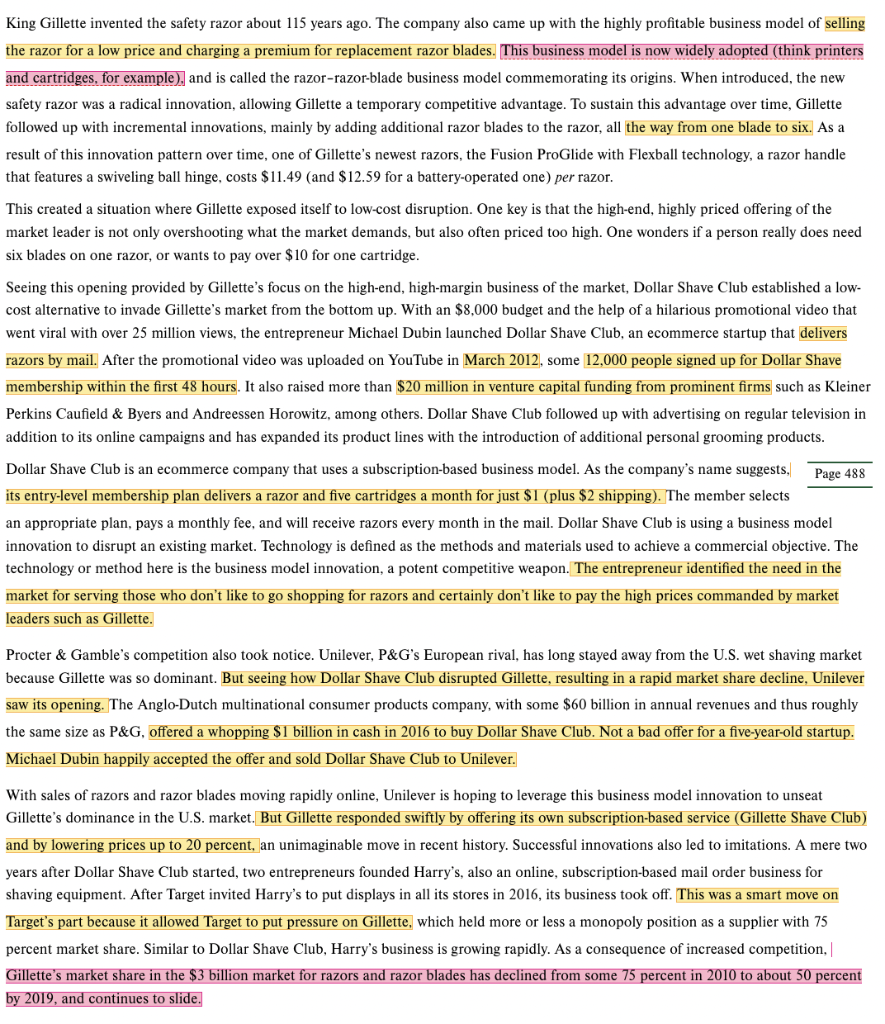

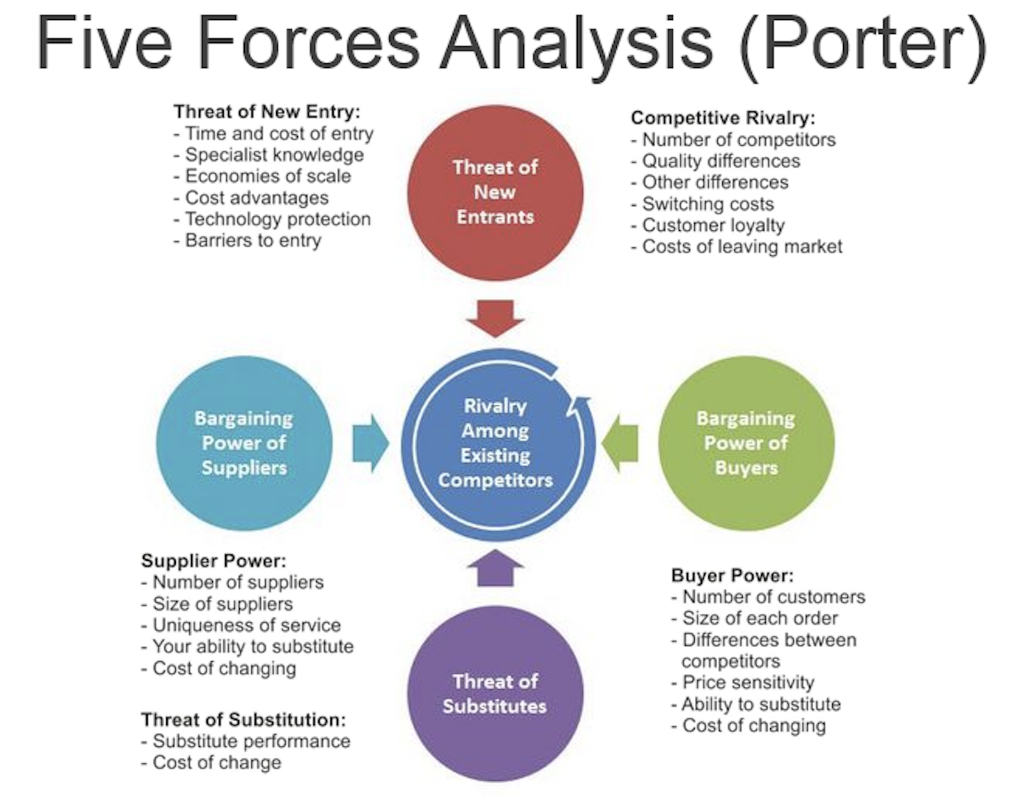

Question: Based On Case Study Create Porter's Five Forces in a diagram form such as the example Business Model Innovation: How Dollar Shave Club Disrupted Gillette

Based On Case Study Create Porter's Five Forces in a diagram form such as the example

Business Model Innovation: How Dollar Shave Club Disrupted Gillette ALTHOUGH MOST OF our attention is captured by fancy high-tech innovations such as the iPhone or Tesla's sleek electric vehicles, innovations do not need to be high-tech or radical to be successful. Until recently, Gillette, a company that invented the safety razor and the razor-razor-blade business model, dominated the $3 billion U.S. market for wet shaving with some Yet Dollar Shave Club, a young, fledgling startup with an initial budget of $8,000, disrupted the powerful Gillette with a low-tech innovation and is gaining market share rapidly. How can the powerful Gillette, a unit of Procter \& Gamble with annual revenues of $67 billion, be beaten by a brash startup? Gillette's pattern of incremental innovation over time led to overshooting in the market, resulting in a product that was overengineered and too expensive. Entrepreneur Michael Dubin founded Dollar Shave Club using a business model innovation by providing an online subscription-based mail-order alternative to in-store retail purchases of razor blades. Many customers were not only turned off by Gillette's premium prices, but also by the inconveniences that in-store purchases entail. Given that packs of razor blades are a prime target for shoplifters, many stores lock them in glass vitrines, much to the dismay of customers who have to hunt down an employee with a key to access razor blades. King Gillette invented the safety razor about 115 years ago. The company also came up with the highly profitable business model of selling the razor for a low price and charging a premium for replacement razor blades. This business model is now widely adopted (think printers and cartridges, for example), and is called the razor-razor-blade business model commemorating its origins. When introduced, the new safety razor was a radical innovation, allowing Gillette a temporary competitive advantage. To sustain this advantage over time, Gillette followed up with incremental innovations, mainly by adding additional razor blades to the razor, all the way from one blade to six. As a result of this innovation pattern over time, one of Gillette's newest razors, the Fusion ProGlide with Flexball technology, a razor handle that features a swiveling ball hinge, costs $11.49 (and $12.59 for a battery-operated one) per razor. This created a situation where Gillette exposed itself to low-cost disruption. One key is that the high-end, highly priced offering of the market leader is not only overshooting what the market demands, but also often priced too high. One wonders if a person really does need six blades on one razor, or wants to pay over $10 for one cartridge. Seeing this opening provided by Gillette's focus on the high-end, high-margin business of the market, Dollar Shave Club established a lowcost alternative to invade Gillette's market from the bottom up. With an $8,000 budget and the help of a hilarious promotional video that went viral with over 25 million views, the entrepreneur Michael Dubin launched Dollar Shave Club, an ecommerce startup that delivers razors by mail. After the promotional video was uploaded on YouTube in March 2012, some 12,000 people signed up for Dollar Shave membership within the first 48 hours. It also raised more than $20 million in venture capital funding from prominent firms such as Kleiner Perkins Caufield \& Byers and Andreessen Horowitz, among others. Dollar Shave Club followed up with advertising on regular television in addition to its online campaigns and has expanded its product lines with the introduction of additional personal grooming products. Dollar Shave Club is an ecommerce company that uses a subscription-based business model. As the company's name suggests, its entry-level membership plan delivers a razor and five cartridges a month for just \$1 (plus \$2 shipping). The member selects an appropriate plan, pays a monthly fee, and will receive razors every month in the mail. Dollar Shave Club is using a business model innovation to disrupt an existing market. Technology is defined as the methods and materials used to achieve a commercial objective. The technology or method here is the business model innovation, a potent competitive weapon. The entrepreneur identified the need in the market for serving those who don't like to go shopping for razors and certainly don't like to pay the high prices commanded by market leaders such as Gillette. Procter \& Gamble's competition also took notice. Unilever, P\&G's European rival, has long stayed away from the U.S. wet shaving market because Gillette was so dominant. But seeing how Dollar Shave Club disrupted Gillette, resulting in a rapid market share decline, Unilever saw its opening. The Anglo-Dutch multinational consumer products company, with some $60 billion in annual revenues and thus roughly the same size as P&G, offered a whopping $1 billion in cash in 2016 to buy Dollar Shave Club. Not a bad offer for a five-year-old startup. Michael Dubin happily accepted the offer and sold Dollar Shave Club to Unilever. With sales of razors and razor blades moving rapidly online, Unilever is hoping to leverage this business model innovation to unseat Gillette's dominance in the U.S. market. But Gillette responded swiftly by offering its own subscription-based service (Gillette Shave Club) and by lowering prices up to 20 percent, an unimaginable move in recent history. Successful innovations also led to imitations. A mere two years after Dollar Shave Club started, two entrepreneurs founded Harry's, also an online, subscription-based mail order business for shaving equipment. After Target invited Harry's to put displays in all its stores in 2016, its business took off. This was a smart move on Target's part because it allowed Target to put pressure on Gillette, which held more or less a monopoly position as a supplier with 75 percent market share. Similar to Dollar Shave Club, Harry's business is growing rapidly. As a consequence of increased competition, Gillette's market share in the \$3 billion market for razors and razor blades has declined from some 75 percent in 2010 to about 50 percent by 2019 , and continues to slide. Fiva Fnrreac nalcic (Dnrter) Business Model Innovation: How Dollar Shave Club Disrupted Gillette ALTHOUGH MOST OF our attention is captured by fancy high-tech innovations such as the iPhone or Tesla's sleek electric vehicles, innovations do not need to be high-tech or radical to be successful. Until recently, Gillette, a company that invented the safety razor and the razor-razor-blade business model, dominated the $3 billion U.S. market for wet shaving with some Yet Dollar Shave Club, a young, fledgling startup with an initial budget of $8,000, disrupted the powerful Gillette with a low-tech innovation and is gaining market share rapidly. How can the powerful Gillette, a unit of Procter \& Gamble with annual revenues of $67 billion, be beaten by a brash startup? Gillette's pattern of incremental innovation over time led to overshooting in the market, resulting in a product that was overengineered and too expensive. Entrepreneur Michael Dubin founded Dollar Shave Club using a business model innovation by providing an online subscription-based mail-order alternative to in-store retail purchases of razor blades. Many customers were not only turned off by Gillette's premium prices, but also by the inconveniences that in-store purchases entail. Given that packs of razor blades are a prime target for shoplifters, many stores lock them in glass vitrines, much to the dismay of customers who have to hunt down an employee with a key to access razor blades. King Gillette invented the safety razor about 115 years ago. The company also came up with the highly profitable business model of selling the razor for a low price and charging a premium for replacement razor blades. This business model is now widely adopted (think printers and cartridges, for example), and is called the razor-razor-blade business model commemorating its origins. When introduced, the new safety razor was a radical innovation, allowing Gillette a temporary competitive advantage. To sustain this advantage over time, Gillette followed up with incremental innovations, mainly by adding additional razor blades to the razor, all the way from one blade to six. As a result of this innovation pattern over time, one of Gillette's newest razors, the Fusion ProGlide with Flexball technology, a razor handle that features a swiveling ball hinge, costs $11.49 (and $12.59 for a battery-operated one) per razor. This created a situation where Gillette exposed itself to low-cost disruption. One key is that the high-end, highly priced offering of the market leader is not only overshooting what the market demands, but also often priced too high. One wonders if a person really does need six blades on one razor, or wants to pay over $10 for one cartridge. Seeing this opening provided by Gillette's focus on the high-end, high-margin business of the market, Dollar Shave Club established a lowcost alternative to invade Gillette's market from the bottom up. With an $8,000 budget and the help of a hilarious promotional video that went viral with over 25 million views, the entrepreneur Michael Dubin launched Dollar Shave Club, an ecommerce startup that delivers razors by mail. After the promotional video was uploaded on YouTube in March 2012, some 12,000 people signed up for Dollar Shave membership within the first 48 hours. It also raised more than $20 million in venture capital funding from prominent firms such as Kleiner Perkins Caufield \& Byers and Andreessen Horowitz, among others. Dollar Shave Club followed up with advertising on regular television in addition to its online campaigns and has expanded its product lines with the introduction of additional personal grooming products. Dollar Shave Club is an ecommerce company that uses a subscription-based business model. As the company's name suggests, its entry-level membership plan delivers a razor and five cartridges a month for just \$1 (plus \$2 shipping). The member selects an appropriate plan, pays a monthly fee, and will receive razors every month in the mail. Dollar Shave Club is using a business model innovation to disrupt an existing market. Technology is defined as the methods and materials used to achieve a commercial objective. The technology or method here is the business model innovation, a potent competitive weapon. The entrepreneur identified the need in the market for serving those who don't like to go shopping for razors and certainly don't like to pay the high prices commanded by market leaders such as Gillette. Procter \& Gamble's competition also took notice. Unilever, P\&G's European rival, has long stayed away from the U.S. wet shaving market because Gillette was so dominant. But seeing how Dollar Shave Club disrupted Gillette, resulting in a rapid market share decline, Unilever saw its opening. The Anglo-Dutch multinational consumer products company, with some $60 billion in annual revenues and thus roughly the same size as P&G, offered a whopping $1 billion in cash in 2016 to buy Dollar Shave Club. Not a bad offer for a five-year-old startup. Michael Dubin happily accepted the offer and sold Dollar Shave Club to Unilever. With sales of razors and razor blades moving rapidly online, Unilever is hoping to leverage this business model innovation to unseat Gillette's dominance in the U.S. market. But Gillette responded swiftly by offering its own subscription-based service (Gillette Shave Club) and by lowering prices up to 20 percent, an unimaginable move in recent history. Successful innovations also led to imitations. A mere two years after Dollar Shave Club started, two entrepreneurs founded Harry's, also an online, subscription-based mail order business for shaving equipment. After Target invited Harry's to put displays in all its stores in 2016, its business took off. This was a smart move on Target's part because it allowed Target to put pressure on Gillette, which held more or less a monopoly position as a supplier with 75 percent market share. Similar to Dollar Shave Club, Harry's business is growing rapidly. As a consequence of increased competition, Gillette's market share in the \$3 billion market for razors and razor blades has declined from some 75 percent in 2010 to about 50 percent by 2019 , and continues to slide. Fiva Fnrreac nalcic (Dnrter)