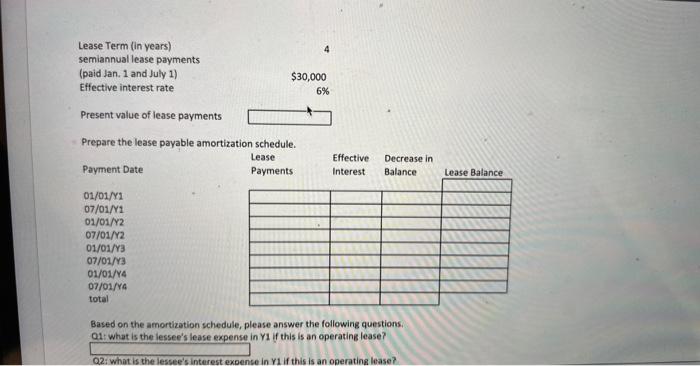

Question: Based on the amortization schedule, please answer the following questions. Q1+ what is the lessee's lease expense in Y1 if this is an operating lease?

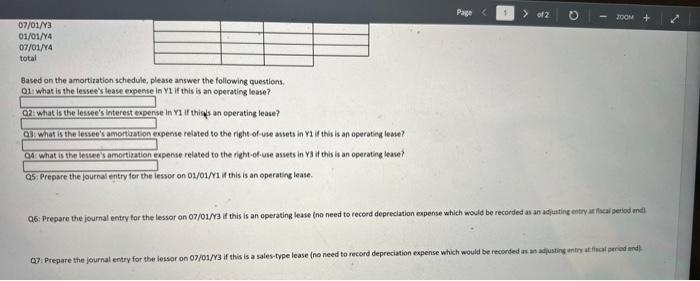

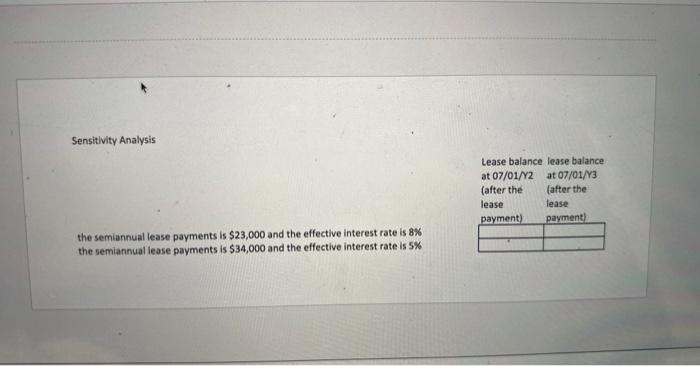

Based on the amortization schedule, please answer the following questions. Q1+ what is the lessee's lease expense in Y1 if this is an operating lease? Based on the amortization schedule, please answer the following questions. Q1: what is the lesteoic leate emeese in Y1 if this is an operating lease? G2: what is the lecuee's interest exoense in Y1 if this an aperating lease? ispense related to the right-of-use assets in Y1 if this is an operating lease? na what ic the leccewc amnetiation expense related to the right-of.use assets in y3 if this is an operating iease? Q5: Prepare the journal entry for the lessor on 0y/01/M1 it this is an operating lease. Q6: Prepare the journal entry for the lessor on 07/01/M3 if this is an operating leaie (no need to recerd depreciation expense which would be recorded as an acianting enty iaf llaal peiod thal Q7. Prepare the journal entry for the iessor on 07/01/Y3 if this is a sales-type lease (no need to record depreciation expense which would be reconded at an aflusting anion at filai periad and Sensitivity Analysis the semiannual lease payments is $23,000 and the effective interest rate is 8% the semiannual lease payments is $34,000 and the effective interest rate is 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts