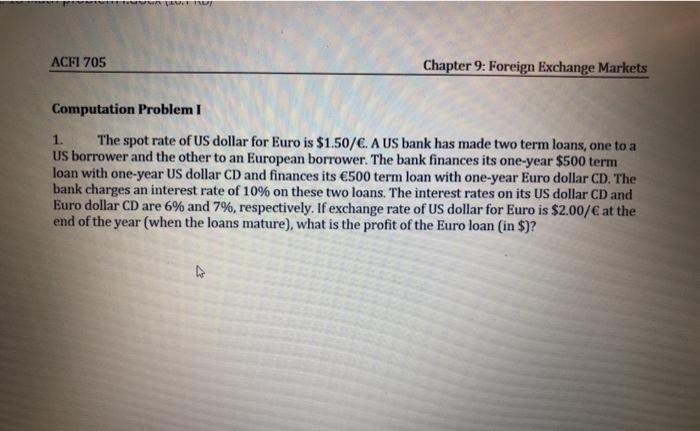

Question: please solve showing steps used ACFI 705 Chapter 9: Foreign Exchange Markets Computation Problem! 1. The spot rate of US dollar for Euro is $1.50/.

ACFI 705 Chapter 9: Foreign Exchange Markets Computation Problem! 1. The spot rate of US dollar for Euro is $1.50/. A US bank has made two term loans, one to a US borrower and the other to an European borrower. The bank finances its one-year $500 term loan with one-year US dollar CD and finances its 500 term loan with one-year Euro dollar CD. The bank charges an interest rate of 10% on these two loans. The interest rates on its US dollar CD and Euro dollar CD are 6% and 7%, respectively. If exchange rate of US dollar for Euro is $2.00/ at the end of the year (when the loans mature), what is the profit of the Euro loan (in $)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts