Question: Background Information -> Questions I need help solving, The management of Blossom Company asks your help in determining the comparative effects of the FIFO and

Background Information ->

Questions I need help solving,

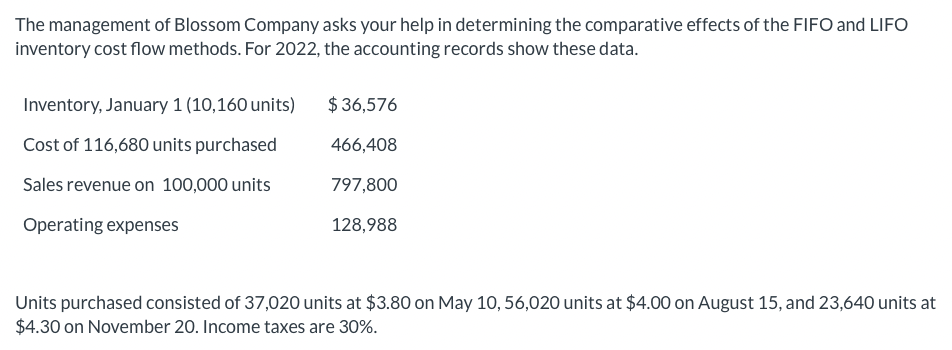

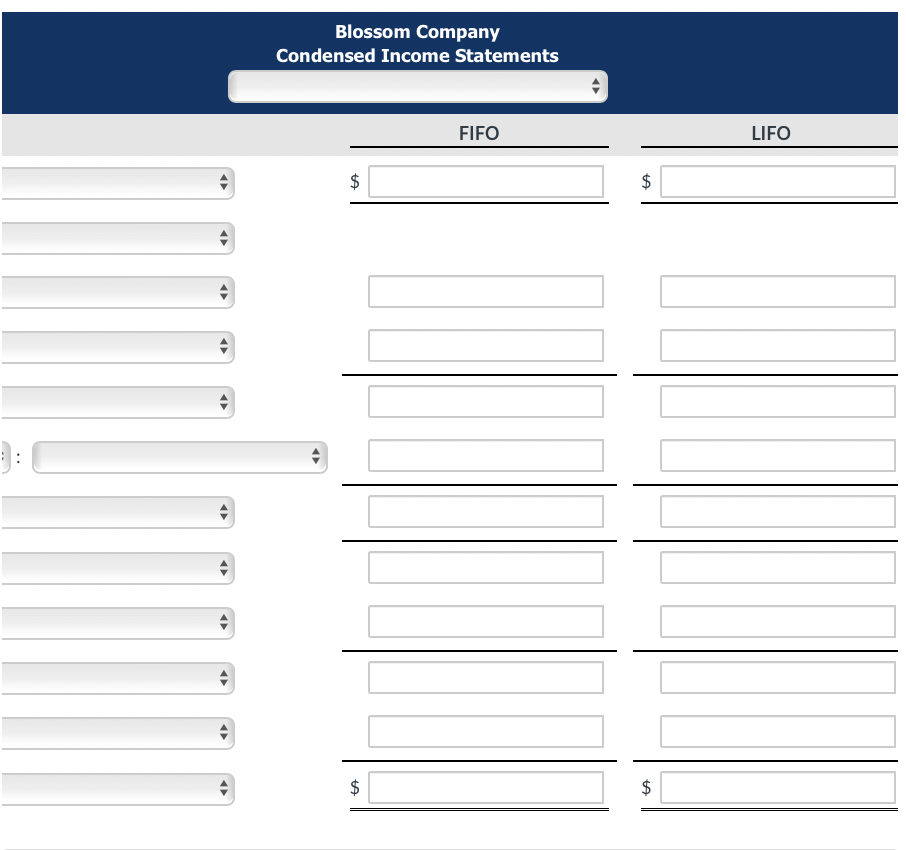

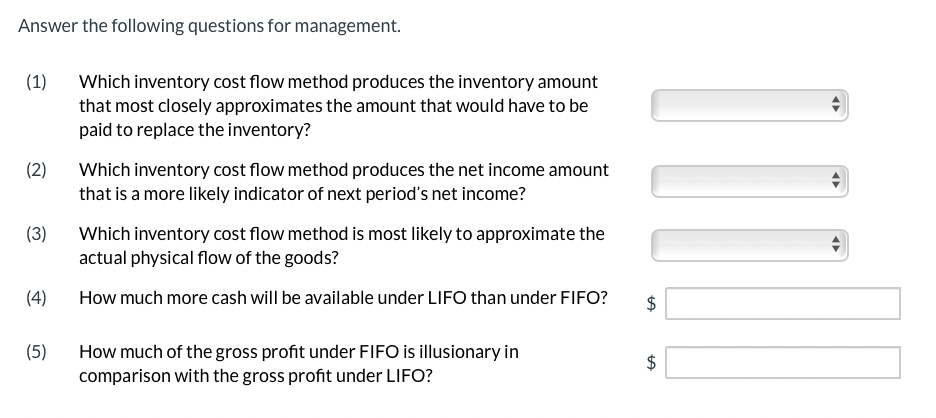

The management of Blossom Company asks your help in determining the comparative effects of the FIFO and LIFO inventory cost flow methods. For 2022, the accounting records show these data. Units purchased consisted of 37,020 units at $3.80 on May 10, 56,020 units at $4.00 on August 15 , and 23,640 units at $4.30 on November 20 . Income taxes are 30%. Blossom Company Condensed Income Statements Answer the following questions for management. (1) Which inventory cost flow method produces the inventory amount that most closely approximates the amount that would have to be paid to replace the inventory? (2) Which inventory cost flow method produces the net income amount that is a more likely indicator of next period's net income? (3) Which inventory cost flow method is most likely to approximate the actual physical flow of the goods? (4) How much more cash will be available under LIFO than under FIFO? (5) How much of the gross profit under FIFO is illusionary in comparison with the gross profit under LIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts