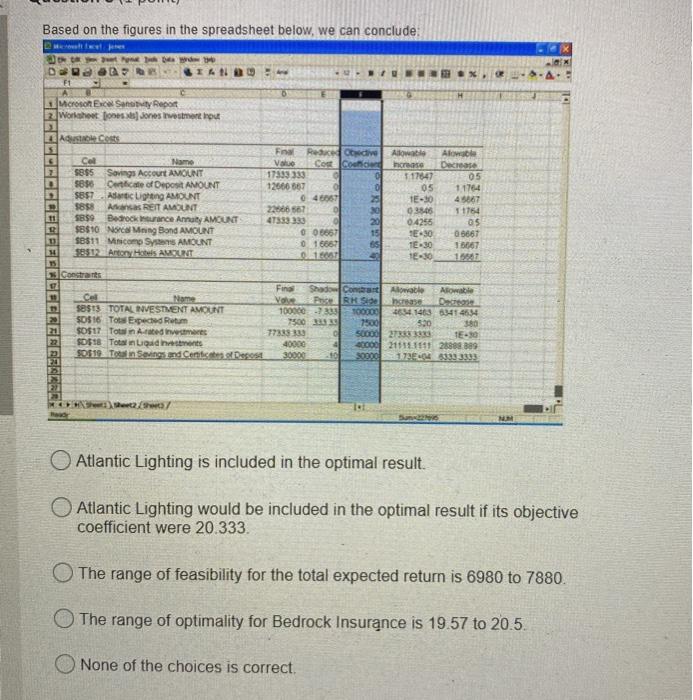

Question: Based on the figures in the spreadsheet below, we can conclude: wird DE t .X E1 H Microsoft Excel Santity Report Worshoot Done Jones Investment

Based on the figures in the spreadsheet below, we can conclude: wird DE t .X E1 H Microsoft Excel Santity Report Worshoot Done Jones Investment A Costs 6 05 Col Name 5855 Savings Account AMOUNT 5896 Oricate of Deposit AMOUNT $857 Antichting AMOUNT $899 Asas REIT AMOUNT SBS Bedrocknunce Anal AMOUNT $B$10 Na Mning Bond AMOUNT $8511 Minicom Systems AMOUNT 98512 Artery Hotels ANCOUNT Fra Receive Volvo Cont Cochod 17333333 12666 367 ol 04607 22000, 507 30 47333333 20 000667 0 16657 6S 0.1 Allowa Aloe Increase Decreto 17647 05 1.1764 TE-30 45887 02845 11754 04256 05 SE430 05667 TE-30 16667 15-30 11 14 Contrats Fing ShadowContrant Allowable Alkowa ile Name PRKS crease sest3 TOTAL INVESTMENT AMOUNT 100000-3333 100000 4654 1463 634145.54 50516 Tot Expected Retur 7500 333 7500 520 380 2010 $D$17 Total in Afted investments 773830 Socod 278383 1E-90 22 $D$18 Total Liqadines 40000 10000211111111 26888.89 $0$19 in Savings and Contest Depost 30000 17.08333.3333 20 2 Ban NU Atlantic Lighting is included in the optimal result. Atlantic Lighting would be included in the optimal result if its objective coefficient were 20.333 The range of feasibility for the total expected return is 6980 to 7880. The range of optimality for Bedrock Insurance is 19.57 to 20.5. None of the choices is correct. Based on the figures in the spreadsheet below, we can conclude: wird DE t .X E1 H Microsoft Excel Santity Report Worshoot Done Jones Investment A Costs 6 05 Col Name 5855 Savings Account AMOUNT 5896 Oricate of Deposit AMOUNT $857 Antichting AMOUNT $899 Asas REIT AMOUNT SBS Bedrocknunce Anal AMOUNT $B$10 Na Mning Bond AMOUNT $8511 Minicom Systems AMOUNT 98512 Artery Hotels ANCOUNT Fra Receive Volvo Cont Cochod 17333333 12666 367 ol 04607 22000, 507 30 47333333 20 000667 0 16657 6S 0.1 Allowa Aloe Increase Decreto 17647 05 1.1764 TE-30 45887 02845 11754 04256 05 SE430 05667 TE-30 16667 15-30 11 14 Contrats Fing ShadowContrant Allowable Alkowa ile Name PRKS crease sest3 TOTAL INVESTMENT AMOUNT 100000-3333 100000 4654 1463 634145.54 50516 Tot Expected Retur 7500 333 7500 520 380 2010 $D$17 Total in Afted investments 773830 Socod 278383 1E-90 22 $D$18 Total Liqadines 40000 10000211111111 26888.89 $0$19 in Savings and Contest Depost 30000 17.08333.3333 20 2 Ban NU Atlantic Lighting is included in the optimal result. Atlantic Lighting would be included in the optimal result if its objective coefficient were 20.333 The range of feasibility for the total expected return is 6980 to 7880. The range of optimality for Bedrock Insurance is 19.57 to 20.5. None of the choices is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts