Question: Based on Canada. Answer me step by step please. Mr. Roelan's has 2019 earned income for RRSP purposes of $51000. He is not a member

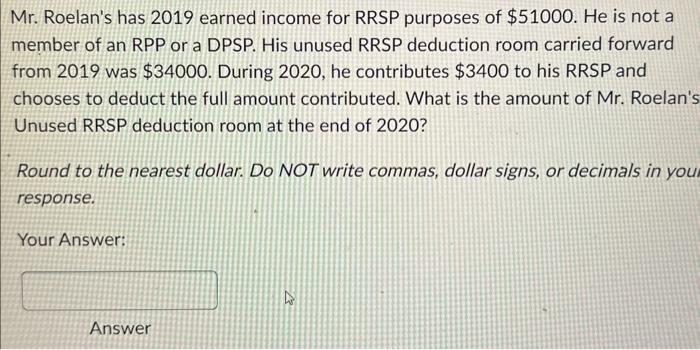

Mr. Roelan's has 2019 earned income for RRSP purposes of $51000. He is not a member of an RPP or a DPSP. His unused RRSP deduction room carried forward from 2019 was $34000. During 2020 , he contributes $3400 to his RRSP and chooses to deduct the full amount contributed. What is the amount of Mr. Roelan's Unused RRSP deduction room at the end of 2020 ? Round to the nearest dollar. Do NOT write commas, dollar signs, or decimals in you response. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts