Question: Balance Sheet Presentation Listed below are items that may appear on a classified balance sheet. Required: Indicate whether each item is included as an operating

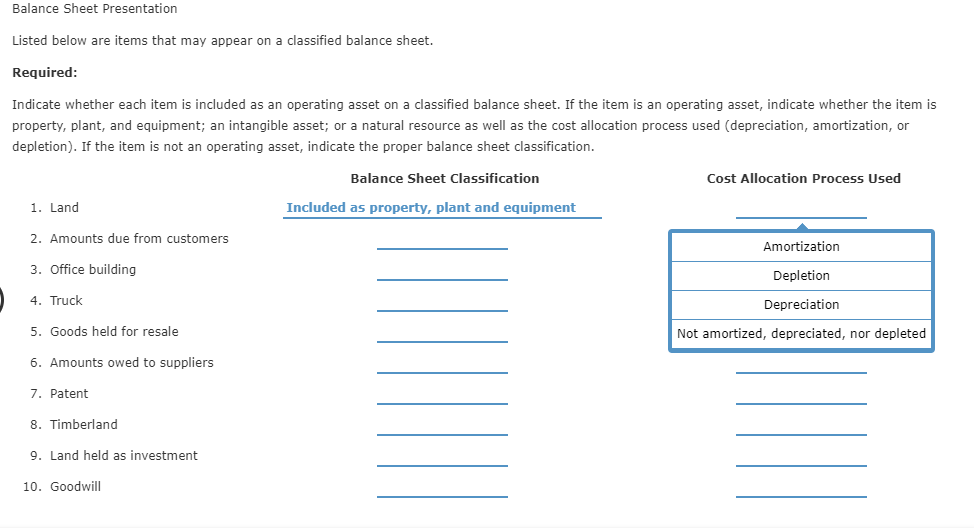

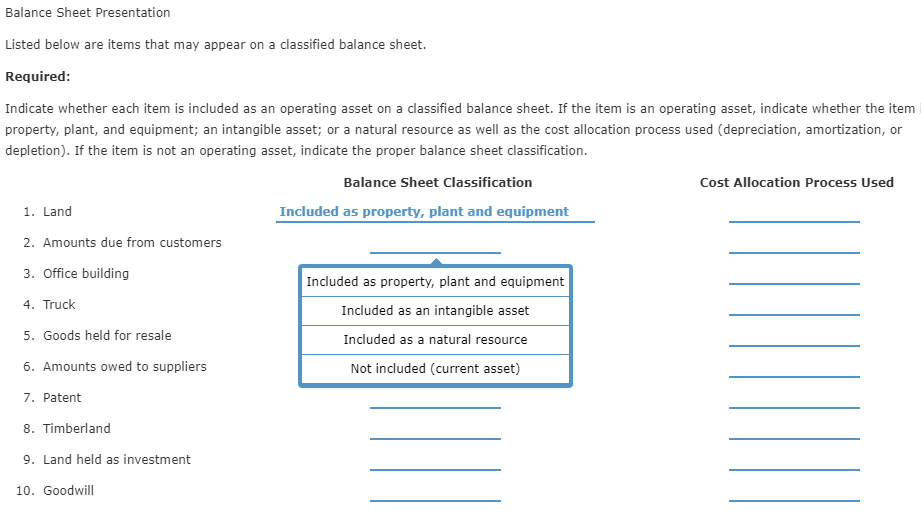

Balance Sheet Presentation Listed below are items that may appear on a classified balance sheet. Required: Indicate whether each item is included as an operating asset on a classified balance sheet. If the item is an operating asset, indicate whether the item is property, plant, and equipment; an intangible asset; or a natural resource as well as the cost allocation process used (depreciation, amortization, or depletion). If the item is not an operating asset, indicate the proper balance sheet classification. Balance Sheet Classification Cost Allocation Process Used 1. Land Included as property, plant and equipment 2. Amounts due from customers Amortization 3. Office building Depletion 4. Truck Depreciation 5, Goods held for resale Not amortized, depreciated, nor depleted 6. Amounts owed to suppliers 7. Patent 8. Timberland 9. Land held as investment 10. Goodwill Balance Sheet Presentation Listed below are items that may appear on a classified balance sheet. Required: Indicate whether each item is included as an operating asset on a classified balance sheet. If the item is an operating asset, indicate whether the item property, plant, and equipment; an intangible asset; or a natural resource as well as the cost allocation process used (depreciation, amortization, or depletion). If the item is not an operating asset, indicate the proper balance sheet classification. Balance Sheet Classification Cost Allocation Process Used Included as property, plant and equipment 1. Land 2. Amounts due from customers 3. Office building Included as property, plant and equipment 4. Truck Included as an intangible asset 5. Goods held for resale Included as a natural resource 6. Amounts owed to suppliers Not included (current asset) 7. Patent 8. Timberland 9. Land held as investment 10. Goodwill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts