Question: Based on the following data, prepare a bank reconciliation for December of the current year: a. Balance per Bank at Dec 31: $61,747 b. Balance

Based on the following data, prepare a bank reconciliation for December of the current year:

a. Balance per Bank at Dec 31: $61,747

b. Balance per Books at Dec 31: $46,865

c. The following checks were still outstanding as of Dec 31, 2020:

Check #1234 $4,567

Check #1235 $7,300

Check #1236 $1,000

d. Interest earned, $100

e. Deposit in transit, not recorded by bank, $2,500

f. Bank debit memorandum for service charges, $25

g. A check for $400 in payment of an invoice was incorrectly recorded in the ledger as $40

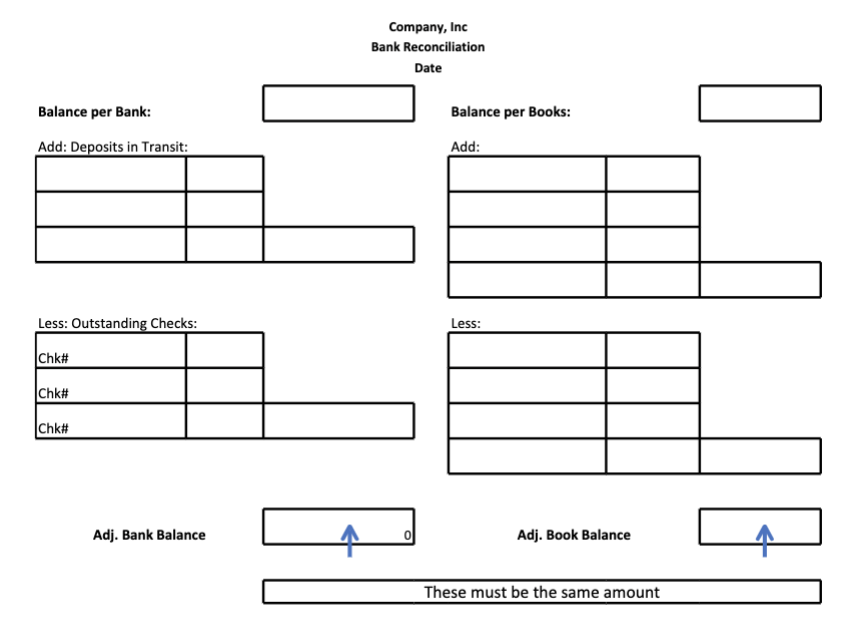

Company, Inc Bank Reconciliation Date Balance per Bank: Balance per Books: Add: Deposits in Transit: Add: Less: Outstanding Checks: Less: \begin{tabular}{|l|l|l|} \hline Chk\# & & \\ \hline Chk\# & & \\ \hline Chk\# & & \\ \hline \end{tabular} Adj. Bank Balance Adj. Book Balance These must be the same amount Company, Inc Bank Reconciliation Date Balance per Bank: Balance per Books: Add: Deposits in Transit: Add: Less: Outstanding Checks: Less: \begin{tabular}{|l|l|l|} \hline Chk\# & & \\ \hline Chk\# & & \\ \hline Chk\# & & \\ \hline \end{tabular} Adj. Bank Balance Adj. Book Balance These must be the same amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts