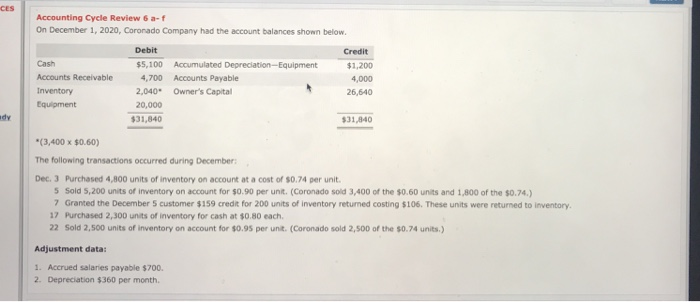

Question: based on photo 1, need help filling out missing values in photo 2 CES Accounting Cycle Review 6a-f On December 1, 2020, Coronado Company had

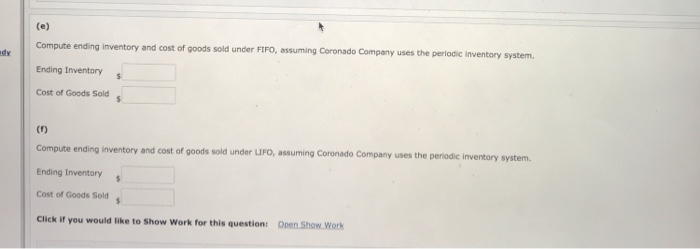

CES Accounting Cycle Review 6a-f On December 1, 2020, Coronado Company had the account balances shown below. Cash Accounts Receivable Inventory Equipment Debit $5,100 Accumulated Depreciation-Equipment 4,700 Accounts Payable 2,040" Owner's Capital 20,000 $31,840 Credit $1,200 4,000 26,640 ady $31,840 *(3,400 x $0.60) The following transactions occurred during December: Dec. 3 Purchased 4,800 units of inventory on account at a cost of $0.74 per unit. 5 Sold 5,200 units of inventory on account for $0.90 per unt. (Coronado sold 3,400 of the $0.60 units and 1,800 of the $0.74.) 7 Granted the December 5 customer $159 credit for 200 units of inventory returned costing $106. These units were returned to inventory 17 Purchased 2,300 units of inventory for cash at $0.80 each. 22 Sold 2,500 units of inventory on account for $0.95 per unit. (Coronado sold 2,800 of the $0.74 units.) Adjustment data: 1. Accrued salaries payable $700. 2. Depreciation $360 per month (e) Compute ending inventory and cost of goods sold under FIFO, assuming Coronado Company uses the periodic inventory system. Ending Inventory $ Cost of Goods Sold $ (1) Compute ending inventory and cost of goods sold under UFO, assuming Coronado Company uses the periodic inventory system. Ending Inventory $ Cost of Goods Sold Click if you would like to show Work for this questioni Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts