives no benefits. Under state law, Lorenzo's employer contributes to a workers' compensation insurance fund that would provide $2.350 per month for month he were disabled and unable to work. Worksheet 2.2 to cakulate Lorenzo's disabilty insurance needs assuming that he won't quality for Medicare under his Social Security benefits. Round your answer to the nearest whole. b. Based on your answer in part a, what would you advise Lorenzo about his need for additional disabity income insurance Discuss the type and size of disability income insurance coverage that he should consider, including possible provisions that he might want to include. What other factors should be take into account the decides to purchase a policy? Grade it Now Save & Continue Continue without saving D22 x fx 8 C D E F H 1 2 4 Name(s) DISABILITY BENEFIT NEEDS Date 7 9 1. 2. 11 13 15 Estimate current monthly take home pay Estimate existing monthly benefits: a. Social Security benefits b. Other government benefits c. Company benefits d. Group disability policy benefits Total existing monthly disability benefits (2a+2b +20+2d) Estimated monthly disability benefits needed (11-31) 17 19 3. 4. 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 27 38 39 40 42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts