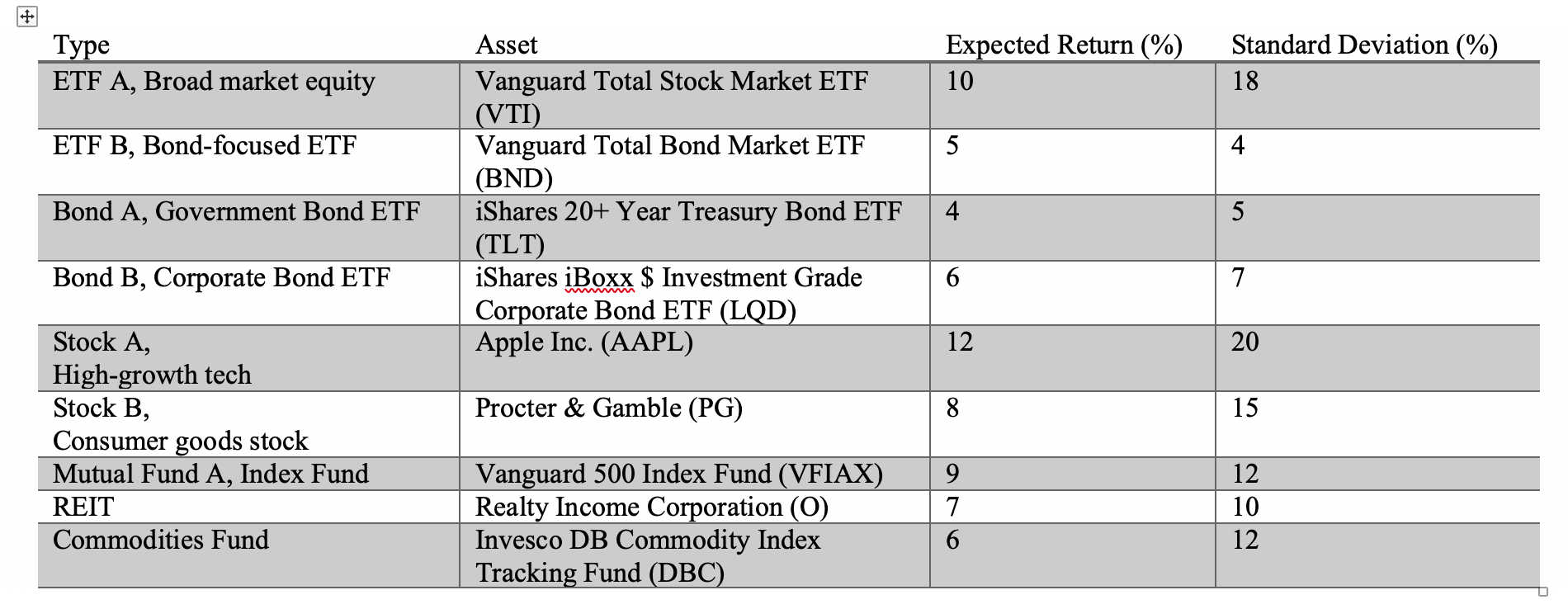

Question: based on the attached, analyze the assets, explaining why the concepts of correlation and diversification are important to portfolio construction. Also, discuss the importance of

based on the attached, analyze the assets, explaining why the concepts of correlation and diversification are important to portfolio construction. Also, discuss the importance of assessing expected returns on a risk-adjusted basis.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts