Question: Based on the excel answer below, please calculate PV, FV, PMT, N and I/Y in each step how to find the without discouting net benefits

Based on the excel answer below, please calculate PV, FV, PMT, N and I/Y in each step how to find the without discouting net benefits and with discouting benefits.

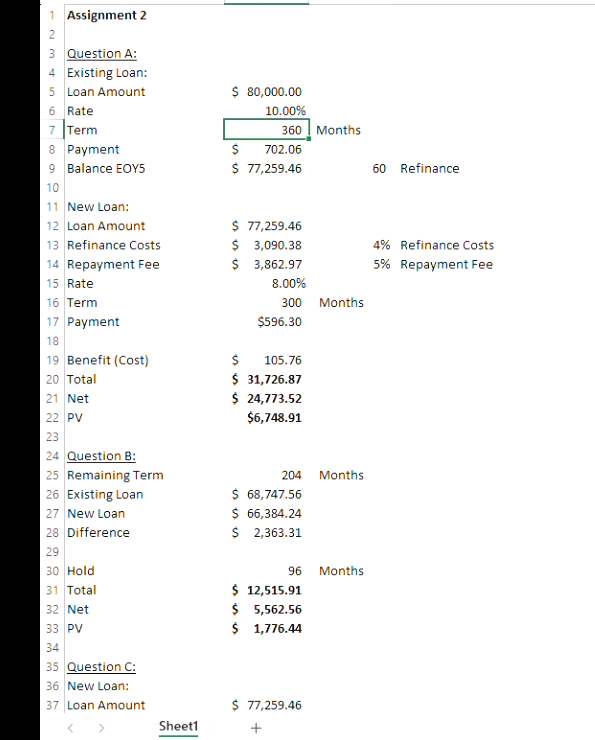

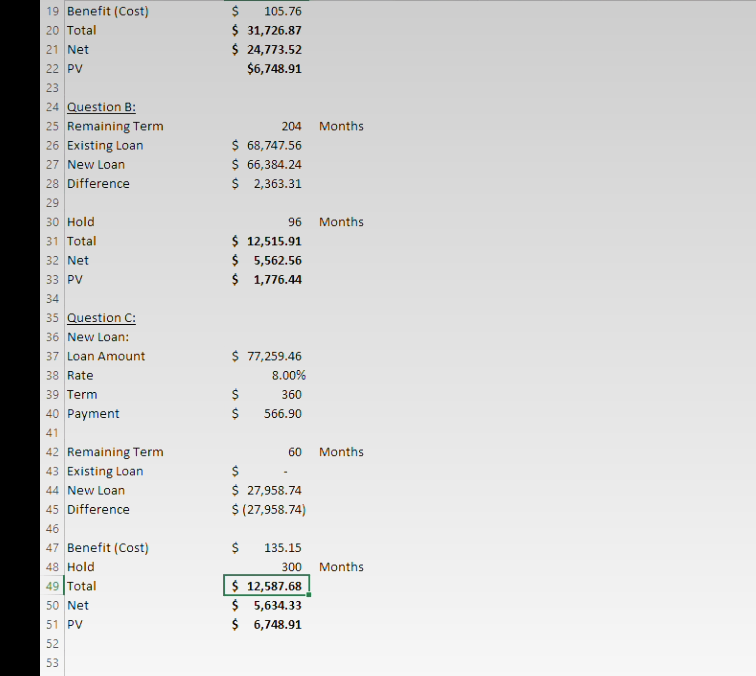

Five years ago a borrower incurred a mortgage for $80,000 at 10% for 30 years, monthly payments. Currently the market rate is 8% on 25-year mortgages. The existing mortgage has a prepayment penalty of 5% of the outstanding balance and the lender will charge 4% financing cost on a new loan.

B. If the borrower plans to hold either mortgage for 8 more years only (we suppose the term of new loan is 25 years, which equals to the number of periods the old loan remains) 1) Without discounting, should he/she refinance, what is the net benefits? 2) With discounting, should he/he refinance, what is the net benefits?

Assignment 2 Question A: Existing Loan: Loan Amount $80,000.00 Rate 7 Term Payment Balance EOY5 New Loan: Loan Amount Refinance Costs Repayment Fee Rate Term Payment Benefit (Cost) Total Net PV \$ 77,259.46 \$ 3,090.38 $3,862.97 8.00% 300 Months $596.30 $105.76 \$ 31,726.87 \$ 24,773.52 $6,748.91 Question B: 25 Remaining Term Existing Loan New Loan Difference Hold Total Net PV 204 4\% Refinance Costs 5\% Repayment Fee 60 Refinance 204 Months $68,747.56 $66,384.24 $2,363.31 $12,515.91$$965,562.561,776.44Months Question C: New Loan: 37 Loan Amount \$ 77,259.46 Sheet1 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts