Question: badly needed, pls help. ASAP! XIII. SELF-TEST: Instruction: Try solving the following short problems. Correct and final answers have been provided. 1. What is business

badly needed, pls help. ASAP!

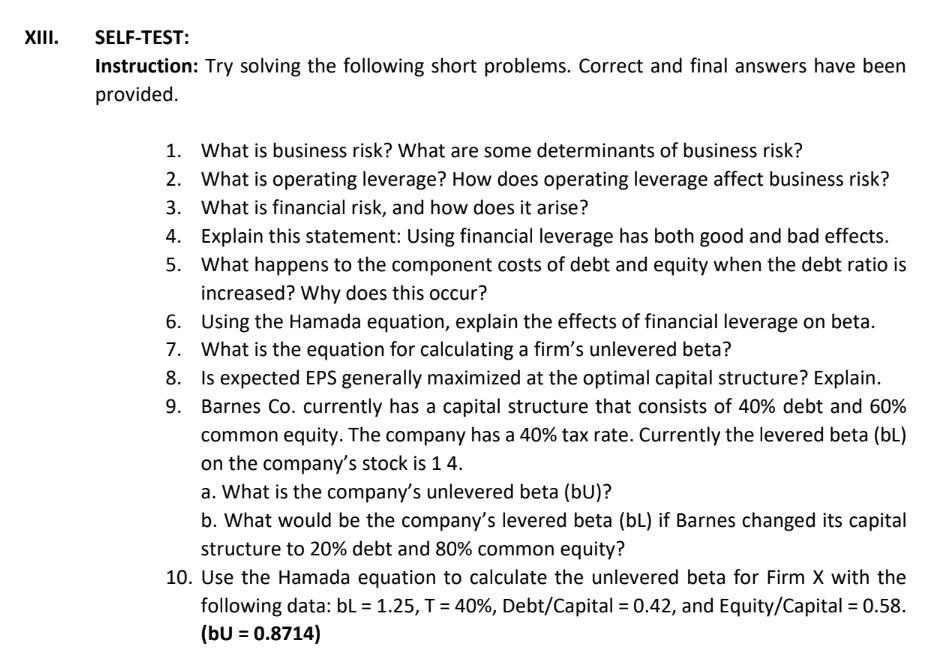

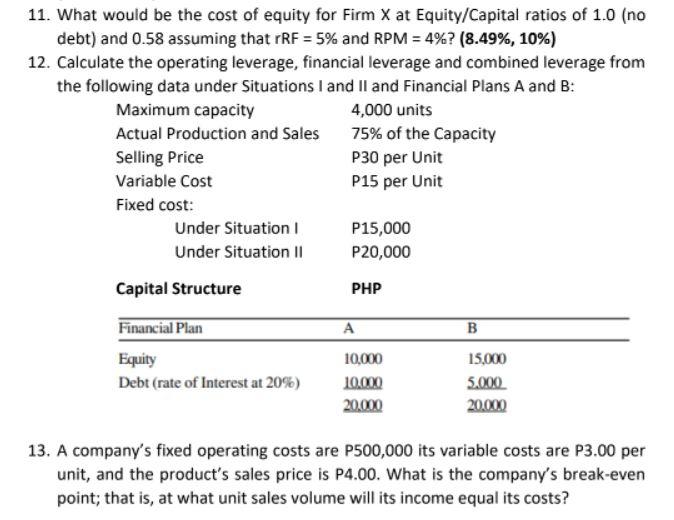

XIII. SELF-TEST: Instruction: Try solving the following short problems. Correct and final answers have been provided. 1. What is business risk? What are some determinants of business risk? 2. What is operating leverage? How does operating leverage affect business risk? What is financial risk, and how does it arise? 4. Explain this statement: Using financial leverage has both good and bad effects. 5. What happens to the component costs of debt and equity when the debt ratio is increased? Why does this occur? 6. Using the Hamada equation, explain the effects of financial leverage on beta. 7. What is the equation for calculating a firm's unlevered beta? 8. Is expected EPS generally maximized at the optimal capital structure? Explain. 9. Barnes Co. currently has a capital structure that consists of 40% debt and 60% common equity. The company has a 40% tax rate. Currently the levered beta (bL) on the company's stock is 1 4. a. What is the company's unlevered beta (bU)? b. What would be the company's levered beta (bL) if Barnes changed its capital structure to 20% debt and 80% common equity? 10. Use the Hamada equation to calculate the unlevered beta for Firm X with the following data: bL = 1.25, T = 40%, Debt/Capital = 0.42, and Equity/Capital = 0.58. (bU = 0.8714) = 11. What would be the cost of equity for Firm X at Equity/Capital ratios of 1.0 (no debt) and 0.58 assuming that rRF = 5% and RPM = 4%? (8.49%, 10%) 12. Calculate the operating leverage, financial leverage and combined leverage from the following data under Situations I and II and Financial Plans A and B: Maximum capacity 4,000 units Actual Production and Sales 75% of the Capacity Selling Price P30 per Unit Variable Cost P15 per Unit Fixed cost: Under Situation 1 P15,000 Under Situation II P20,000 Capital Structure PHP B Financial Plan Equity Debt (rate of Interest at 20%) 10,000 10,000 20.000 15,000 5.000 20.000 13. A company's fixed operating costs are P500,000 its variable costs are P3.00 per unit, and the product's sales price is P4.00. What is the company's break-even point; that is, at what unit sales volume will its income equal its costs? XIII. SELF-TEST: Instruction: Try solving the following short problems. Correct and final answers have been provided. 1. What is business risk? What are some determinants of business risk? 2. What is operating leverage? How does operating leverage affect business risk? What is financial risk, and how does it arise? 4. Explain this statement: Using financial leverage has both good and bad effects. 5. What happens to the component costs of debt and equity when the debt ratio is increased? Why does this occur? 6. Using the Hamada equation, explain the effects of financial leverage on beta. 7. What is the equation for calculating a firm's unlevered beta? 8. Is expected EPS generally maximized at the optimal capital structure? Explain. 9. Barnes Co. currently has a capital structure that consists of 40% debt and 60% common equity. The company has a 40% tax rate. Currently the levered beta (bL) on the company's stock is 1 4. a. What is the company's unlevered beta (bU)? b. What would be the company's levered beta (bL) if Barnes changed its capital structure to 20% debt and 80% common equity? 10. Use the Hamada equation to calculate the unlevered beta for Firm X with the following data: bL = 1.25, T = 40%, Debt/Capital = 0.42, and Equity/Capital = 0.58. (bU = 0.8714) = 11. What would be the cost of equity for Firm X at Equity/Capital ratios of 1.0 (no debt) and 0.58 assuming that rRF = 5% and RPM = 4%? (8.49%, 10%) 12. Calculate the operating leverage, financial leverage and combined leverage from the following data under Situations I and II and Financial Plans A and B: Maximum capacity 4,000 units Actual Production and Sales 75% of the Capacity Selling Price P30 per Unit Variable Cost P15 per Unit Fixed cost: Under Situation 1 P15,000 Under Situation II P20,000 Capital Structure PHP B Financial Plan Equity Debt (rate of Interest at 20%) 10,000 10,000 20.000 15,000 5.000 20.000 13. A company's fixed operating costs are P500,000 its variable costs are P3.00 per unit, and the product's sales price is P4.00. What is the company's break-even point; that is, at what unit sales volume will its income equal its costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts