Question: Based on Exhibits 2 and 3 and using Method 1, the amount (in absolute terms) by which the Hutto- Barkley corporate bond is mispriced is

Based on Exhibits 2 and 3 and using Method 1, the amount (in absolute terms)

by which the Hutto- Barkley corporate bond is mispriced is closest to:

| 0.3368 per 100 of par value.

| ||

| 0.4682 per 100 of par value. | ||

| 0.5156 per 100 of par value.

| ||

| 0.5556 per 100 of par value.

|

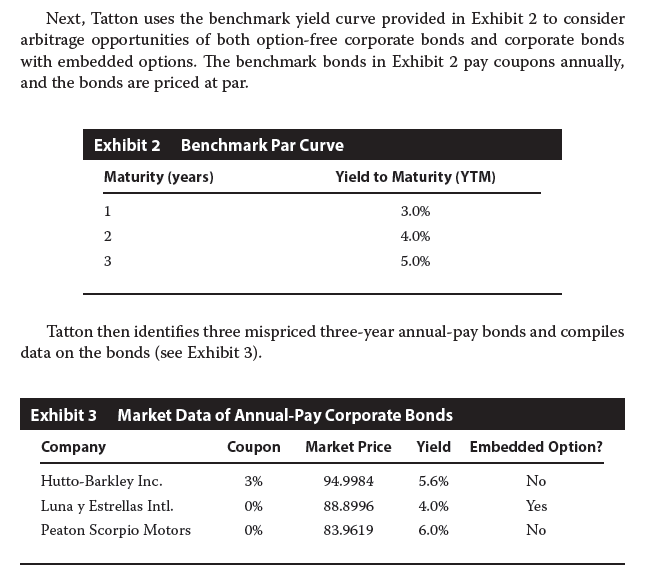

Next, Tatton uses the benchmark yield curve provided in Exhibit 2 to consider arbitrage opportunities of both option-free corporate bonds and corporate bonds with embedded options. The benchmark bonds in Exhibit 2 pay coupons annually, and the bonds are priced at par. Exhibit 2 Benchmark Par Curve Maturity (years) Yield to Maturity (YTM) 3.0% 4.0% 5.0% Tatton then identifies three mispriced three-year annual-pay bonds and compiles data on the bonds (see Exhibit 3). Exhibit 3 Market Data of Annual-Pay Corporate Bonds Company Coupon Market Price Yield Embedded Option? 3% 5.6% No Hutto-Barkley Inc. Luna y Estrellas Intl. Peaton Scorpio Motors 94.9984 88.8996 83.9619 4.0% 6.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts