Question: This first screenshot contains the problem questions, the 2nd is the data given Suzy Q Muffins is expecting a 20 percent increase in sales next

This first screenshot contains the problem questions, the 2nd is the data given

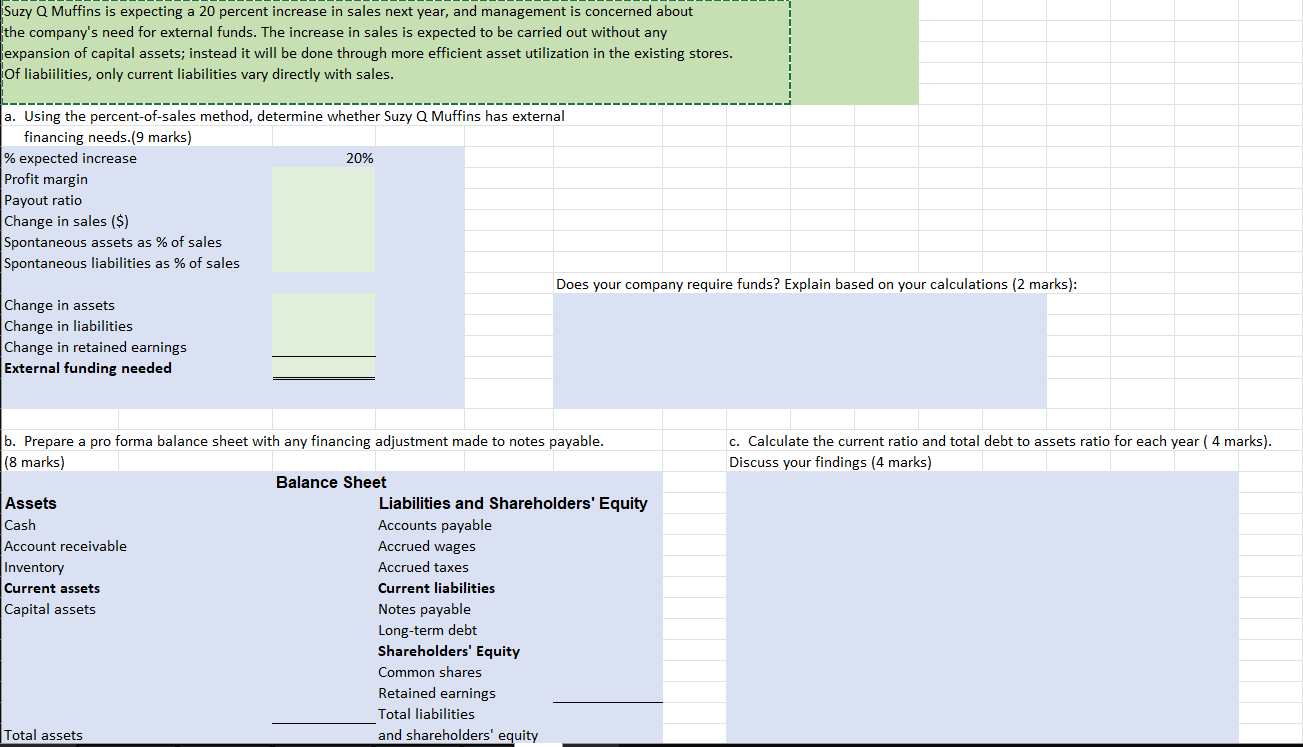

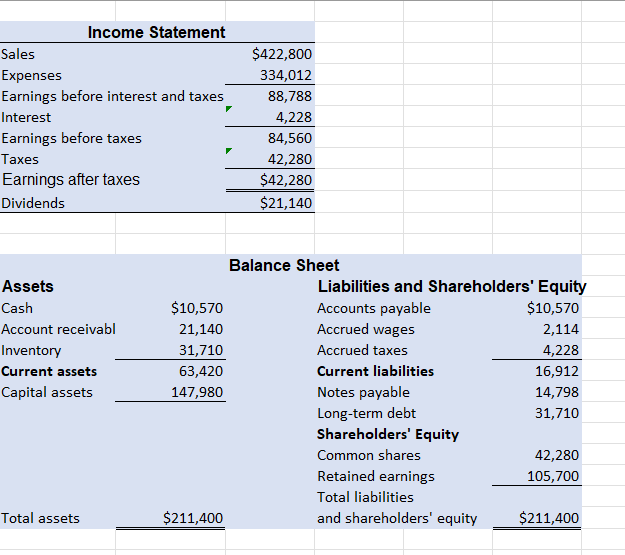

Suzy Q Muffins is expecting a 20 percent increase in sales next year, and management is concerned about the company's need for external funds. The increase in sales is expected to be carried out without any expansion of capital assets; instead it will be done through more efficient asset utilization in the existing stores. Of liabiilities, only current liabilities vary directly with sales. a. Using the percent-of-sales method, determine whether Suzy Q Muffins has external financing needs.( 9 marks) % expected increase 20% Profit margin Payout ratio Change in sales (\$) Spontaneous assets as % of sales Spontaneous liabilities as % of sales Does your company require funds? Explain based on your calculations ( 2 marks): Change in assets Change in liabilities Change in retained earnings External funding needed b. Prepare a pro forma balance sheet with any financing adjustment made to notes payable. c. Calculate the current ratio and total debt to assets ratio for each year ( 4 marks). ( 8 marks) Discuss your findings ( 4 marks) Balance Sheet Assets Liabilities and Shareholders' Equity Cash Accounts payable Account receivable Accrued wages Inventory Accrued taxes Current assets Current liabilities Capital assets Notes payable Long-term debt Shareholders' Equity Common shares Retained earnings Total liabilities Total assets and shareholders' equity Income Statement Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts