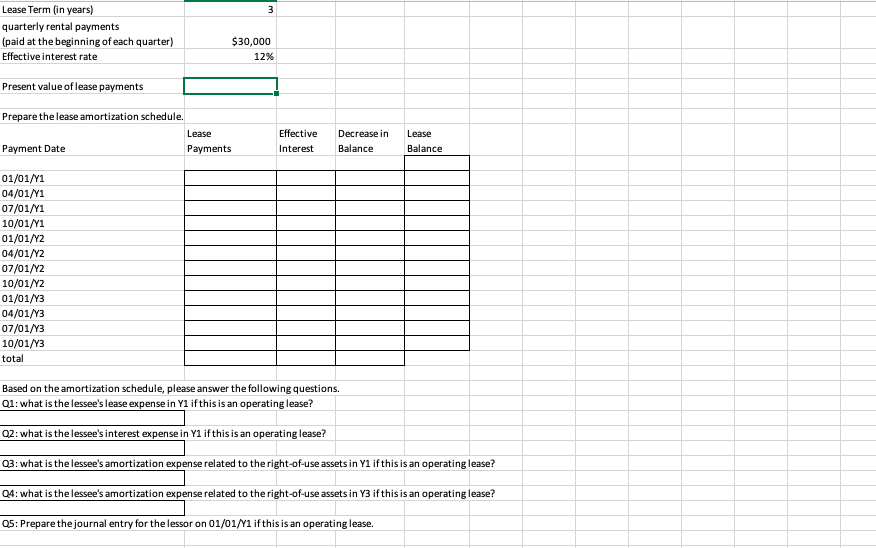

Question: Based on the amortization schedule, please answer the following questions. Q1: what is the lessee's lease expense in Y1 if this is an operating lease?

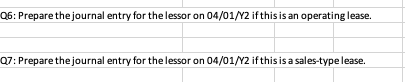

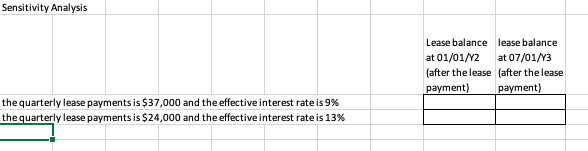

Based on the amortization schedule, please answer the following questions. Q1: what is the lessee's lease expense in Y1 if this is an operating lease? Q2: what is the lessee's interest expense in Y1 if this is an operating lease? Q3: what is the lessee's amortization expense related to the right-of-use assets in Y1 if this is an operating lease? Q4: what is the lessee's amortization expense related to the right-of-use assets in Y3 if this is an operating lease? Q5: Prepare the journal entry for the lessor on 01/01/Y1 if this is an operating lease. Q7: Prepare the journal entry for the lessor on 04/01/Y2 if this is a sales-type lease. Sensitivity Analysis the quarterly lease payments is $37,000 and the effective interest rate is 9% Based on the amortization schedule, please answer the following questions. Q1: what is the lessee's lease expense in Y1 if this is an operating lease? Q2: what is the lessee's interest expense in Y1 if this is an operating lease? Q3: what is the lessee's amortization expense related to the right-of-use assets in Y1 if this is an operating lease? Q4: what is the lessee's amortization expense related to the right-of-use assets in Y3 if this is an operating lease? Q5: Prepare the journal entry for the lessor on 01/01/Y1 if this is an operating lease. Q7: Prepare the journal entry for the lessor on 04/01/Y2 if this is a sales-type lease. Sensitivity Analysis the quarterly lease payments is $37,000 and the effective interest rate is 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts