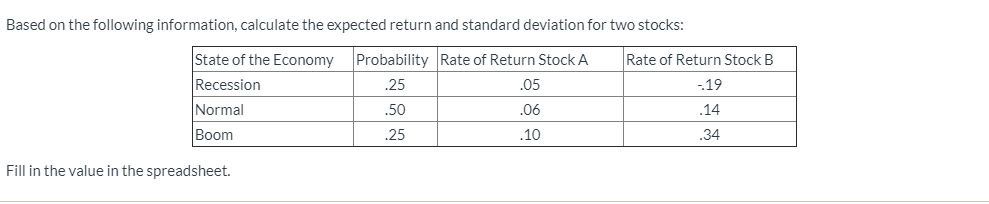

Question: Based on the following information, calculate the expected return and standard deviation for two stocks: Rate of Return Stock B .05 -19 State of the

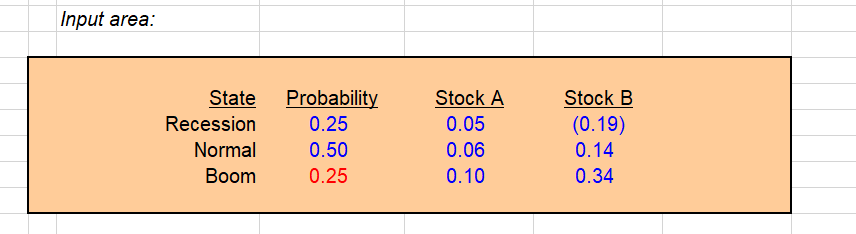

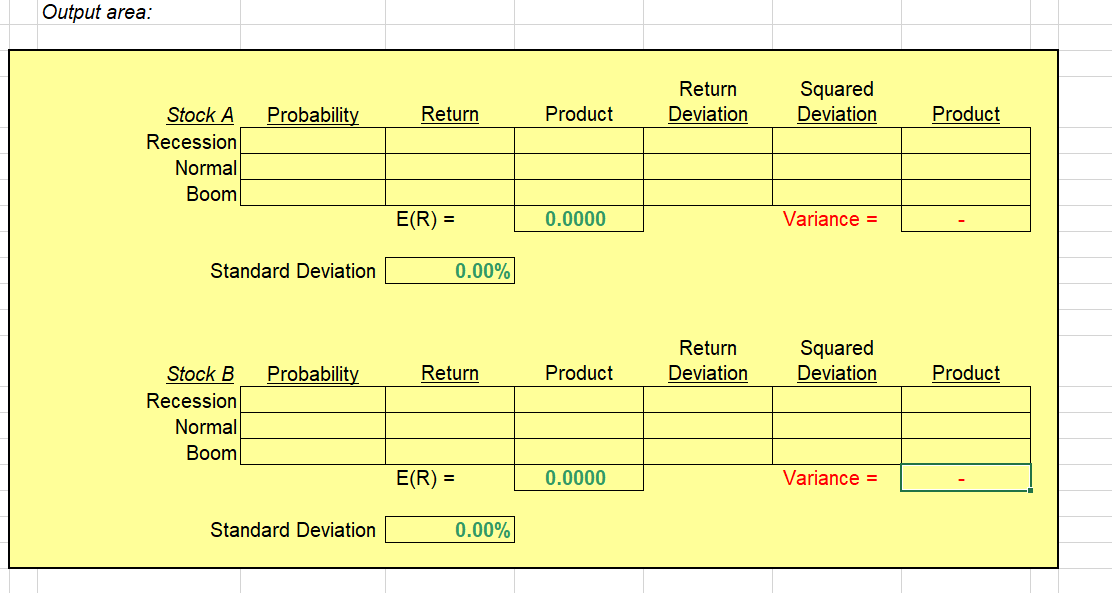

Based on the following information, calculate the expected return and standard deviation for two stocks: Rate of Return Stock B .05 -19 State of the Economy Recession Normal Boom Probability Rate of Return Stock A .25 .50 .06 .10 .14 25 .34 Fill in the value in the spreadsheet. Input area: State Recession Normal Boom Probability 0.25 0.50 0.25 Stock A 0.05 0.06 0.10 Stock B (0.19) 0.14 0.34 0.30 Output area: Return Deviation Squared Deviation Probability Return Product Product Stock A Recession Normal Boom E(R) = 0.0000 Variance = Standard Deviation 0.00% Return Deviation Squared Deviation Probability Return Product Product Stock B Recession Normal Boom| E(R) = 0.0000 Variance = Standard Deviation 0.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts