Question: Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this

Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:

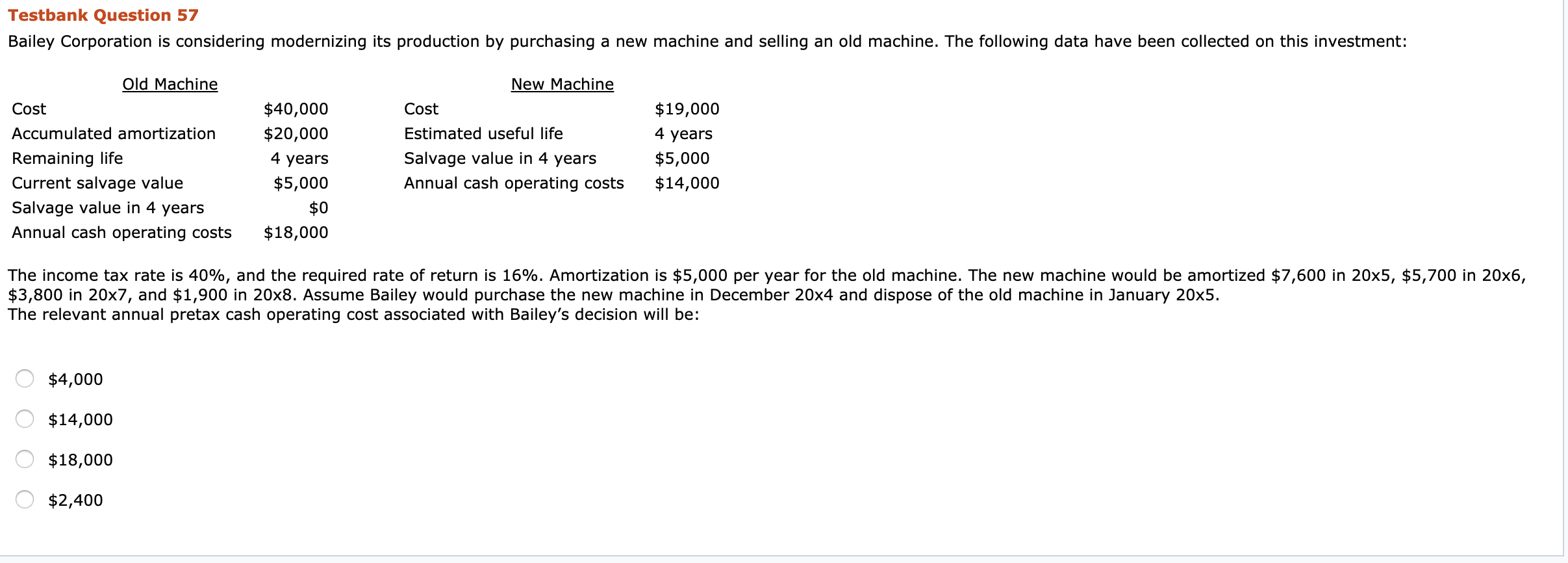

Testbank Question 57 Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment: Old Machine Cost Accumulated amortization Remaining life Current salvage value Salvage value in 4 years Annual cash operating costs $40,000 $20,000 4 years $5,000 New Machine Cost Estimated useful life Salvage value in 4 years Annual cash operating costs $19,000 4 years $5,000 $14,000 $0 $18,000 The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x5, $5,700 in 20x6, $3,800 in 20x7, and $1,900 in 20x8. Assume Bailey would purchase the new machine in December 20x4 and dispose of the old machine in January 20x5. The relevant annual pretax cash operating cost associated with Bailey's decision will be: 0 $4,000 0 0 $14,000 $18,000 O $2,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts