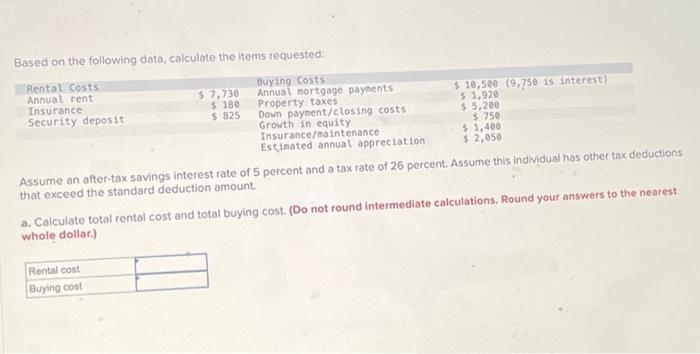

Question: Based on the following data, calculate the items requested: Buying Costs Annual mortgage payments Property taxes Rental Costs Annual rent Insurance Security deposit $7,730 $

Based on the following data, calculate the items requested: is interest) Assume an after-tax savings interest rate of 5 percent and a tax rate of 26 percent. Assume this inuvidual has other tax deductions that exceed the standard deduction amount. a. Calculate total rental cost and total buying cost. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts