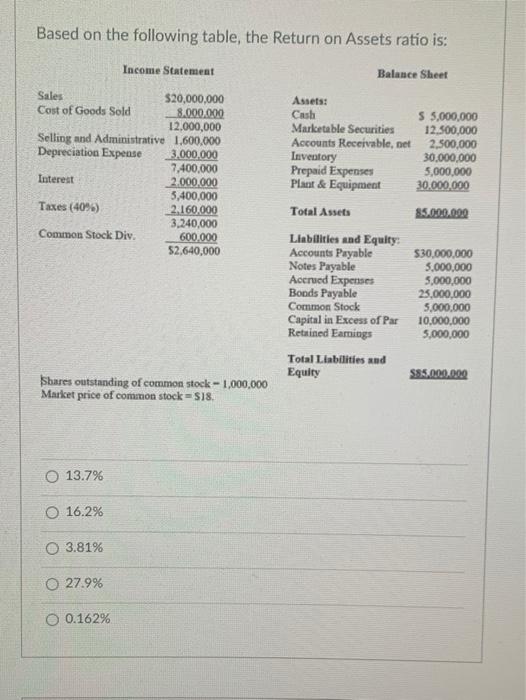

Question: Based on the following table, the Return on Assets ratio is: Income Statement Balance Sheet Sales $20,000,000 Cost of Goods Sold __8.000.000 12,000,000 Selling and

Based on the following table, the Return on Assets ratio is: Income Statement Balance Sheet Sales $20,000,000 Cost of Goods Sold __8.000.000 12,000,000 Selling and Administrative 1.600.000 Depreciation Expense 3,000,000 7,400,000 Interest 2.000.000 3,400,000 Taxes (40%) 2.160.000 3.240,000 Common Stock Div. 600.000 52,640,000 Assets: Cash S 5,000,000 Marketable Securities 12.500,000 Accounts Receivable, net 2,500,000 Inventory 30,000,000 Prepaid Expenses 5,000,000 Plant & Equipment 30,000,000 Total Assets 85.000.000 Liabilities and Equity: Accounts Payable 530,000,000 Notes Payable 3,000,000 Accrued Expenses 5,000,000 Boods Payable 25,000,000 Common Stock 5,000,000 Capital in Excess of Par 10,000,000 Retained Earnings 5,000,000 Total Liabilities and Equity $85.000.000 Shares outstanding of common stock - 1,000,000 Market price of common stock =$18. 13.7% O 16.2% 3.81% 27.9% O 0.162%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts