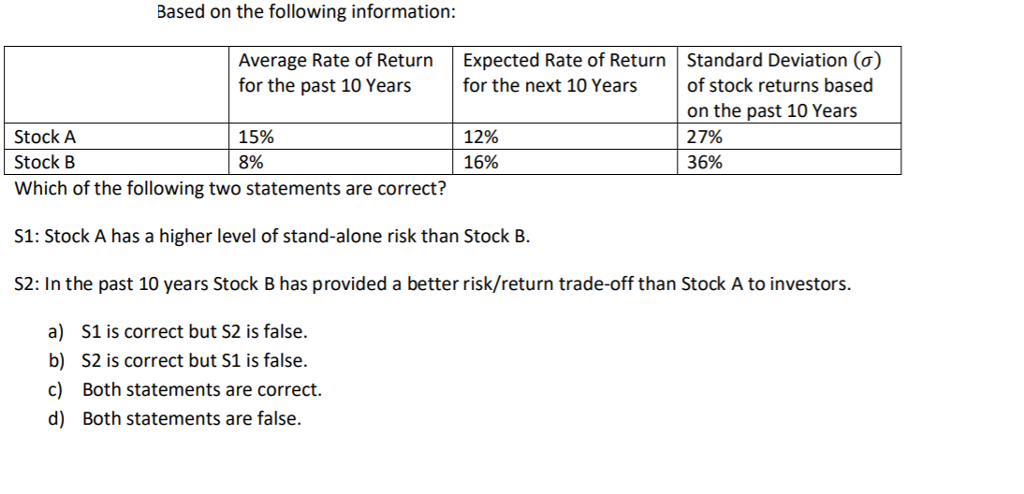

Question: Based on the following information: Average Rate of Return Expected Rate of Return Standard Deviation (a) for the past 10 Years for the next 10

Based on the following information: Average Rate of Return Expected Rate of Return Standard Deviation (a) for the past 10 Years for the next 10 Years of stock returns based on the past 10 Years Stock A Stock B Which of the following two statements are correct? 15% 8% 12% 16% 27% 36% S1: Stock A has a higher level of stand-alone risk than Stock B. S2: In the past 10 years Stock B has provided a better risk/return trade-off than Stock A to investors. a) b) c) d) S1 is correct but S2 is false. S2 is correct but S1 is false. Both statements are correct. Both statements are false

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock