Question: based on Canada. Answer me step by step. please. Mr. Renaud has 2019 earned income for RRSP purposes of $37000. His employer reports a 2019

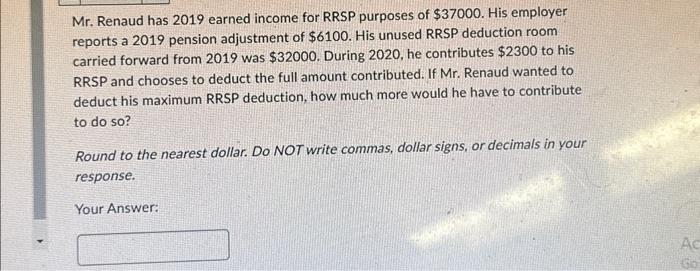

Mr. Renaud has 2019 earned income for RRSP purposes of $37000. His employer reports a 2019 pension adjustment of $6100. His unused RRSP deduction room carried forward from 2019 was $32000. During 2020 , he contributes $2300 to his RRSP and chooses to deduct the full amount contributed. If Mr. Renaud wanted to deduct his maximum RRSP deduction, how much more would he have to contribute to do so? Round to the nearest dollar. Do NOT write commas, dollar signs, or decimals in your response. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts