Question: Banking 5 PoE ( 6 1 5 8 9 LP 2 0 1 8 6 ) V 7 - eLearning ( SP 2 ) Summative

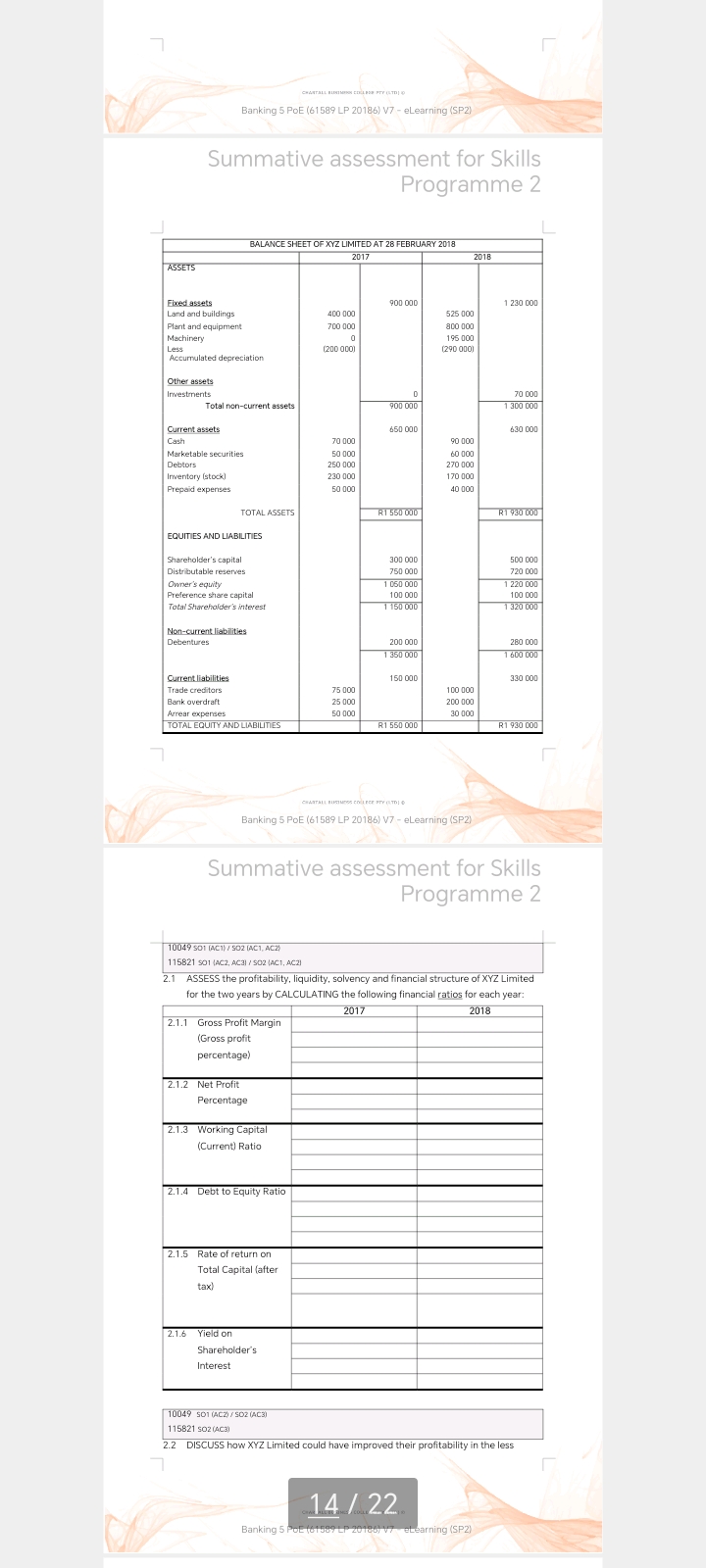

Banking PoE LP V eLearning SP Summative assessment for Skills Programme Banking PoE LP V eLearning SP Summative assessment for Skills Programme AC AC SOAC AC for the two years by CALCULATING the following financial ratios for each year: begintabularlll & & multirow Gross Profit Margin Gross profit percentage & & & & & & multirow Net Profit Percentage & & & & & & multirowt Working Capital Current Ratio & & & & & & multirowt Debt to Equity Ratio & & & & & & & & multirowt Rate of return on Total Capital after tax & & & & & & & & multirowtbegintabularl Yield on Shareholder's Interest endtabular & & & & & & & & endtabular SOACZ SOAC SOAC DISCUSS how XYZ Limited could have improved their profitability in the less Banking PoEtoise LP vetearning SP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock