Question: Base on the information of a link provided : https://www.crunchbase.com/organization/softbank Value this firm's equity using 'real options' techniques For example: (real option techniques by DAMODARAN

Base on the information of a link provided : https://www.crunchbase.com/organization/softbank

Value this firm's equity using 'real options' techniques

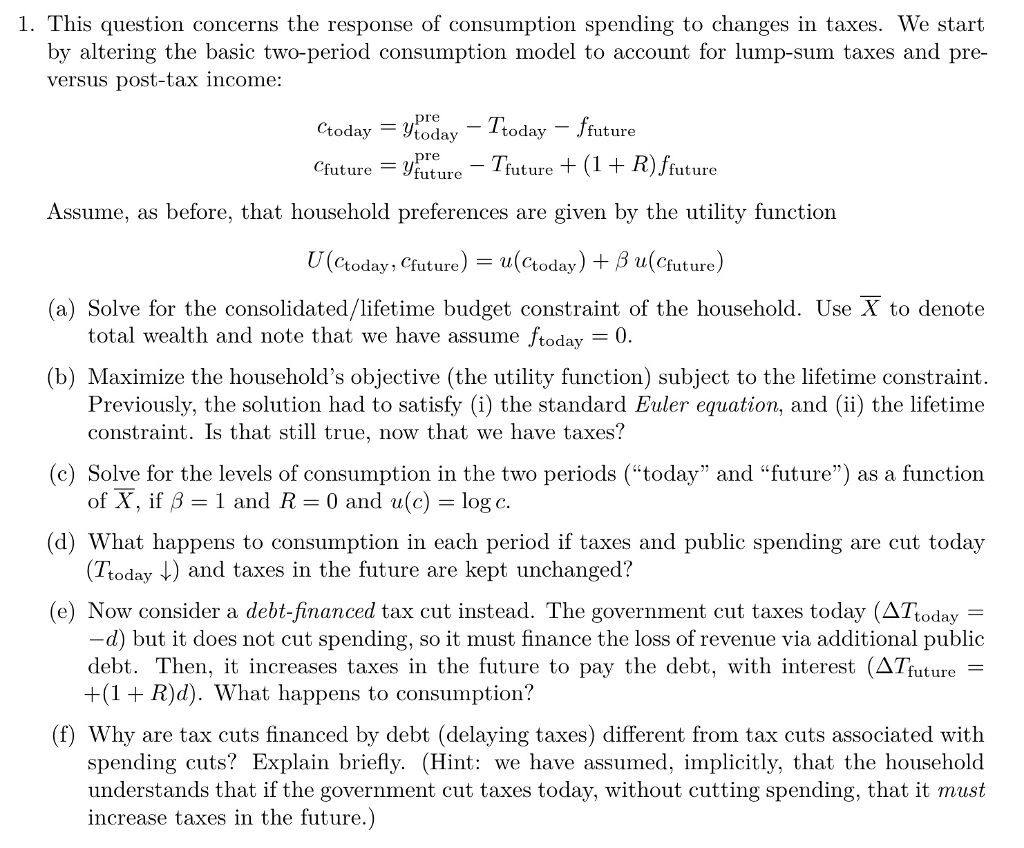

For example: (real option techniques by DAMODARAN (2005)

IN PRACTICE: Valuing an Option to Expand: The Home Depot Assume that The Home Depot is considering opening a small store in France. The store will cost 100 million FF to build, and the present value of the expected cash flows from the store is 120 million FF. Thus, by itself, the store has a negative NPV of 20 million FF.

Assume, however, that by opening this store, the Home Depot acquires the option to expand into a much larger store any time over the next 5 years. The cost of expansion will be 200 million FF, and it will be undertaken only if the present value of the expected cash flows exceeds 200 million FF. At the moment, the present value of the expected cash flows from the expansion is believed to be only 150 million FF. If it were not, the Home Depot would have opened to larger store right away. The Home Depot still does not know much about the market for home improvement products in France, and there is considerable uncertainty about this estimate. The variance is 0.08.

The value of the option to expand can now be estimated, by defining the inputs to the option pricing model as follows:

Value of the Underlying Asset (S) = PV of Cash Flows from Expansion, if done now =150 million FF

Strike Price (K) =Cost of Expansion = 200 million FF

Variance in Underlying Asset's Value = 0.08

Time to expiration = Period for which expansion option applies = 5 years

Assume that the five-year riskless rate is 6%. The value of the option can be estimated as follows:

Call Value= 150 exp(-0.06)(5) (0.6314) -200 (exp(-0.06)(20) (0.3833)= 37.91 million FF

This value can be added on to the net present value of the original project under consideration.

NPV of Store = 80 million FF - 100 million FF = -20 million

Value of Option to Expand = 37.91 million FF

NPV of store with option to expand = -20 million + 37.91 million = 17.91 mil FF

The Home Depot should open the smaller store, even though it has a negative net present value, because it acquires an option of much greater value, as a consequence.

Please refer to the example above to value Soft Bank's equity using "real option" techniques

Present all numerical data in a table and include a graph similar to the one displayed in the answer to this question, but with the actual numbers that are used in your valuation.

Present all numerical data in a table and include a graph similar to the one displayed in the answer to this question, but with the actual numbers that are used in your valuation.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts