Question: Bailey Builders Corp. signed a three-year, $1,000,000 fixed price contract with a customer to renovate the customer's parking deck. Bailey uses the cost-to-cost method of

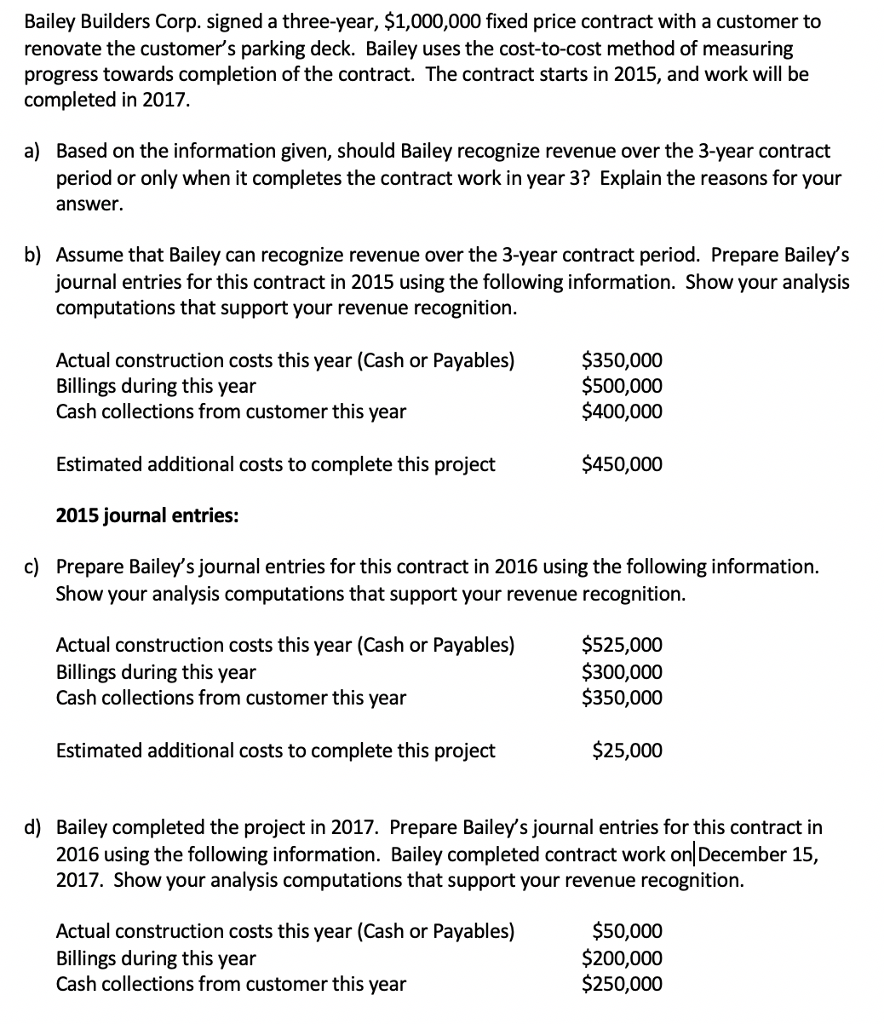

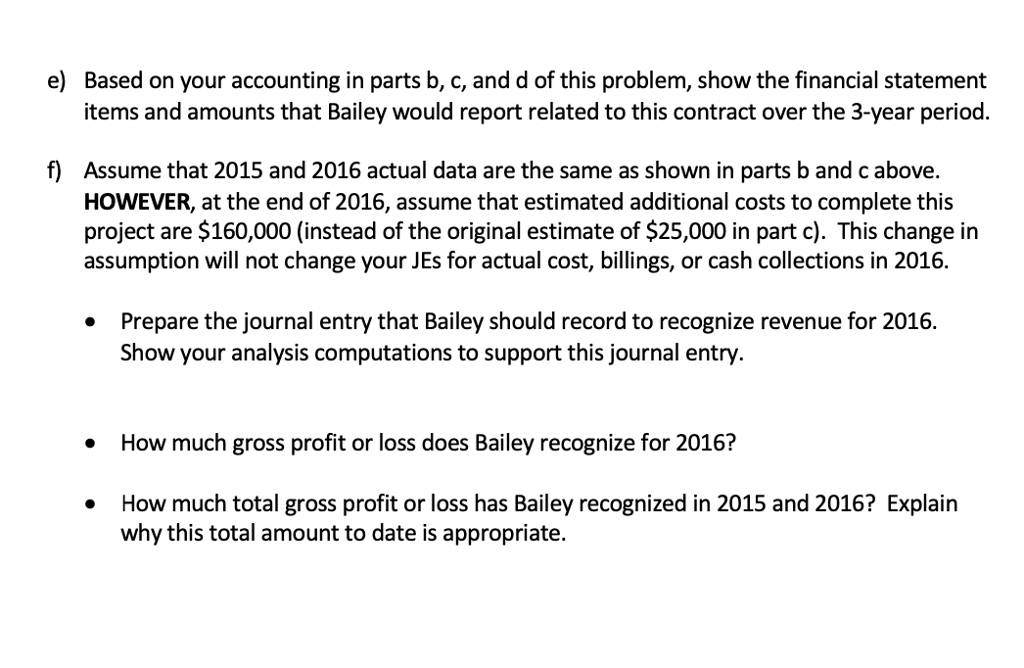

Bailey Builders Corp. signed a three-year, $1,000,000 fixed price contract with a customer to renovate the customer's parking deck. Bailey uses the cost-to-cost method of measuring progress towards completion of the contract. The contract starts in 2015, and work will be completed in 2017. a) Based on the information given, should Bailey recognize revenue over the 3-year contract period or only when it completes the contract work in year 3? Explain the reasons for your answer. b) Assume that Bailey can recognize revenue over the 3-year contract period. Prepare Bailey's journal entries for this contract in 2015 using the following information. Show your analysis computations that support your revenue recognition. Actual construction costs this year (Cash or Payables) Billings during this year Cash collections from customer this year $350,000 $500,000 $400,000 Estimated additional costs to complete this project $450,000 2015 journal entries: c) Prepare Bailey's journal entries for this contract in 2016 using the following information. Show your analysis computations that support your revenue recognition Actual construction costs this year (Cash or Payables) Billings during this year Cash collections from customer this year 525,000 $300,000 $350,000 Estimated additional costs to complete this project $25,000 d) Bailey completed the project in 2017. Prepare Bailey's journal entries for this contract in 2016 using the following information. Bailey completed contract work on December 15, 2017. Show your analysis computations that support your revenue recognition Actual construction costs this year (Cash or Payables) Billings during this year Cash collections from customer this year $50,000 $200,000 $250,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts