Question: Based on the 2 graphs above, which stock is likely to help reduce the overall portfolio risk below the market risk for an investor currently

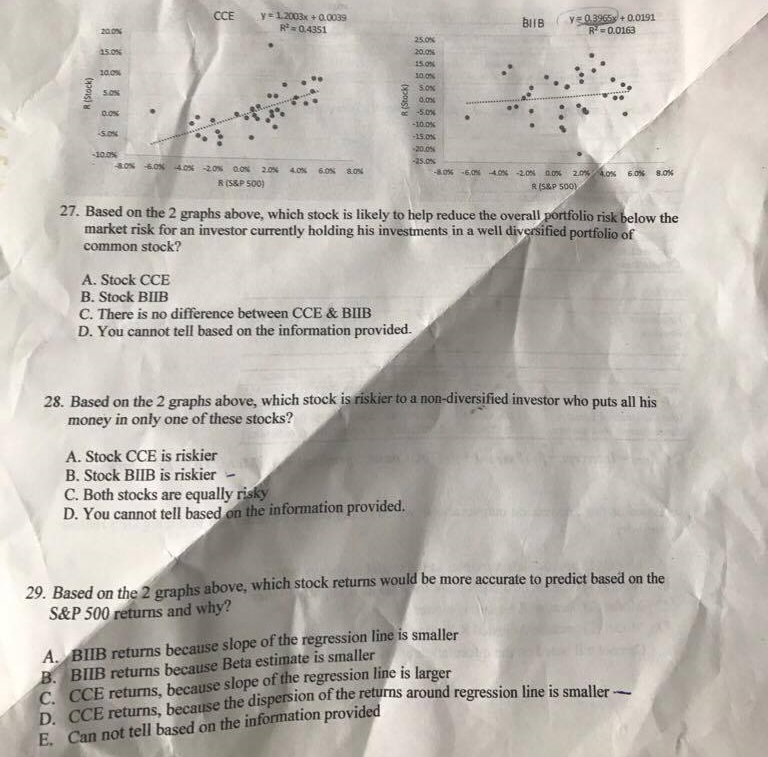

Based on the 2 graphs above, which stock is likely to help reduce the overall portfolio risk below the market risk for an investor currently holding his investments in a well diversified portfolio of common stock? A. Stock CCE B. Stock BIIB C. There is no difference between CCE & BIIB D. You cannot tell based on the information provided. Based on the 2 graphs above, which stock is riskier to a non-diversified investor who puts all his money in only one of these stocks? A. Stock CCE is riskier B. Stock BIIB is riskier C. Both stocks are equally risky D. You cannot tell based on the information provided. Based on the 2 graphs above, which stock returns would be more accurate to predict based on the S&P 500 returns and why? A. BIIB returns because slope of the regression line is smaller B. BIIB returns because Beta estimate is smaller C. CCE returns, because slope of the regression line is larger D. CCE returns, because the dispersion of the returns around regression line is smaller E. Cannot tell based on the information provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts