Question: Number one as a y-intercept changes the relative differences in the required write a return for the three Risk levels is? 2. as a slope

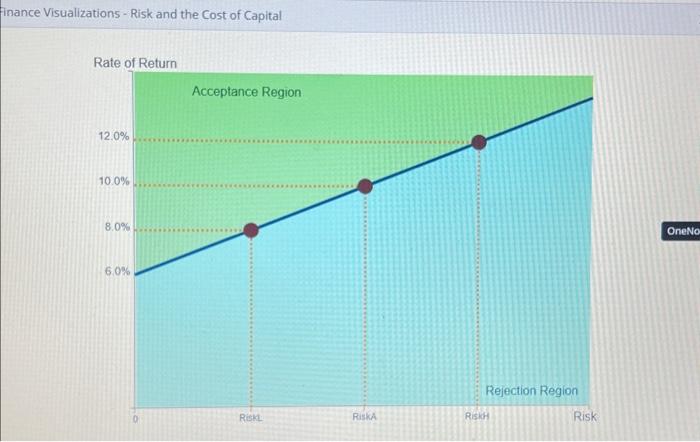

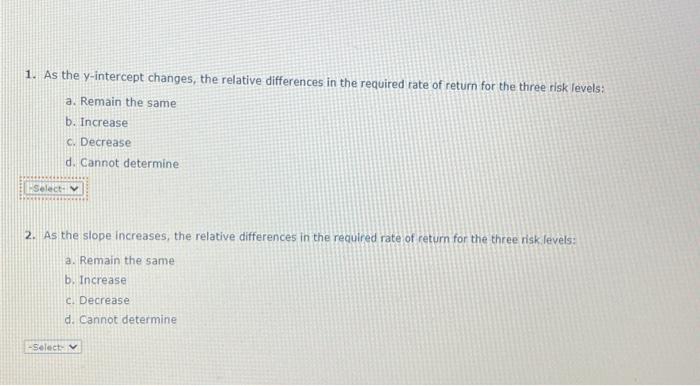

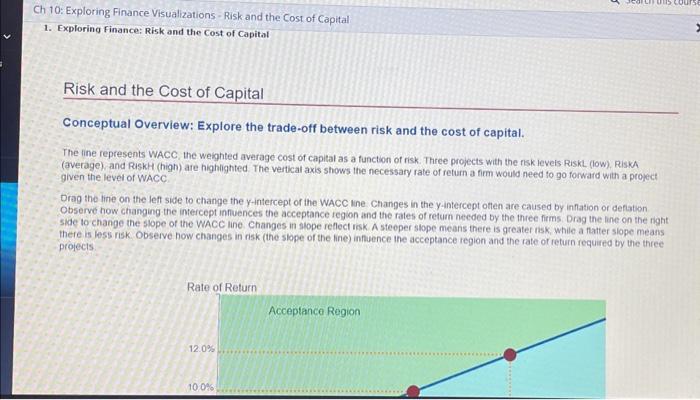

Conceptual Overview: Explore the trade-off between risk and the cost of capital. The line represents WACC, the weighted average cost of capilal as a function of risk. Three projects with the risk levels RiskL (low). RiskA (average), and RiskH (high) are highlighted. The vertical axis shows the necessary rate of return a firm would need to go forward with a projec given the level of WACC Drag the line on the lef side to change the y-intercept of the WACC line. Changes in the y-intercept often are caused by inflation or deflation Observe how changing the intercept influences the acceptance region and the rates of return needed by the three firms. Drag the line on the n side to change the slope of the WACC line Changes in slope reflect risk. A steeper slope means there is greater risk. while a flatter slope mea there is less risk. Observe how changes in risk (the slope of the line) influence the acceptance region and the fate of return required by the thre projects Finance Visualizations - Risk and the Cost of Capital 1. As the y-intercept changes, the relative differences in the required rate of return for the three risk levels: a. Remain the same b. Increase c. Decrease d. Cannot determine 2. As the slope increases, the relative differences in the required rate of return for the three risk levels: a. Remain the same b. Increase c. Decrease d. Cannot determine Conceptual Overview: Explore the trade-off between risk and the cost of capital. The ine represents WACC, the weighted average cost of capital as a function of risk. Three projects with the nisk leveis RiskL, (low), RiskA (average), and RiskH (high) are highlighted. The vertical axis shows the necessary rate of return a firm would need to go forward with a project given the level of WACC Drag the line on the lef side to change the y-intercept of the WACC ine. Changes in the y-intercept otten are caused by innation or cefiation Observe now changing the intercept innuences the acceptance iegion and the rales of retum needed by the thee firms Drag the line on the night side to change the slope of the WacC line. Changes in llope reflect isk A steeper slope means there is greater nsk, while a thatter slope means there is less risk. Observe how changes in risk (the slope of the line) infuence the acceptance region and the rate of return required by the three projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts