Question: Based on the case help answer the questions at the end Real-Life Research 3.1 PNC Bank Considers Changing Its Customer Satisfaction Measurement Scale Based in

Based on the case help answer the questions at the end

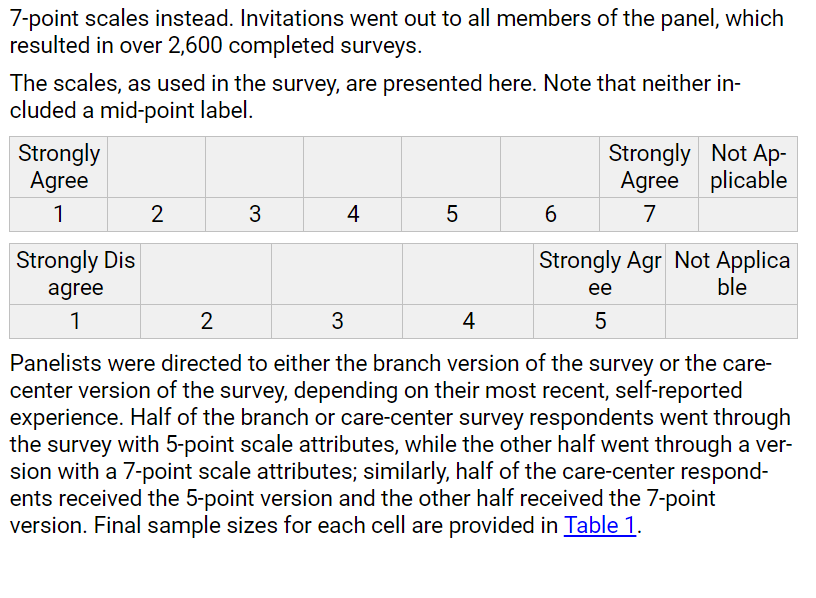

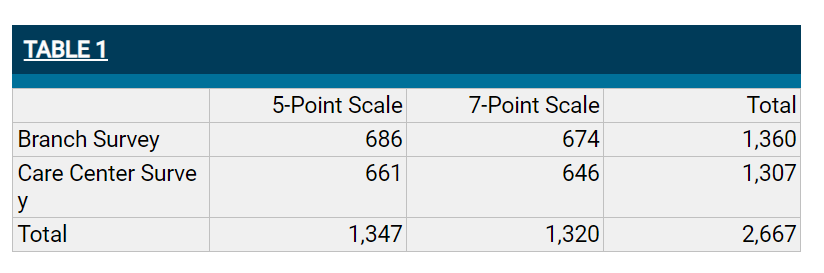

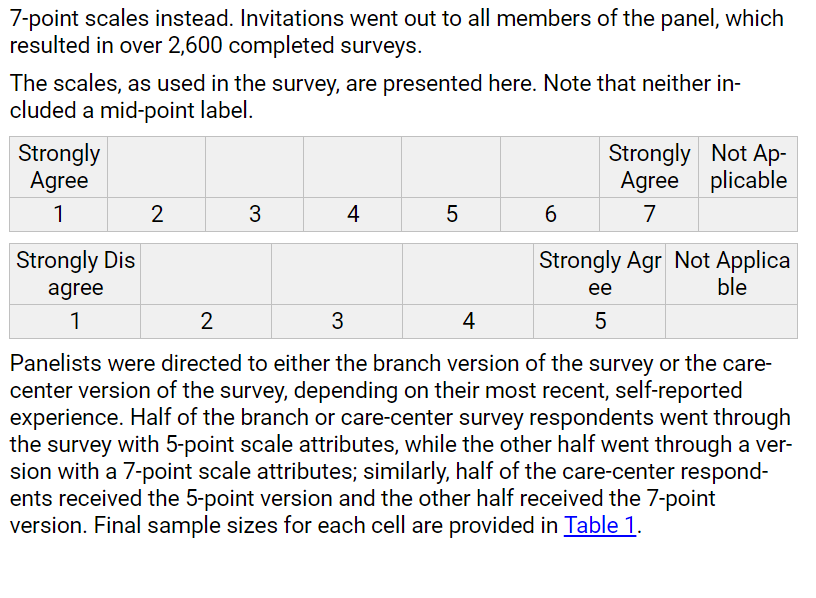

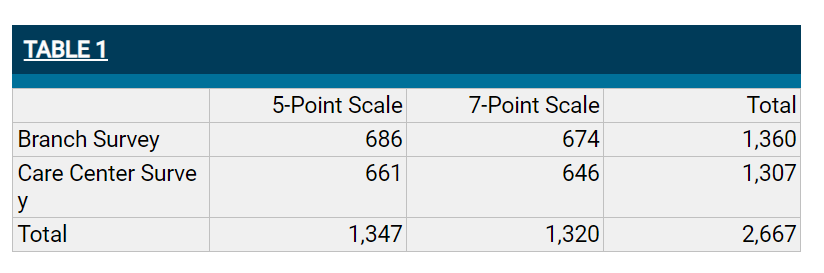

Real-Life Research 3.1 PNC Bank Considers Changing Its Customer Satisfaction Measurement Scale Based in Pittsburgh, PNC Bank, one of the largest regional banks in the United States, maintains a customer focus as one of its core values. In order to deliver on this value, PNC has a strong commitment to customer satisfaction. A crit- ical component of this commitment is the use of follow-up surveys to assess customer experiences across a range of PNC Bank products, services, and interactions. For several years now, as a part of this customer service experience, regular surveys have been administered to customer who have interacted with a PNC Bank branch banker or representatives at PNC Bank's customer care center to assess satisfaction with the respective experience. When customers have an interaction with a PNC Bank employee in a branch or in the PNC Bank customer care center, they receive a follow-up email invitation to participate in a brief survey. The surveys are typically three-to-four minute questionnaires covering the over- all experience and a number of scaled attributes to identify drivers of customer satisfaction or working with branch or call-center employees. The scaled attrib- utes explore customer reactions to the experience and perceptions of how well their interaction was handled by the PNC Bank employee. In addition, there is a customer advocacy measure with a follow-up, open-ended question to under- stand the impact of the branch or care-center experience on the customer's likelihood to recommend PNC Bank. Most surveys administered across PNC Bank and, in particular, these follow-up customer experience surveys, utilize 7-point scales to assess performance across a range of attributes. This branch and care-center survey predated ef- forts at standardizing survey design within PNC Bank; therefore, it instead in- corporated 5-point scales for attributes. Thus, the scaled evaluations used in the branch and care-center transactional survey are being transitioned from the current 5-point scales to 7-point scales. Some Concern However, since the results of these surveys can have direct and indirect im- pacts on branch and call-center employees' internal evaluation, there was some (highly justified) concern from the employees about the transition. In particular, they expressed apprehensions as to whether the past-state and future-state scales would prove to be comparable and if there would be any im- pact on the customer recommendation scores associated with employees. It was up to the PNG research team to provide evidence that switching scales would not cause any significant disruption in what the results of these surveys ultimately mean for the employees being evaluated. To test any potential impact of switching scales, researchers chose to conduct a split-sample experiment using our internal Community Insights Research Panel, administered by our external research partner, Morpace Inc. This re- search panel is a group of approximately 12,000 current PNC Bank customers who have agreed to participate in various research activities with PNC Bank on an occasional basis. PNC Researchers work with panel to conduct all types of qualitative and quantitative research, such as assessing marketing communications, getting feedback on Web site user experience, small busi- ness banking customer needs, and testing new names for products or services. It is a valuable resource that has impact across the entire business. The panel gives our customers an avenue to provide valuable feedback and en- sures that PNC Bank's products, services, and messaging are aligned with genuine customer needs and expectations. Developed two versions To understand the potential impact of changing the branch and care-center sur- vey attributes from 5- to 7-point scales, company researchers developed two versions of the customer experience surveys to be administered within this customer panel. The original version, using the 5-point scales for overall satis- faction and attribute evaluations, was fielded along with a revised version using 7-point scales instead. Invitations went out to all members of the panel, which resulted in over 2,600 completed surveys. The scales, as used in the survey, are presented here. Note that neither in- cluded a mid-point label. Strongly Strongly Not Ap- Agree Agree plicable 1 2 3 4 5 6 7 Strongly Dis agree 1 Strongly Agr Not Applica ee ble 5 2 3 4 Panelists were directed to either the branch version of the survey or the care- center version of the survey, depending on their most recent, self-reported experience. Half of the branch or care-center survey respondents went through the survey with 5-point scale attributes, while the other half went through a ver- sion with a 7-point scale attributes; similarly, half of the care-center respond- ents received the 5-point version and the other half received the 7-point version. Final sample sizes for each cell are provided in Table 1. TABLE 1 5-Point Scale 686 661 7-Point Scale 674 646 Branch Survey Care Center Surve y Total Total 1,360 1,307 1,347 1,320 2,667 Quite a surprise The results were analyzed using SPSS and proved to be quite a surprise in that there was near-perfect alignment between top-box scores for the five-point scaled attributes and the top-box scores from the seven-point scaled attributes (Table 1). The charts in Figure 1 provide results across four of the attributes used in the branch survey. In no case is there more than a three percentage-point differ- ence between 5-point scale results and 7-point scale results on a top-box basis. There is even a high degree of correspondence between middle-box scores as well. In fact, the primary differences appear to be that ratings of 4 on the 5-point scale tend to get split up between 5 and 6 on the 7-point scales. These results are further supported by the results of the care-center surveys, where a similar set of attributes demonstrated a similarly high degree of align- ment between the two versions. The results of the experiment were presented to internal stakeholders with the recommendation that they convert from the current 5-point scale survey to a 7- point scale. This will allow for the results from the branch and care-center eval- uations to be compared with results from other PNC units since they will all now be using the same 7-point scale.22 3. How might the researchers have approached the measurement of validity? 4. The researchers hypothesized that the test results would show that the top-box scores from the 5-point scales would be spread out over the top- two boxes on the 7-point scale. Why would they make his hypothesis? What did the tests actually show? What does this mean? 5. Go back and look at the types of research that is conducted with the Com- munity Insights Research Panel. Next, review the various types of scales discussed in the chapter. Pick two scales and explain how they could be used with one of the types of research conducted with the Panel. 6. Why were employees worried about converting from a 5- to a 7-point scale? Under what circumstances would their worries have been justified