Question: read the following case and answer this question. What impact would warehouse consolidation have on: Inventory Carrying Costs, Customer Service Fill rate Safety Stock Modification

read the following case and answer this question.

- What impact would warehouse consolidation have on:

- Inventory Carrying Costs,

- Customer Service

- Fill rate

- Safety Stock Modification

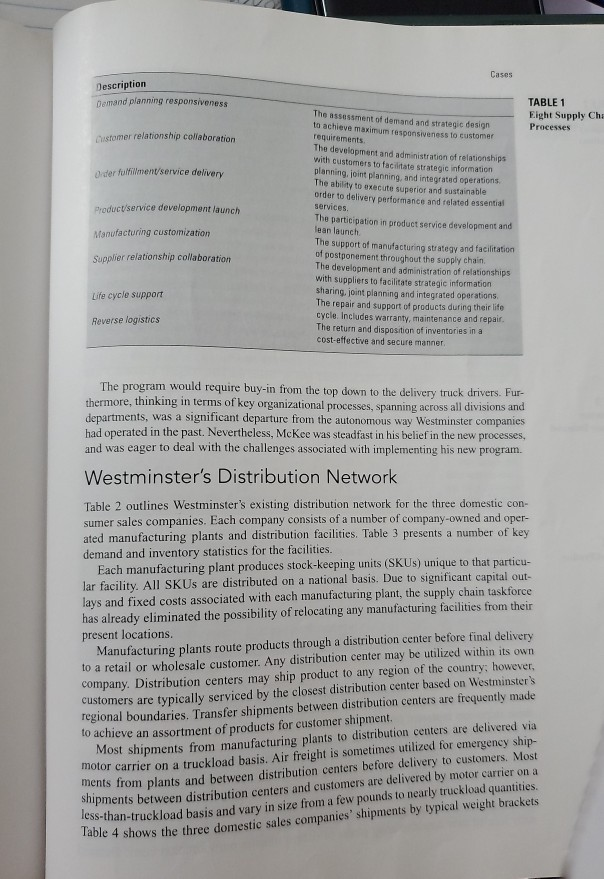

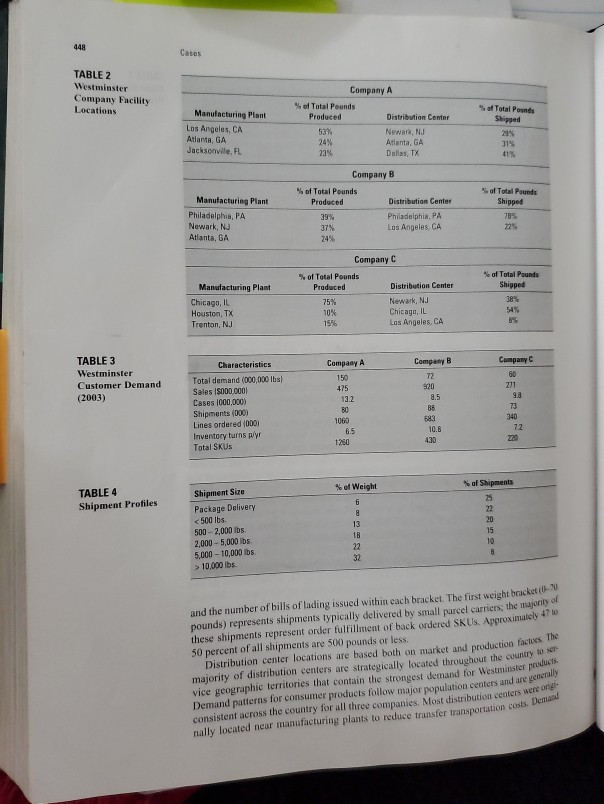

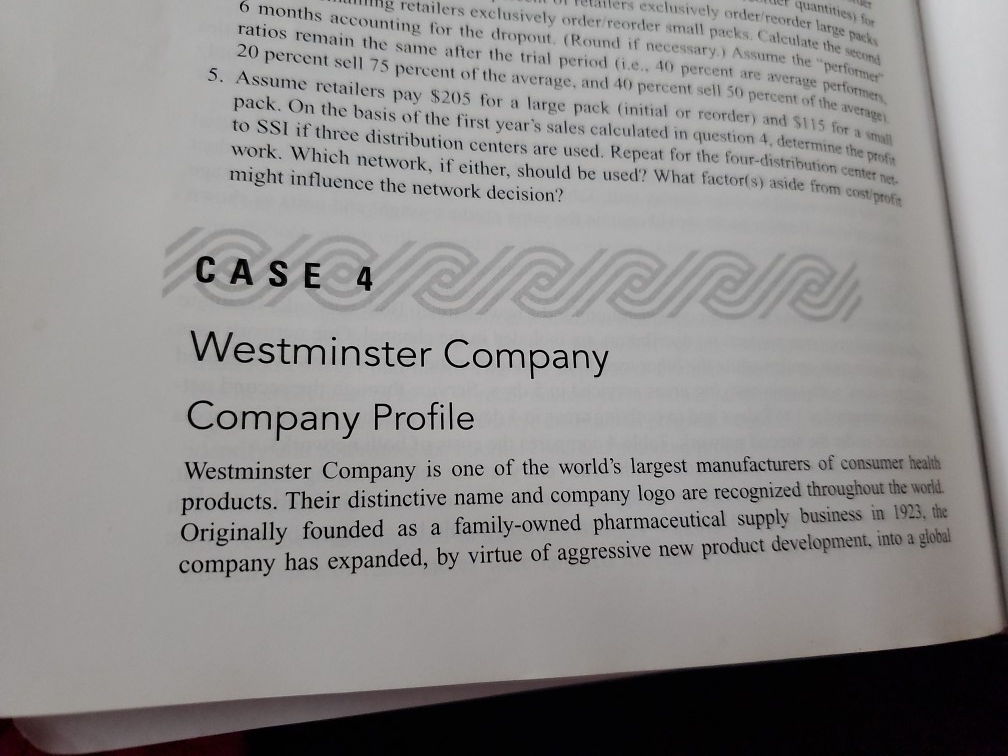

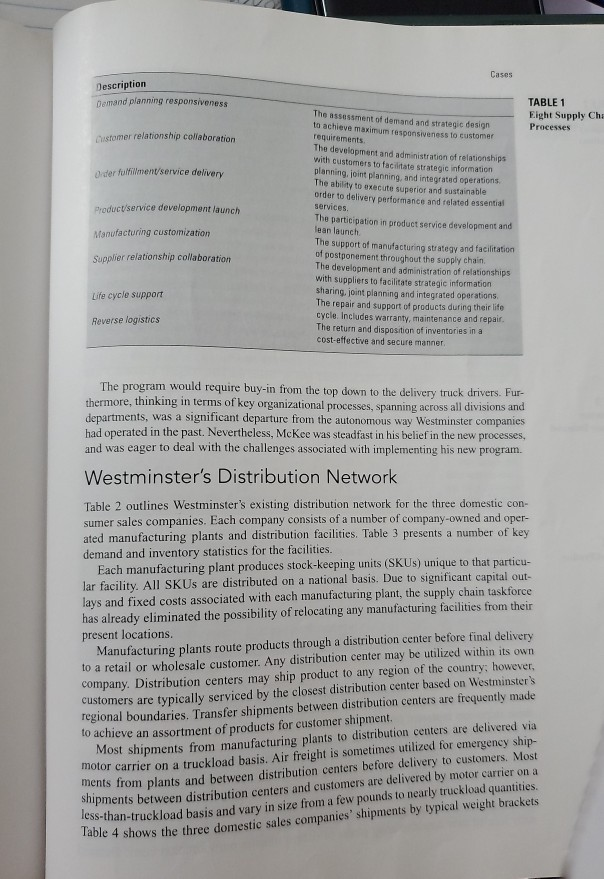

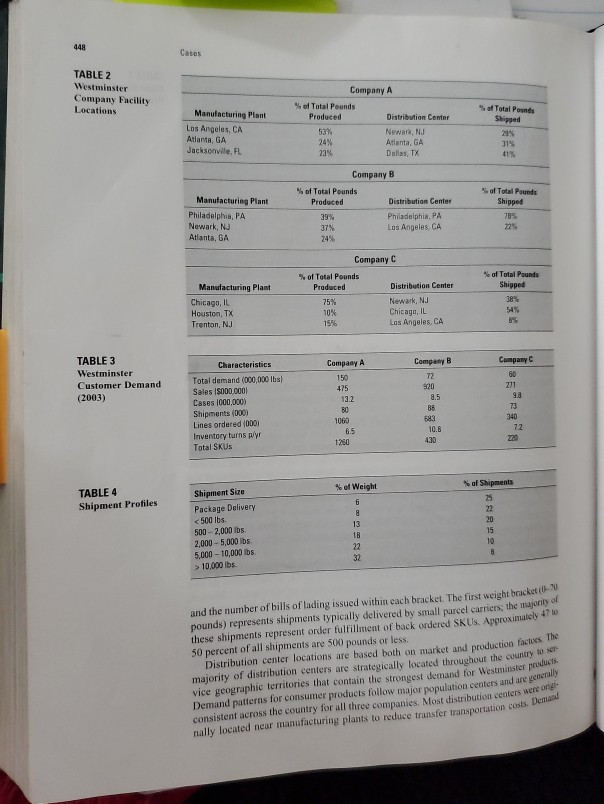

quantities for ailers exclusively order reorder large packs retailers exclusively order reorder small packs. Calculate the second 6 months accounting for the dropout. (Round if necessary. Assume the performer ratios remain the same after the trial period Cie., 40 percent are average performers 20 percent sell 75 percent of the average, and 40 percent sell 50 percent of the average 5. Assume retailers pay $205 for a large pack (initial or reorder) and 5115 for a small pack. On the basis of the first year's sales calculated in question 4, determine the profia to SSI if three distribution centers are used. Repeat for the four-distribution centerne work. Which network, if either, should be used? What factor(s) aside from cost profit might influence the network decision? CASE ATATU Westminster Company Company Profile Westminster Company is one of the world's largest manufacturers of consumer health products. Their distinctive name and company logo are recognized throughout the world. Originally founded as a family-owned pharmaceutical supply business in 1923, the company has expanded, by virtue of aggressive new product development, into a global distribution Cases provider of health care consumer products. Westminster maintains regional offices in Europe, Latin America and the Pacific Rim to support overseas manufacturing and Westminster's domestic operations consist of three separate but wholly owned compa- nies that each manufactures and distributes unique product lines. Decentralized manage ment has been a proud historical tradition at Westminster. According to President Jonathan Beamer, the policy of maintaining unique and independent companies encourages respon sibility, self-ownership of the product development and marketing process and provides the incentive for entrepreneurial management. Westminster's products are marketed through a network of diverse retailers and wholesalers. Trade class as a percent of sales is 37 percent grocery, 20 percent drug, 35 percent mass merchandise and 8 percent miscellaneous. All three companies sell and distribute products to several of the same customers. Westminster Today Pressure from domestic and global competitors, as well as large domestic Westminster customers has recently forced the company to reevaluate their traditional supply chain practices. In particular, attention has focused on the changes that customers are demanding as well as other operational modifications in current practice that management feels are required to effectively compete in the 21st century marketplace Westminster just completed several months of extensive study focusing on their cus- tomers' current and future supply chain requirements. The findings addressed a variety of issues, but two key topics were identified: (1) customer composition and, (2) customer service requirements. The most significant trend with regard to customer composition over the past decade has been the growth of key customers into very large accounts. Mass merchants now account for 35 percent of total corporate sales volume and have become the fastest grow- ing category of trade. All three companies sell to this category of trade. This trend is expected to continue into the foreseeable future. The major shift in the mix of accounts is not expected, however, to dramatically alter the historical composition of product sales. Approximately 70 percent of domestic consumer sales volume is concentrated with 10 percent of Westminster's customers. What may affect the composition of product sales to large retail accounts, however, is the rapid growth of private-label nonprescription drugs and consumer health competitors. Cost-efficient private-label manufacturers offer large retail accounts higher profit margins, and willingness to provide private labeled products. The private-label health and beauty aids business sales exceeded $5 billion in 2008. The second research conclusion confirmed senior management's belief that these large accounts have an increasing commitment to improved supply chain efficiency. To maintain and increase the percentage of sales volume Westminster generates from these important customer accounts, management has identified several key customer service improve ments. These improvements specifically address the second issue of customer service requirements. Company research has also concluded that the formulation of supply chain collaborations between Westminster and its large customers has now become a competitive necessity. In many instances, powerful retailers demand such collaboration and oftentimes have the leverage to dictate relational arrangement. Westminster will have to maintain con- siderable flexibility in order to develop unique supply chain solutions for a variety of large. powerful customers. Ideally, Westminster would like to establish a position of leadership within these collaboration arrangements. Westminster's management is well aware that successful retailers and wholesalers are focusing strategic effort on more timely, efficient and accurate inventory delivery. Many large firms have identified their supply chain management capabilities as a primary Cases strategy to achieve successful inventory management and improving overall financial performance. "I visualize three important changes for our operations with regard to large accounts," says Alex Coldfield, Westminster Vice-President of SCM: First, traditional inventory replenishment procedures must be replaced by POS driven information systems. Customers have the ability to transmit daily or biweekly actual product sales at the SKU level in order to ensure timely inventory replenishment and allow produc- tion to be scheduled according to response based sales information rather than forecasts. We will also establish and utilize customer support "work-teams" that operate on-site with key customer accounts to better manage ordering and distribution Second, order cycle times can be reduced from current levels. Large accounts will increas- ingly demand three rather than one delivery per week. In addition, many large accounts want to simplify their procurement practices and are questioning why we cannot provide integrated deliveries of merchandise from our three consumer product companies when cost reductions are achievable. The demand for direct store delivery (DSD) may also significantly increase. A long term goal is to arrange a mix of products from all Westminster companies delivered on a single trailer to key customers, perhaps direct to retail. The long term has become now Third, products will increasingly have to meet specific customer requirements, such as assembly of individual store customized pallets, and customer specific inner packs and dis- play units. Bar codes will have to utilize industry standards such as UCC 128 and there will be increased demand for RFID capability on unit loads and master cartons. Invoicing and payment, particularly with regard to promotional allowances and discounts, must increas- ingly move toward paperless transactions. Our pricing will evolve to reflect value added services as provided, rather than purely traditional logistical order fulfillment, transportation and handling For the balance of Westminster's customers, the smaller retailers, service will be pro- vided much as it is today. Although other customers may not be willing or able to initiate close working relationships, they are entitled to a high standard of basic service that pro- vides timely and consistent performance. For these accounts, purchase price will remain the priority, although there will be some increased pressure for improved order fill rates and decreased cycle times. Traditional purchase order invoicing and payment will also remain the rule. In response to the issues raised by company research, CEO Wilson McKee directed the company's executive management committee to organize a supply chain taskforce. The taskforce, to include top-level managers from each company, has been directed to identify changes necessary within the three domestic sales' supply chain practices and operational network that will achieve improved distribution performance and responsiveness. As a framework to guide the integrative redesign McKee decided to seek recommen- dations around the eight key processes that link a firm into a supply chain structure with customers and suppliers. McKee remembered a framework he was introduced to at a lead- ership seminar he attended the previous year. A speaker on supply chain strategy high- lighted a set of "Eight Supply Chain Processes" (see Table 1) as a requisite for supply chain excellence. McKee then thought about the performance gaps that existed between present-day and the idealized processes, as well as the measures he proposed to achieve operational integration Clearly McKee's initiatives, if implemented correctly, would enhance demand planning and strengthen relationships with customers and channel partners. Moreover, the initia- tives also would improve the timeliness and attentiveness of how Westminster fills and delivers its orders. However, implementing the new processes would be no mean feat, and would represent a paradigm shift from an anticipatory mode, based on forecasts to a more customer-responsive based operation. Cases Description Demand planning responsiveness TABLE 1 Eight Supply Che Processes Customer relationship collaboration Oder fulfillment/service delivery Product/service development launch The assessment of demand and strategic design to achieve maximum responsiveness to customer requirements The development and administration of relationships with customers to facilitate strategic information planning joint planning, and integrated operations The ability to execute superior and sustainable order to delivery performance and related essential services The participation in product service development and Tean launch The support of manufacturing strategy and facilitation of postponement throughout the supply chain The development and administration of relationships with suppliers to facilitate strategic information sharing, joint planning and integrated operations The repair and support of products during their life cycle. Includes warranty, maintenance and repair The return and disposition of inventories in a cost-effective and secure manner Manufacturing customization Supplier relationship collaboration Life cycle support Reverse logistics The program would require buy-in from the top down to the delivery truck drivers. Fur- thermore, thinking in terms of key organizational processes, spanning across all divisions and departments, was a significant departure from the autonomous way Westminster companies had operated in the past. Nevertheless, McKee was steadfast in his belief in the new processes, and was eager to deal with the challenges associated with implementing his new program. Westminster's Distribution Network Table 2 outlines Westminster's existing distribution network for the three domestic con- sumer sales companies. Each company consists of a number of company-owned and oper- ated manufacturing plants and distribution facilities. Table 3 presents a number of key demand and inventory statistics for the facilities. Each manufacturing plant produces stock-keeping units (SKU) unique to that particu- lar facility. All SKUs are distributed on a national basis. Due to significant capital out- lays and fixed costs associated with each manufacturing plant, the supply chain taskforce has already eliminated the possibility of relocating any manufacturing facilities from their present locations. Manufacturing plants route products through a distribution center before final delivery to a retail or wholesale customer. Any distribution center may be utilized within its own company. Distribution centers may ship product to any region of the country; however, customers are typically serviced by the closest distribution center based on Westminster's regional boundaries. Transfer shipments between distribution centers are frequently made to achieve an assortment of products for customer shipment. Most shipments from manufacturing plants to distribution centers are delivered via motor carrier on a truckload basis. Air freight is sometimes utilized for emergency ship- ments from plants and between distribution centers before delivery to customers. Most shipments between distribution centers and customers are delivered by motor carrier on a less-than-truckload basis and vary in size from a few pounds to nearly truckload quantities. Table 4 shows the three domestic sales companies' shipments by typical weight brackets 448 Cases TABLE 2 Westminster Company Facility Locations Manufacturing Plant Los Angeles, CA Atlanta, GA Jacksonville, FL Company A % of Total Pounds Produced Distribution Center 53% Newark, NJ 24% Atlanta, GA 23% Dallas, TX of Total Pounds Shipped 28% 319 415 Manufacturing Plant Philadelphia, PA Newark, NJ Atlanta, GA Company B % of Total Pounds Produced Distribution Center 39% Philadelphia, PA 37% Los Angeles, CA 24% of Total Pounds Shipped 78% 72% Manufacturing Plant Chicago, IL Houston, TX Trenton, NJ Company C % of Total Pounds Produced Distribution Center 75% Newark, NJ 10% Chicago, IL 1556 Los Angeles, CA % of Total Pounds Shipped 38% 54% TABLE 3 Westminster Customer Demand (2003) Characteristics Total demand (000,000 lbs) Sales S000,000 Cases 1000,000) Shipments (000) Lines ordered 10001 Inventory turns p/y! Total SKUS Company A 150 475 13.2 30 1060 6.5 1280 Company B 72 920 8.5 B8 583 10.B 430 Company 60 211 9.8 73 340 72 220 % of Weight TABLE4 Shipment Profiles 6 8 Shipment Size Package Delivery 10.000 lbs of Shipments 25 22 20 15 10 8 13 18 22 32 and the number of bill of lading issued within each bracket. The first weight bracket 0 pounds) represents shipments typically delivered by small parcel carriers, the majority of these shipments represent order fulfillment of back ordered SKUs. Approximately 4760 50 percent of all shipments are 500 pounds or less. Distribution center locations are based both on market and production factors the majority of distribution centers are strategically located throughout the country to se vice geographic territories that contain the strongest demand for Westminster products Demand patterns for consumer products follow major population centers and are generally consistent across the country for all three companies. Most distribution centers were origi nally located near manufacturing plants to reduce transfer transportation costs. Desund