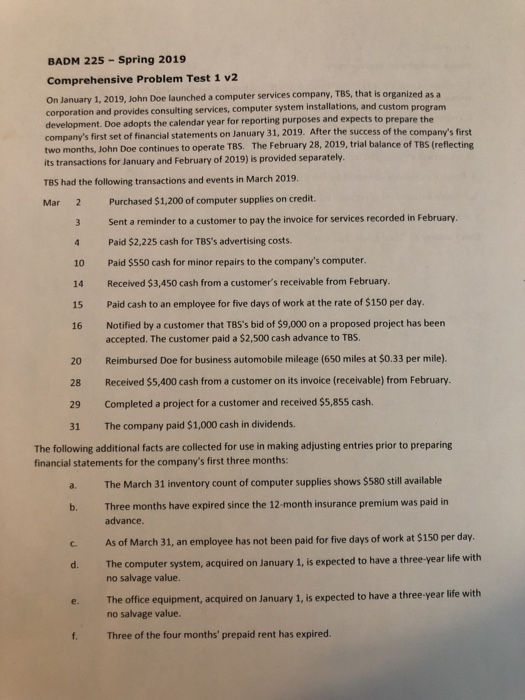

Question: BADM 225-Spring 2019 Comprehensive Problem Test 1 v2 computer services company, TBS, that is organized as a On January 1, 2019, John Doe launched a

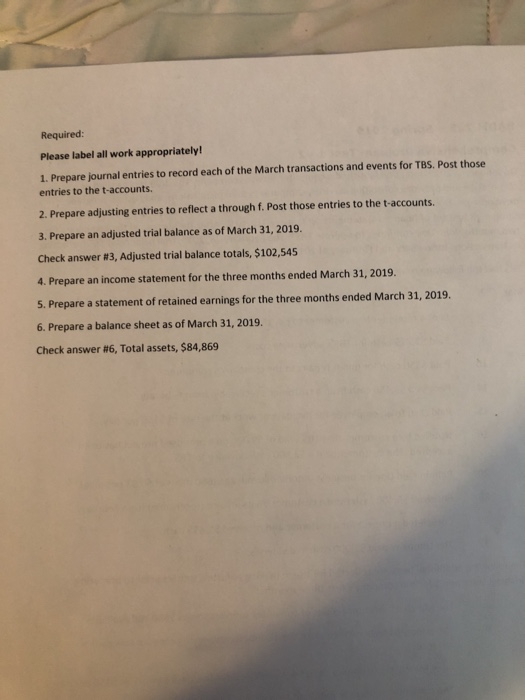

BADM 225-Spring 2019 Comprehensive Problem Test 1 v2 computer services company, TBS, that is organized as a On January 1, 2019, John Doe launched a corpora developmen company's first set of financial statements on January 31, 2019. After the success of the company's first two months, John Doe continues to operate TBS. The Febr tion and provides consulting services, computer system installations, and custom program t. Doe adopts the calendar year for reporting purposes and expects to prepare the uary 28, 2019, trial balance of TBS (reflecting its transactions for January and February of 2019) is provided separately. TBS had the following transactions and events in March 2019 Purchased $1,200 of computer supplies on credit. 2 3 Sent a reminder to a customer to pay the invoice for services recorded in February 4 Paid $2,225 cash for TBS's advertising costs. 10 Paid $550 cash for minor repairs to the company's computer 14 Received $3,450 cash from a customer's receivable from February. 15 Paid cash to an employee for five days of work at the rate of $150 per day. 16 Notified by a customer that TBS's bid of $9,000 on a proposed project has been Mar 20 28 29 31 accepted. The customer paid a $2,500 cash advance to TBS. Reimbursed Doe for business automobile mileage (650 miles at $0.33 per mile). Received $5,400 cash from a customer on its invoice (receivable) from February. Completed a project for a customer and received $5,855 cash. The company paid $1,000 cash in dividends. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months a. The March 31 inventory count of computer supplies shows $580 still available Three months have expired since the 12-month insurance premium was paid in advance. b. c. As of March 31, an employee has not been paid for five days of work at $150 per day. d. The computer system, acquired on January 1, is expected to have a three-year life with e. The office equipment, acquired on January 1,is expected to have a three-year life with f. Three of the four months' prepaid rent has expired no salvage value no salvage value. Required Please label all work appropriately! 1. Prepare journal entries to record each of the March transactions and events for TBS. Post those entries to the t-accounts. 2. Prepare adjusting entries to reflect a through f. Post those entries to the t-accounts. 3. Prepare an adjusted trial balance as of March 31, 2019 Check answer #3, Adjusted trial balance totals, S 102,545 4. Prepare an income statement for the three months ended March 31, 2019. 5. Prepare a statement of retained earnings for the three months ended March 31, 2019. 6. Prepare a balance sheet as of March 31, 2019. Check answer #6, Total assets, $84,869 BADM 225-Spring 2019 Comprehensive Problem Test 1 v2 computer services company, TBS, that is organized as a On January 1, 2019, John Doe launched a corpora developmen company's first set of financial statements on January 31, 2019. After the success of the company's first two months, John Doe continues to operate TBS. The Febr tion and provides consulting services, computer system installations, and custom program t. Doe adopts the calendar year for reporting purposes and expects to prepare the uary 28, 2019, trial balance of TBS (reflecting its transactions for January and February of 2019) is provided separately. TBS had the following transactions and events in March 2019 Purchased $1,200 of computer supplies on credit. 2 3 Sent a reminder to a customer to pay the invoice for services recorded in February 4 Paid $2,225 cash for TBS's advertising costs. 10 Paid $550 cash for minor repairs to the company's computer 14 Received $3,450 cash from a customer's receivable from February. 15 Paid cash to an employee for five days of work at the rate of $150 per day. 16 Notified by a customer that TBS's bid of $9,000 on a proposed project has been Mar 20 28 29 31 accepted. The customer paid a $2,500 cash advance to TBS. Reimbursed Doe for business automobile mileage (650 miles at $0.33 per mile). Received $5,400 cash from a customer on its invoice (receivable) from February. Completed a project for a customer and received $5,855 cash. The company paid $1,000 cash in dividends. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months a. The March 31 inventory count of computer supplies shows $580 still available Three months have expired since the 12-month insurance premium was paid in advance. b. c. As of March 31, an employee has not been paid for five days of work at $150 per day. d. The computer system, acquired on January 1, is expected to have a three-year life with e. The office equipment, acquired on January 1,is expected to have a three-year life with f. Three of the four months' prepaid rent has expired no salvage value no salvage value. Required Please label all work appropriately! 1. Prepare journal entries to record each of the March transactions and events for TBS. Post those entries to the t-accounts. 2. Prepare adjusting entries to reflect a through f. Post those entries to the t-accounts. 3. Prepare an adjusted trial balance as of March 31, 2019 Check answer #3, Adjusted trial balance totals, S 102,545 4. Prepare an income statement for the three months ended March 31, 2019. 5. Prepare a statement of retained earnings for the three months ended March 31, 2019. 6. Prepare a balance sheet as of March 31, 2019. Check answer #6, Total assets, $84,869

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts