Question: Based off the information below. Please provide a General Ledger and Unadjusted Trial Balance for June. (and corrections to my journal entries if you note

Based off the information below. Please provide a General Ledger and Unadjusted Trial Balance for June. (and corrections to my journal entries if you note any) Thank you!

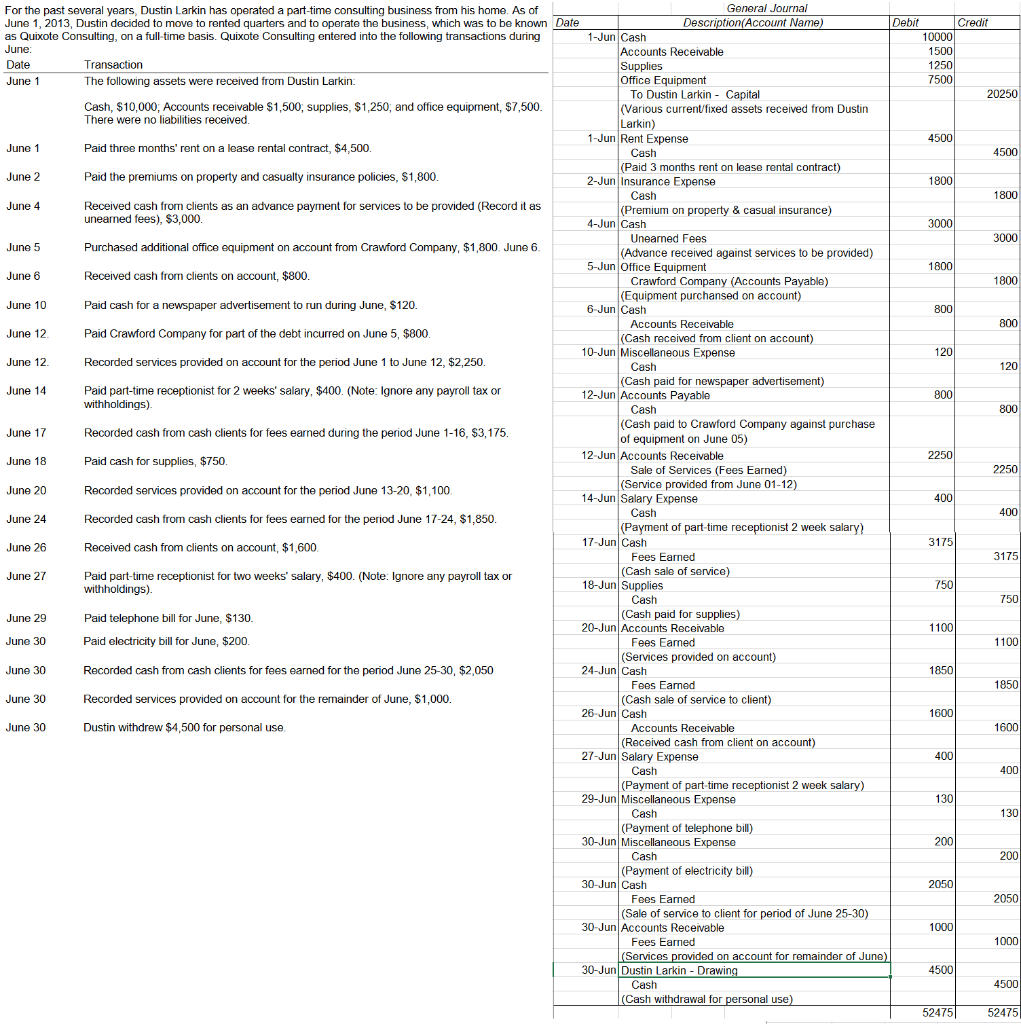

For the past several years, Dustin Larkin has operated a part-time consulting business from his home. As of General Journal June 1, 2013, Dustin decided to move to rented quarters and to operate the business, which was to be known Date Description(Account Name) Debit Credit as Quixote Consulting, on a full-time basis. Quixote Consulting entered into the following transactions during 1-Jun Cash 10000 June Accounts Receivable 1500 Date Transaction Supplies 1250 June 1 The following assets were received from Dustin Larkin: Office Equipment 7500 To Dustin Larkin - Capital 20250 Cash, $10,000, Accounts receivable $1,500, supplies, $1,250, and office equipment, $7,500. (Various current fixed assets received from Dustin There were no liabilities received Larkin) 1-Jun Rent Expense 4500 June 1 Paid three months' rent on a lease rental contract, $4,500. Cash 4500 (Paid 3 months rent on lease rental contract) June 2 Paid the premiums on property and casualty insurance policies, $1,800. 2-Jun Insurance Expense 1800 Cash 1800 June 4 Received cash from clients as an advance payment for services to be provided (Record it as (Premium on property & casual insurance) unearned fees), $3,000 . 4-Jun Cash 3000 Unearned Fees 3000 June 5 Purchased additional office equipment on account from Crawford Company, $1,800. June 6. (Advance received against services to be provided) 5-Jun Office Equipment 1800 June 6 Received cash from clients on account, $800. Crawford Company (Accounts Payable) 1800 (Equipment purchansed on account) June 10 Paid cash for a newspaper advertisement to run during June, $120. 6-Jun Cash 800 Accounts Receivable 800 June 12 Paid Crawford Company for part of the debt incurred on June 5, $800. (Cash received from client on account) 10-Jun Miscellaneous Expense 120 June 12 Recorded services provided on account for the period June 1 to June 12, $2,250. Cash 120 June 14 (Cash paid for newspaper advertisement) Paid part-time receptionist for 2 weeks' salary, $400. (Note: Ignore any payroll tax or 12-Jun Accounts Payable 8001 withholdings). Cash 800 June 17 (Cash paid to Crawford Company against purchase Recorded cash from cash clients for fees earned during the period June 1-16, $3,175. of equipment on June 05) June 18 Paid cash for supplies, $750. 12-Jun Accounts Receivable 2250 Sale of Services (Fees Earned) 2250 June 20 Recorded services provided on account for the period June 13-20. $1,100. (Service provided from June 01-12) 14-Jun Salary Expense 400 Cash 400 June 24 Recorded cash from cash clients for fees earned for the period June 17-24, $1,850. $ (Payment of part-time receptionist 2 week salary) June 26 Received cash from clients on account, $1,600 17-Jun Cash 3175 Fees Earned 3175 June 27 Paid part-time receptionist for two weeks' salary, $400. (Note: Ignore any payroll tax or (Cash sale of service) withholdings). 18-Jun Supplies 750 Cash 750 June 29 Paid telephone bill for June, $130. (Cash paid for supplies) 20-Jun Accounts Receivable 1100 June 30 Paid electricity bill for June, $200. Fees Eamed 1100 (Services provided on account) June 30 Recorded cash from cash clients for fees earned for the period June 25-30, $2,050 24-Jun Cash 1850 Fees Eamed 1850 June 30 Recorded services provided on account for the remainder of June, $1,000. (Cash sale of service to client) 26-Jun Cash 1600 June 30 Dustin withdrew $4,500 for personal use. Accounts Receivable 1600 (Received cash from client on account) 27-Jun Salary Expense 400 Cash 400 (Payment of part-time receptionist 2 week salary) 29-Jun Miscellaneous Expense 130 Cash 130 (Payment of telephone bill) 30-Jun Miscellaneous Expense 200 Cash 200 (Payment of electricity bill) 30-Jun Cash 2050 Fees Earned 2050 (Sale of service to client for period of June 25-30) 30-Jun Accounts Receivable 1000 Fees Earned 1000 (Services provided on account for remainder of June) 30-Jun Dustin Larkin - Drawing 4500 Cash 4500 (Cash withdrawal for personal use) 52475 52475

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts