Question: Banking institutions access data sets with different dimensions, which are unparalleled in depth, breadth, and complexity. Personal financial data everywhere is: 1) Data generated by

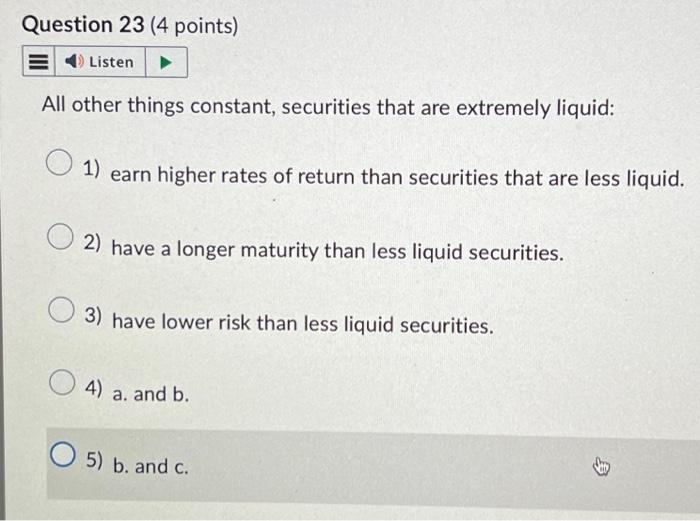

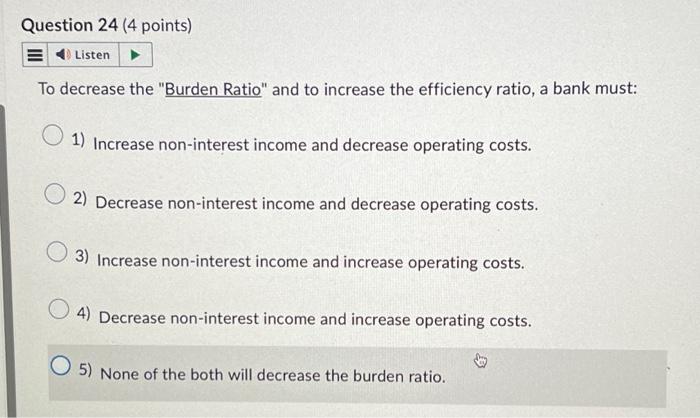

Banking institutions access data sets with different dimensions, which are unparalleled in depth, breadth, and complexity. Personal financial data everywhere is: 1) Data generated by customers when they use products provided by other banks. 2) Data generated by specific customers when they use the bank's services. 3) Data generated by millions of customers when they use social networking sites. 4) Data generated by customers when they use the bank's website. 5) Data generated by customers when they use a product provided by the bank. What is an advantage of PIN-based debit cards? 1) Improved security 2) Wider merchant acceptance 3) Lower interchange fees 4) Faster transaction speeds What payment channel is declining in usage in the US but still widely used? 1) Checks 2) Credit cards 3) Automated clearing house (ACH) 4) Wire transfers The "protecting capital" needs of a banking customer can be groups into all of the following main objectives EXCEPT: 1) Prepare for the unexpected. 2) Grow some capital with varying expectations of return and security. 3) Protect enough to cover current needs. 4) Choose securities with the greatest expected return possible. 5) Plan for less productive years. Under the master credit line, the customer line of credit will be extended to which of the following customer's needs? 1) Loan 2) Car loan 3) Loan 4) Financing 5) of the above To decrease the "Burden Ratio" and to increase the efficiency ratio, a bank must: 1) Increase non-interest income and decrease operating costs. 2) Decrease non-interest income and decrease operating costs. 3) Increase non-interest income and increase operating costs. 4) Decrease non-interest income and increase operating costs. 5) None of the both will decrease the burden ratio. All other things constant, securities that are extremely liquid: 1) earn higher rates of return than securities that are less liquid. 2) have a longer maturity than less liquid securities. 3) have lower risk than less liquid securities. 4) a. and b. 5) b. and c. TRUE or FALSE: "Banks do not hold inventories; therefore it would be meaningless to calculate an 'inventory turnover ratio' for a bank." 1) True 2) False What is one purpose of blockchain technology? 1) To record currency transactions 2) To eliminate the need for banks 3) To facilitate mobile payments 4) To enable cryptocurrencies When does a payment receive the quality of finality? 1) When the payee receives provisional credit 2) When the payer's account is debited 3) When it becomes unconditional and irrevocable 4) When it is processed through the ACH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts