Question: Based on Bed Bath & Beyond?s 2019 10-K. If Bed Bath & Beyond adopted IFRS would its reporting for inventory differ? Briefly explain. Identify other

Based on Bed Bath & Beyond?s 2019 10-K. If Bed Bath & Beyond adopted IFRS would its reporting for inventory differ? Briefly explain. Identify other areas that would be impacted if your company adopted IFRS. Based on analysis and company research would you, as a bank-lending officer, approve a 5-year loan for this company? If so, how much would you approve the loan for and for what purpose? Would you require security or collateral? Explain your reasoning.

Provide a recommendation as to whether an investor should buy, sell, or hold the stock of your company compared to the selected competitor. Your recommendation should be supported by an adequate explanation and reference to supporting analysis and ratios.

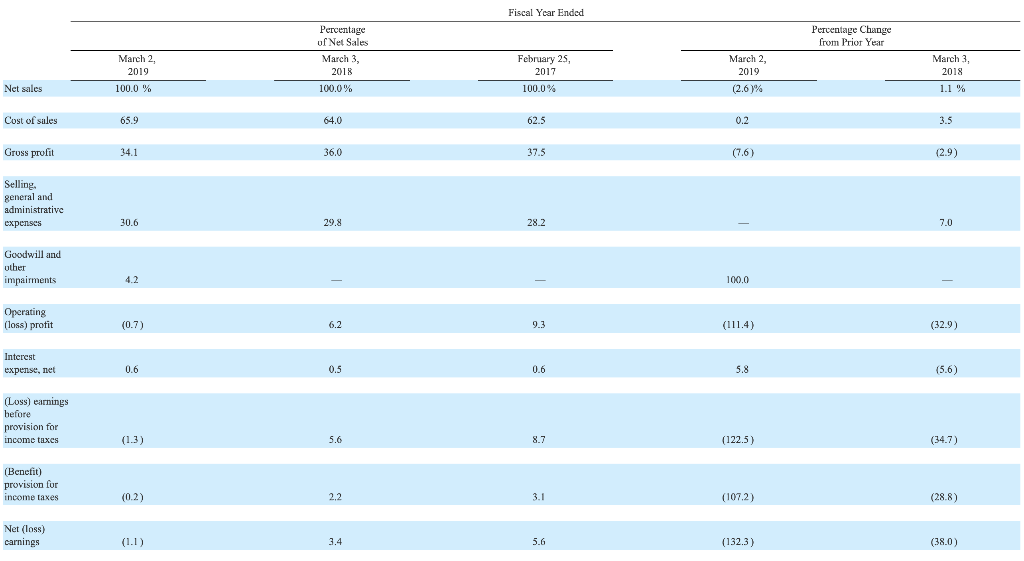

Net sales Cost of sales Gross profit Selling, general and administrative expenses Goodwill and other impairments Operating (loss) protit Interest expense, net (Loss) earnings before provision for income taxes (Benefit) provision for income taxes Net (loss) carnings March 2, 2019 100.0 % 65.9 34.1 30.6 4.2 (0.7) 0.6 (1.3) (0.2) (1.1) Percentage of Net Sales March 3, 2018 100.0% 64.0 36.0 29.8 6.2 0.5 56 2,2 3.4 Fiscal Year Ended February 25, 2017 100.0% 62.5 37.5 28.2 9.3 0.6 87 3.1 5.6 March 2, 2019 (2.6)% 0.2 (7.6) 100,0 (111.4) 5.8 (122.5) (107.2) (132.3) Percentage Change from Prior Year March 3, 2018 1.1 % 3.5 (2.9) 7.0 (32.9) (5.6) (34.7) (28.8) (38.0)

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Adoption of IFRS and Inventory Reporting Inventory Reporting Differences 1 FIFOLIFO Approach Under IFRS the LIFO LastIn FirstOut method is not permitt... View full answer

Get step-by-step solutions from verified subject matter experts