Question: Based on past default (repayment) experience by Confidence Bank, their statisticians use a linear probability model to find common variables that may predict the probability

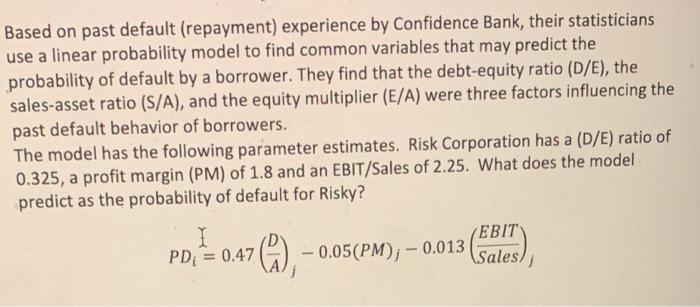

Based on past default (repayment) experience by Confidence Bank, their statisticians use a linear probability model to find common variables that may predict the probability of default by a borrower. They find that the debt-equity ratio (D/E), the sales-asset ratio (S/A), and the equity multiplier (E/A) were three factors influencing the past default behavior of borrowers. The model has the following parameter estimates. Risk Corporation has a (D/E) ratio of 0.325 , a profit margin (PM) of 1.8 and an EBIT/Sales of 2.25 . What does the model predict as the probability of default for Risky? PDi=X0.47(AD)j0.05(PM)j0.013(SalesEBIT)j

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock