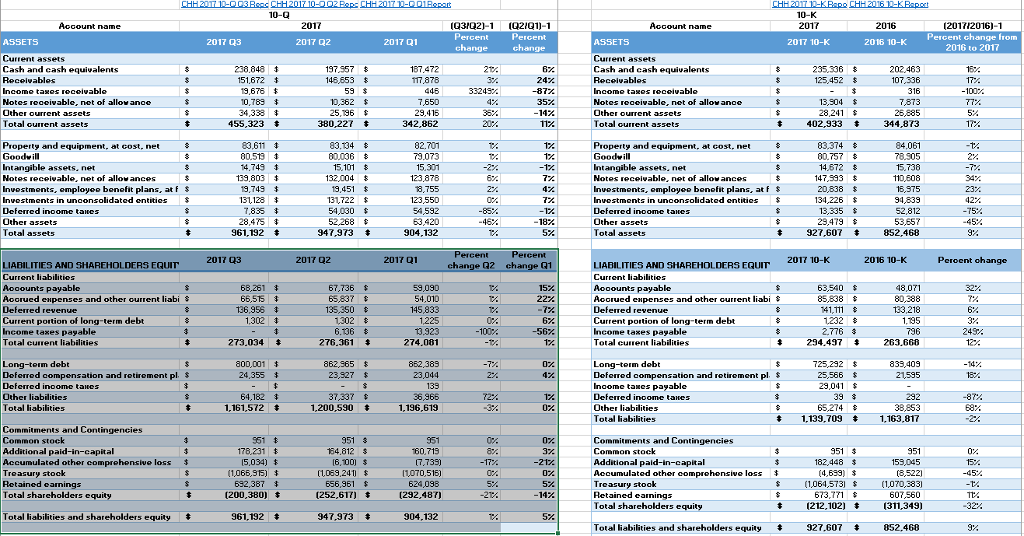

Question: Based on a balance sheet analysis (below), list at least 5 key recommendations for improving the clients asset management. Highlight 5 key recommendations for the

Based on a balance sheet analysis (below), list at least 5 key recommendations for improving the clients asset management. Highlight 5 key recommendations for the client in a bulleted list(recommendations to management).

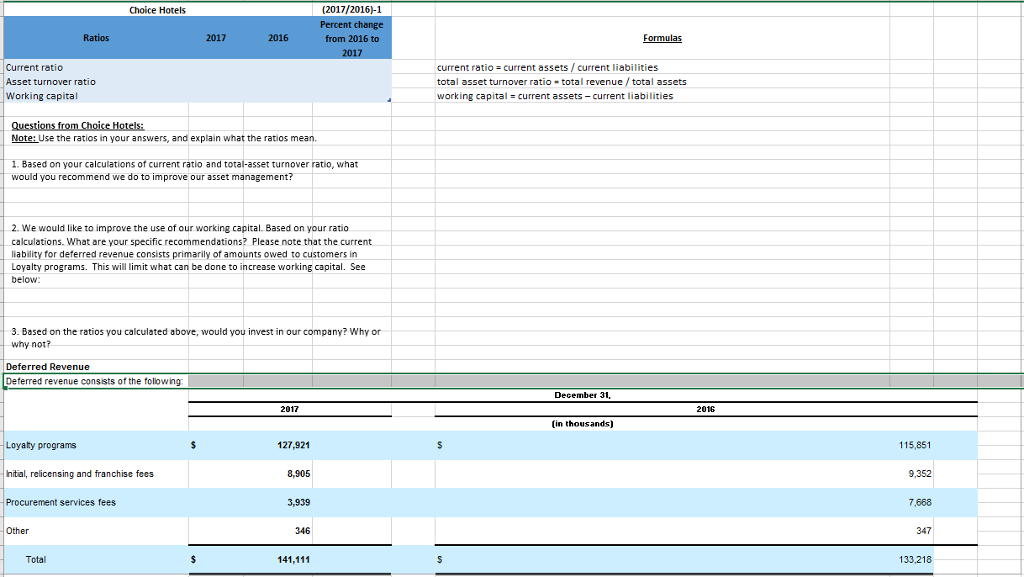

(2017/2016)-1 Percent change from 2016 to Choice Hotels Ratios 2017 2016 Formulas Current ratio Asset turnover ratio Working capital current ratio current assets/current liabilities total asset turnover ratio-total revenue total assets working capital current assets- current liabilities Note: Use the ratios in your answers, and explain what the ratios mean. 1. Based on your calculations of current ratio and total-asset turnover ratio, what would you recommend we do to improve our asset management? 2. We would like to improve the use of our working capital. Based on your ratio calculations. What are your specific recommendations? Please note that the current liability for deferred revenue consists primarily of amounts owed to customers in Loyalty programs. This will limit what can be done to increase working capital. See below 3. Based on the ratios you calculated above, would you invest in our company? Why or why not? Deferred Revenue Deferred revenue cons ists of the folowing December 31, 2017 2016 in thousands) Loyaty programs 127,921 115,851 nitial, relicensing and franchise fees 8,905 9,352 Procurement services fees 3,939 7,668 Other 346 347 Total 141,111 133,218 (2017/2016)-1 Percent change from 2016 to Choice Hotels Ratios 2017 2016 Formulas Current ratio Asset turnover ratio Working capital current ratio current assets/current liabilities total asset turnover ratio-total revenue total assets working capital current assets- current liabilities Note: Use the ratios in your answers, and explain what the ratios mean. 1. Based on your calculations of current ratio and total-asset turnover ratio, what would you recommend we do to improve our asset management? 2. We would like to improve the use of our working capital. Based on your ratio calculations. What are your specific recommendations? Please note that the current liability for deferred revenue consists primarily of amounts owed to customers in Loyalty programs. This will limit what can be done to increase working capital. See below 3. Based on the ratios you calculated above, would you invest in our company? Why or why not? Deferred Revenue Deferred revenue cons ists of the folowing December 31, 2017 2016 in thousands) Loyaty programs 127,921 115,851 nitial, relicensing and franchise fees 8,905 9,352 Procurement services fees 3,939 7,668 Other 346 347 Total 141,111 133,218

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts