Question: Back to s et Altempts Score 2 1. Exploring Finance: Risk and the cost of Capital Risk and the Cost of Capital Conceptual Overview: Explore

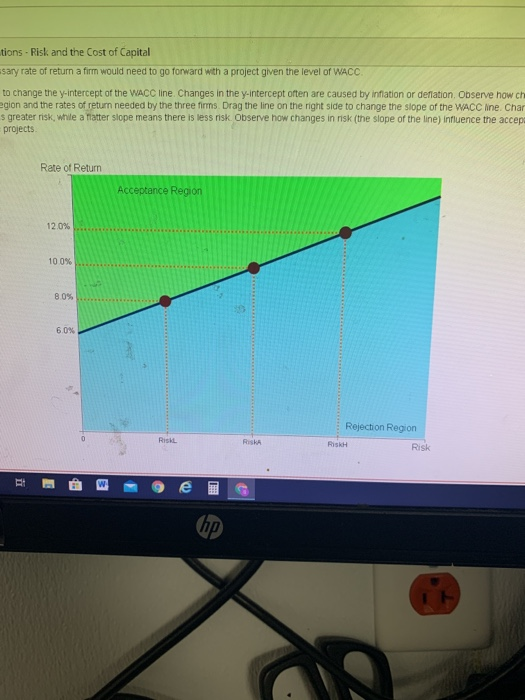

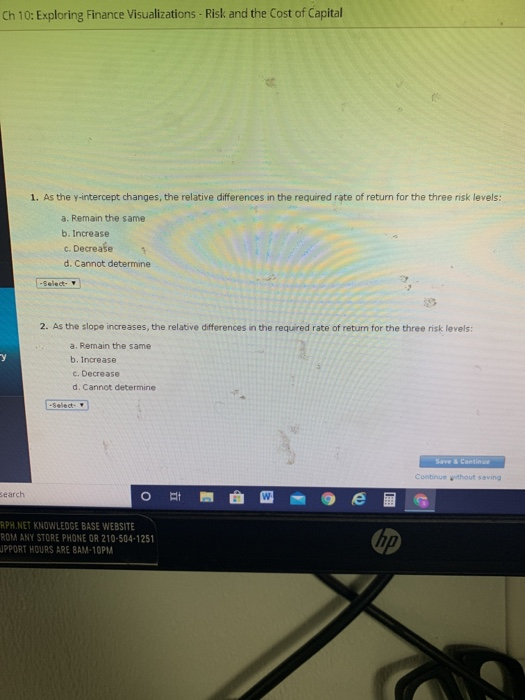

Back to s et Altempts Score 2 1. Exploring Finance: Risk and the cost of Capital Risk and the Cost of Capital Conceptual Overview: Explore the trade-off between risk and the cost of capital. The ne represents YCC, the weighted average cost of coas function of risk Three projects with the seves (ow). RISKA (average and is fignare highligte The vertical shows the necessary rate of retum a firm would need to go forward win a prout given the ever of WACC Orag the line on the left side to change the intercept of the WACC Changes the intercept often are caused by ination or destin Observe how changing the intercept fuences the acceptance region and the rates of return needed by the three firma Orag te ne on the right side to change the slope of the WACC Ine Changes in opererectisk A steeper slope means there is greaterns, wheater slope means there is serve how changes in the scope of the neuence te acceptance region and merce of return required by the three projects Raoof Retum Acceptance Region 100 o earch 2:39 PM SP.NET KNOWLEDGE BASE WEBSITE ROM ANY STORE PHONE OR 210-504-1251 PPORT HOURS ARE BAM-10PM tions - Risk and the Cost of Capital sary rate of return a firm would need to go forward with a project given the level of WACC to change the y-intercept of the WACC line. Changes in the y-intercept often are caused by inflation or deflation. Observe how ch egion and the rates of return needed by the three firms. Drag the line on the right side to change the slope of the WACC line. Char s greater risk, while a matter slope means there is less risk. Observe how changes in risk (the slope of the line) influence the accepi projects Rate of Return Acceptance Region 12 0% 100% 80% Rejection Region (hp Ch 10: Exploring Finance Visualizations - Risk and the Cost of Capital 1. As the y-intercept changes, the relative differences in the required rate of return for the three risk levels: a. Remain the same b. Increase c. Decrease d. Cannot determine -Select- 2. As the slope increases, the relative differences in the required rate of return for the three risk levels: a. Remain the same b. Increase c. Decrease d. Cannot determine -Select- Continue without saving Search ot W e RPH.NET KNOWLEDGE BASE WEBSITE ROM ANY STORE PHONE OR 210-504-1251 JPPORT HOURS ARE BAM10PM Back to s et Altempts Score 2 1. Exploring Finance: Risk and the cost of Capital Risk and the Cost of Capital Conceptual Overview: Explore the trade-off between risk and the cost of capital. The ne represents YCC, the weighted average cost of coas function of risk Three projects with the seves (ow). RISKA (average and is fignare highligte The vertical shows the necessary rate of retum a firm would need to go forward win a prout given the ever of WACC Orag the line on the left side to change the intercept of the WACC Changes the intercept often are caused by ination or destin Observe how changing the intercept fuences the acceptance region and the rates of return needed by the three firma Orag te ne on the right side to change the slope of the WACC Ine Changes in opererectisk A steeper slope means there is greaterns, wheater slope means there is serve how changes in the scope of the neuence te acceptance region and merce of return required by the three projects Raoof Retum Acceptance Region 100 o earch 2:39 PM SP.NET KNOWLEDGE BASE WEBSITE ROM ANY STORE PHONE OR 210-504-1251 PPORT HOURS ARE BAM-10PM tions - Risk and the Cost of Capital sary rate of return a firm would need to go forward with a project given the level of WACC to change the y-intercept of the WACC line. Changes in the y-intercept often are caused by inflation or deflation. Observe how ch egion and the rates of return needed by the three firms. Drag the line on the right side to change the slope of the WACC line. Char s greater risk, while a matter slope means there is less risk. Observe how changes in risk (the slope of the line) influence the accepi projects Rate of Return Acceptance Region 12 0% 100% 80% Rejection Region (hp Ch 10: Exploring Finance Visualizations - Risk and the Cost of Capital 1. As the y-intercept changes, the relative differences in the required rate of return for the three risk levels: a. Remain the same b. Increase c. Decrease d. Cannot determine -Select- 2. As the slope increases, the relative differences in the required rate of return for the three risk levels: a. Remain the same b. Increase c. Decrease d. Cannot determine -Select- Continue without saving Search ot W e RPH.NET KNOWLEDGE BASE WEBSITE ROM ANY STORE PHONE OR 210-504-1251 JPPORT HOURS ARE BAM10PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts