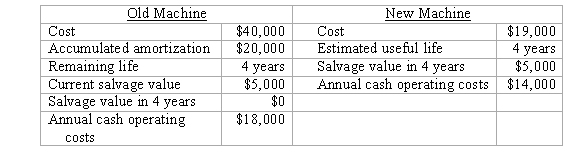

Question: Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this

Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:  The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x1, $5,700 in 20x2, $3,800 in 20x3, and $1,900 in 20x4. Assume Bailey would purchase the new machine in December 20x0 and dispose of the old machine in January 20x1. The tax effect of selling the new machine in 20x4 would be:

The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x1, $5,700 in 20x2, $3,800 in 20x3, and $1,900 in 20x4. Assume Bailey would purchase the new machine in December 20x0 and dispose of the old machine in January 20x1. The tax effect of selling the new machine in 20x4 would be:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock